FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Orascom</strong> <strong>Development</strong> Holding (Consolidated Financial Statement)<br />

IFRS 9<br />

IAS 24<br />

Financial Instruments: Recognition and<br />

Measurement was issued in 2009 and<br />

amended in <strong>2010</strong> to cover<br />

classification and measurement of<br />

financial assets and financial liabilities,<br />

as the first part of its project to replace<br />

IAS 39.<br />

Related <strong>Part</strong>y Disclosures – Revised<br />

definition of related parties.<br />

<strong>Annual</strong><br />

periods<br />

beginning on<br />

or after 1<br />

January 2013<br />

<strong>Annual</strong><br />

periods<br />

beginning on<br />

or after 1<br />

January 2011<br />

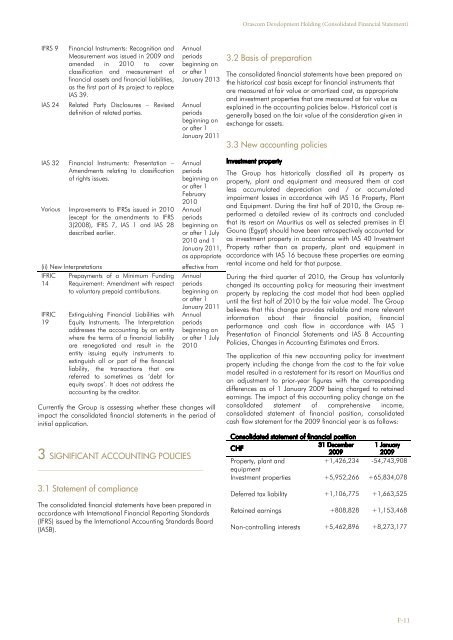

3.2 Basis of preparation<br />

The consolidated financial statements have been prepared on<br />

the historical cost basis except for financial instruments that<br />

are measured at fair value or amortized cost, as appropriate<br />

and investment properties that are measured at fair value as<br />

explained in the accounting policies below. Historical cost is<br />

generally based on the fair value of the consideration given in<br />

exchange for assets.<br />

3.3 New accounting policies<br />

IAS 32 Financial Instruments: Presentation –<br />

Amendments relating to classification<br />

of rights issues.<br />

Various Improvements to IFRSs issued in <strong>2010</strong><br />

(except for the amendments to IFRS<br />

3(2008), IFRS 7, IAS 1 and IAS 28<br />

described earlier.<br />

(ii) New Interpretations<br />

IFRIC Prepayments of a Minimum Funding<br />

14 Requirement: Amendment with respect<br />

to voluntary prepaid contributions.<br />

IFRIC<br />

19<br />

Extinguishing Financial Liabilities with<br />

Equity Instruments. The Interpretation<br />

addresses the accounting by an entity<br />

where the terms of a financial liability<br />

are renegotiated and result in the<br />

entity issuing equity instruments to<br />

extinguish all or part of the financial<br />

liability, the transactions that are<br />

referred to sometimes as ‘debt for<br />

equity swaps’. It does not address the<br />

accounting by the creditor.<br />

<strong>Annual</strong><br />

periods<br />

beginning on<br />

or after 1<br />

February<br />

<strong>2010</strong><br />

<strong>Annual</strong><br />

periods<br />

beginning on<br />

or after 1 July<br />

<strong>2010</strong> and 1<br />

January 2011,<br />

as appropriate<br />

effective from<br />

<strong>Annual</strong><br />

periods<br />

beginning on<br />

or after 1<br />

January 2011<br />

<strong>Annual</strong><br />

periods<br />

beginning on<br />

or after 1 July<br />

<strong>2010</strong><br />

Currently the Group is assessing whether these changes will<br />

impact the consolidated financial statements in the period of<br />

initial application.<br />

3 SIGNIFICANT ACCOUNTING POLICIES<br />

_______________________________________________________________________________________<br />

3.1 Statement of compliance<br />

The consolidated financial statements have been prepared in<br />

accordance with International Financial <strong>Report</strong>ing Standards<br />

(IFRS) issued by the International Accounting Standards Board<br />

(IASB).<br />

Investment property<br />

The Group has historically classified all its property as<br />

property, plant and equipment and measured them at cost<br />

less accumulated depreciation and / or accumulated<br />

impairment losses in accordance with IAS 16 Property, Plant<br />

and Equipment. During the first half of <strong>2010</strong>, the Group reperformed<br />

a detailed review of its contracts and concluded<br />

that its resort on Mauritius as well as selected premises in El<br />

Gouna (Egypt) should have been retrospectively accounted for<br />

as investment property in accordance with IAS 40 Investment<br />

Property rather than as property, plant and equipment in<br />

accordance with IAS 16 because these properties are earning<br />

rental income and held for that purpose.<br />

During the third quarter of <strong>2010</strong>, the Group has voluntarily<br />

changed its accounting policy for measuring their investment<br />

property by replacing the cost model that had been applied<br />

until the first half of <strong>2010</strong> by the fair value model. The Group<br />

believes that this change provides reliable and more relevant<br />

information about their financial position, financial<br />

performance and cash flow in accordance with IAS 1<br />

Presentation of Financial Statements and IAS 8 Accounting<br />

Policies, Changes in Accounting Estimates and Errors.<br />

The application of this new accounting policy for investment<br />

property including the change from the cost to the fair value<br />

model resulted in a restatement for its resort on Mauritius and<br />

an adjustment to prior-year figures with the corresponding<br />

differences as of 1 January 2009 being charged to retained<br />

earnings. The impact of this accounting policy change on the<br />

consolidated statement of comprehensive income,<br />

consolidated statement of financial position, consolidated<br />

cash flow statement for the 2009 financial year is as follows:<br />

Consolidated statement of financial position<br />

CHF<br />

31 December 1 January<br />

2009<br />

2009<br />

Property, plant and<br />

+1,426,234 -54,743,908<br />

equipment<br />

Investment properties +5,952,266 +65,834,078<br />

Deferred tax liability +1,106,775 +1,663,525<br />

Retained earnings +808,828 +1,153,468<br />

Non-controlling interests +5,462,896 +8,273,177<br />

F-11