FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Orascom</strong> <strong>Development</strong> Holding (Consolidated Financial Statement)<br />

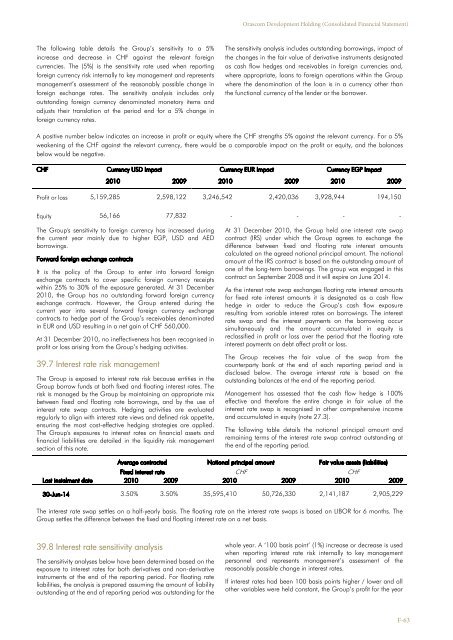

The following table details the Group’s sensitivity to a 5%<br />

increase and decrease in CHF against the relevant foreign<br />

currencies. The (5%) is the sensitivity rate used when reporting<br />

foreign currency risk internally to key management and represents<br />

management’s assessment of the reasonably possible change in<br />

foreign exchange rates. The sensitivity analysis includes only<br />

outstanding foreign currency denominated monetary items and<br />

adjusts their translation at the period end for a 5% change in<br />

foreign currency rates.<br />

The sensitivity analysis includes outstanding borrowings, impact of<br />

the changes in the fair value of derivative instruments designated<br />

as cash flow hedges and receivables in foreign currencies and,<br />

where appropriate, loans to foreign operations within the Group<br />

where the denomination of the loan is in a currency other than<br />

the functional currency of the lender or the borrower.<br />

A positive number below indicates an increase in profit or equity where the CHF strengths 5% against the relevant currency. For a 5%<br />

weakening of the CHF against the relevant currency, there would be a comparable impact on the profit or equity, and the balances<br />

below would be negative.<br />

CHF Currency USD Impact Currency EUR Impact Currency EGP Impact<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Profit or loss 5,159,285 2,598,122 3,246,542 2,420,036 3,928,944 194,150<br />

Equity 56,166 77,832 - - - -<br />

The Group's sensitivity to foreign currency has increased during<br />

the current year mainly due to higher EGP, USD and AED<br />

borrowings.<br />

Forward foreign exchange contracts<br />

It is the policy of the Group to enter into forward foreign<br />

exchange contracts to cover specific foreign currency receipts<br />

within 25% to 30% of the exposure generated. At 31 December<br />

<strong>2010</strong>, the Group has no outstanding forward foreign currency<br />

exchange contracts. However, the Group entered during the<br />

current year into several forward foreign currency exchange<br />

contracts to hedge part of the Group’s receivables denominated<br />

in EUR and USD resulting in a net gain of CHF 560,000.<br />

At 31 December <strong>2010</strong>, no ineffectiveness has been recognised in<br />

profit or loss arising from the Group’s hedging activities.<br />

39.7 Interest rate risk management<br />

The Group is exposed to interest rate risk because entities in the<br />

Group borrow funds at both fixed and floating interest rates. The<br />

risk is managed by the Group by maintaining an appropriate mix<br />

between fixed and floating rate borrowings, and by the use of<br />

interest rate swap contracts. Hedging activities are evaluated<br />

regularly to align with interest rate views and defined risk appetite,<br />

ensuring the most cost-effective hedging strategies are applied.<br />

The Group's exposures to interest rates on financial assets and<br />

financial liabilities are detailed in the liquidity risk management<br />

section of this note.<br />

At 31 December <strong>2010</strong>, the Group held one interest rate swap<br />

contract (IRS) under which the Group agrees to exchange the<br />

difference between fixed and floating rate interest amounts<br />

calculated on the agreed notional principal amount. The notional<br />

amount of the IRS contract is based on the outstanding amount of<br />

one of the long-term borrowings. The group was engaged in this<br />

contract on September 2008 and it will expire on June 2014.<br />

As the interest rate swap exchanges floating rate interest amounts<br />

for fixed rate interest amounts it is designated as a cash flow<br />

hedge in order to reduce the Group’s cash flow exposure<br />

resulting from variable interest rates on borrowings. The interest<br />

rate swap and the interest payments on the borrowing occur<br />

simultaneously and the amount accumulated in equity is<br />

reclassified in profit or loss over the period that the floating rate<br />

interest payments on debt affect profit or loss.<br />

The Group receives the fair value of the swap from the<br />

counterparty bank at the end of each reporting period and is<br />

disclosed below. The average interest rate is based on the<br />

outstanding balances at the end of the reporting period.<br />

Management has assessed that the cash flow hedge is 100%<br />

effective and therefore the entire change in fair value of the<br />

interest rate swap is recognised in other comprehensive income<br />

and accumulated in equity (note 27.3).<br />

The following table details the notional principal amount and<br />

remaining terms of the interest rate swap contract outstanding at<br />

the end of the reporting period.<br />

Last instalment date<br />

Average contracted Notional principal amount Fair value assets (liabilities)<br />

Fixed interest rate CHF CHF<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

30-Jun-14 3.50% 3.50% 35,595,410 50,726,330 2,141,187 2,905,229<br />

The interest rate swap settles on a half-yearly basis. The floating rate on the interest rate swaps is based on LIBOR for 6 months. The<br />

Group settles the difference between the fixed and floating interest rate on a net basis.<br />

39.8 Interest rate sensitivity analysis<br />

The sensitivity analyses below have been determined based on the<br />

exposure to interest rates for both derivatives and non-derivative<br />

instruments at the end of the reporting period. For floating rate<br />

liabilities, the analysis is prepared assuming the amount of liability<br />

outstanding at the end of reporting period was outstanding for the<br />

whole year. A ‘100 basis point’ (1%) increase or decrease is used<br />

when reporting interest rate risk internally to key management<br />

personnel and represents management’s assessment of the<br />

reasonably possible change in interest rates.<br />

If interest rates had been 100 basis points higher / lower and all<br />

other variables were held constant, the Group’s profit for the year<br />

F-63