FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ODH <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

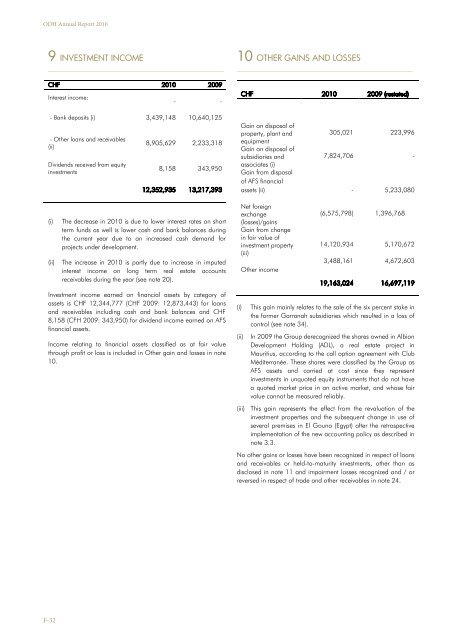

9 INVESTMENT INCOME<br />

___________________________________________________________________________________<br />

CHF <strong>2010</strong> 2009<br />

Interest income:<br />

- -<br />

- Bank deposits (i) 3,439,148 10,640,125<br />

- Other loans and receivables<br />

(ii)<br />

Dividends received from equity<br />

investments<br />

(i)<br />

(ii)<br />

8,905,629 2,233,318<br />

8,158 343,950<br />

12,352,935 13,217,393<br />

The decrease in <strong>2010</strong> is due to lower interest rates on short<br />

term funds as well is lower cash and bank balances during<br />

the current year due to an increased cash demand for<br />

projects under development.<br />

The increase in <strong>2010</strong> is partly due to increase in imputed<br />

interest income on long term real estate accounts<br />

receivables during the year (see note 20).<br />

Investment income earned on financial assets by category of<br />

assets is CHF 12,344,777 (CHF 2009: 12,873,443) for loans<br />

and receivables including cash and bank balances and CHF<br />

8,158 (CFH 2009: 343,950) for dividend income earned on AFS<br />

financial assets.<br />

Income relating to financial assets classified as at fair value<br />

through profit or loss is included in Other gain and losses in note<br />

10.<br />

10 OTHER GAINS AND LOSSES<br />

___________________________________________________________________________________<br />

CHF <strong>2010</strong> 2009 (restated)<br />

Gain on disposal of<br />

property, plant and<br />

305,021 223,996<br />

equipment<br />

Gain on disposal of<br />

subsidiaries and<br />

7,824,706 -<br />

associates (i)<br />

Gain from disposal<br />

of AFS financial<br />

assets (ii) - 5,233,080<br />

Net foreign<br />

exchange<br />

(losses)/gains<br />

Gain from change<br />

in fair value of<br />

investment property<br />

(iii)<br />

(i)<br />

(ii)<br />

(iii)<br />

Other income<br />

(6,575,798) 1,396,768<br />

14,120,934 5,170,672<br />

3,488,161 4,672,603<br />

19,163,024 16,697,119<br />

This gain mainly relates to the sale of the six percent stake in<br />

the former Garranah subsidiaries which resulted in a loss of<br />

control (see note 34).<br />

In 2009 the Group derecognized the shares owned in Albion<br />

<strong>Development</strong> Holding (ADL), a real estate project in<br />

Mauritius, according to the call option agreement with Club<br />

Méditerranée. These shares were classified by the Group as<br />

AFS assets and carried at cost since they represent<br />

investments in unquoted equity instruments that do not have<br />

a quoted market price in an active market, and whose fair<br />

value cannot be measured reliably.<br />

This gain represents the effect from the revaluation of the<br />

investment properties and the subsequent change in use of<br />

several premises in El Gouna (Egypt) after the retrospective<br />

implementation of the new accounting policy as described in<br />

note 3.3.<br />

No other gains or losses have been recognized in respect of loans<br />

and receivables or held-to-maturity investments, other than as<br />

disclosed in note 11 and impairment losses recognized and / or<br />

reversed in respect of trade and other receivables in note 24.<br />

F-32