FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ODH <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

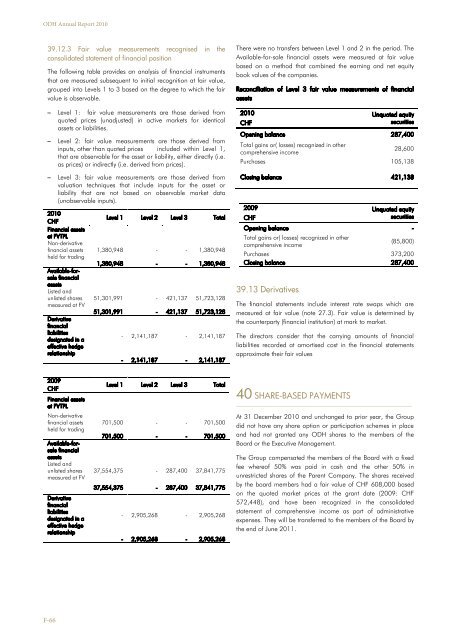

39.12.3 Fair value measurements recognised in the<br />

consolidated statement of financial position<br />

The following table provides an analysis of financial instruments<br />

that are measured subsequent to initial recognition at fair value,<br />

grouped into Levels 1 to 3 based on the degree to which the fair<br />

value is observable.<br />

– Level 1: fair value measurements are those derived from<br />

quoted prices (unadjusted) in active markets for identical<br />

assets or liabilities.<br />

– Level 2: fair value measurements are those derived from<br />

inputs, other than quoted prices included within Level 1,<br />

that are observable for the asset or liability, either directly (i.e.<br />

as prices) or indirectly (i.e. derived from prices).<br />

– Level 3: fair value measurements are those derived from<br />

valuation techniques that include inputs for the asset or<br />

liability that are not based on observable market data<br />

(unobservable inputs).<br />

<strong>2010</strong><br />

CHF<br />

Financial assets<br />

at FVTPL<br />

Non-derivative<br />

financial assets<br />

held for trading<br />

Available-forsale<br />

financial<br />

assets<br />

Listed and<br />

unlisted shares<br />

measured at FV<br />

Derivative<br />

financial<br />

liabilities<br />

designated in a<br />

effective hedge<br />

relationship<br />

Level 1 Level 2 Level 3 Total<br />

1,380,948 - - 1,380,948<br />

1,380,948 - - 1,380,948<br />

51,301,991 - 421,137 51,723,128<br />

51,301,991 - 421,137 51,723,128<br />

- 2,141,187 - 2,141,187<br />

- 2,141,187 - 2,141,187<br />

There were no transfers between Level 1 and 2 in the period. The<br />

Available-for-sale financial assets were measured at fair value<br />

based on a method that combined the earning and net equity<br />

book values of the companies.<br />

Reconciliation of Level 3 fair value measurements of financial<br />

assets<br />

<strong>2010</strong> Unquoted equity<br />

CHF<br />

securities<br />

Opening balance 287,400<br />

Total gains or( losses) recognized in other<br />

comprehensive income<br />

28,600<br />

Purchases 105,138<br />

Closing balance 421,138<br />

2009 Unquoted equity<br />

CHF<br />

securities<br />

Opening balance -<br />

Total gains or( losses) recognized in other<br />

comprehensive income<br />

(85,800)<br />

Purchases 373,200<br />

Closing balance 287,400<br />

39.13 Derivatives<br />

The financial statements include interest rate swaps which are<br />

measured at fair value (note 27.3). Fair value is determined by<br />

the counterparty (financial institution) at mark to market.<br />

The directors consider that the carrying amounts of financial<br />

liabilities recorded at amortised cost in the financial statements<br />

approximate their fair values<br />

2009<br />

CHF<br />

Financial assets<br />

at FVTPL<br />

Non-derivative<br />

financial assets<br />

held for trading<br />

Available-forsale<br />

financial<br />

assets<br />

Listed and<br />

unlisted shares<br />

measured at FV<br />

Derivative<br />

financial<br />

liabilities<br />

designated in a<br />

effective hedge<br />

relationship<br />

Level 1 Level 2 Level 3 Total<br />

701,500 - - 701,500<br />

701,500 - - 701,500<br />

37,554,375 - 287,400 37,841,775<br />

37,554,375 - 287,400 37,841,775<br />

- 2,905,268 - 2,905,268<br />

- 2,905,268 - 2,905,268<br />

40 SHARE-BASED PAYMENTS<br />

___________________________________________________________________________________<br />

At 31 December <strong>2010</strong> and unchanged to prior year, the Group<br />

did not have any share option or participation schemes in place<br />

and had not granted any ODH shares to the members of the<br />

Board or the Executive Management.<br />

The Group compensated the members of the Board with a fixed<br />

fee whereof 50% was paid in cash and the other 50% in<br />

unrestricted shares of the Parent Company. The shares received<br />

by the board members had a fair value of CHF 608,000 based<br />

on the quoted market prices at the grant date (2009: CHF<br />

572,448), and have been recognized in the consolidated<br />

statement of comprehensive income as part of administrative<br />

expenses. They will be transferred to the members of the Board by<br />

the end of June 2011.<br />

F-66