FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Orascom</strong> <strong>Development</strong> Holding (Consolidated Financial Statement)<br />

stake of 98.05%, later increased to 98.16% at 31 December<br />

2008.<br />

Whereas the new holding company (ODH) is ultimately owned<br />

and controlled by the same major shareholders, management<br />

decided that this Group reorganisation was for the purpose of<br />

capital restructuring and it has been accounted for as a<br />

continuation of the financial statements of the initial holding<br />

Group (OHD) in the 2008 consolidated financial statements<br />

Management concluded that the above Group restructure is<br />

classified as a transaction under common control since the<br />

combining entities are ultimately controlled by the same parties<br />

both before and after the combination and that control is not<br />

transitory.<br />

However, since IFRS 3 Business Combinations excludes from its<br />

scope business combinations involving entities or businesses<br />

under common control (common control transactions), IAS 8<br />

requires management to develop and apply an accounting policy<br />

that results in information that is relevant and reliable.<br />

Management used its judgment in developing and applying an<br />

accounting policy for common control transactions arising from<br />

the Group’s capital restructuring as follows:<br />

−<br />

−<br />

−<br />

Recognition of the assets acquired and liabilities<br />

assumed of the initial holding Group (OHD) at their<br />

previous carrying amounts;<br />

Recognition of the difference between purchase<br />

consideration and net assets acquired as an adjustment<br />

to equity;<br />

Transaction costs, which were incurred in relation to the<br />

issuance of ODH shares, have been recognised as a<br />

reduction to the reserve from common control<br />

transaction. Amount included in the consolidated<br />

statement of changes in equity.<br />

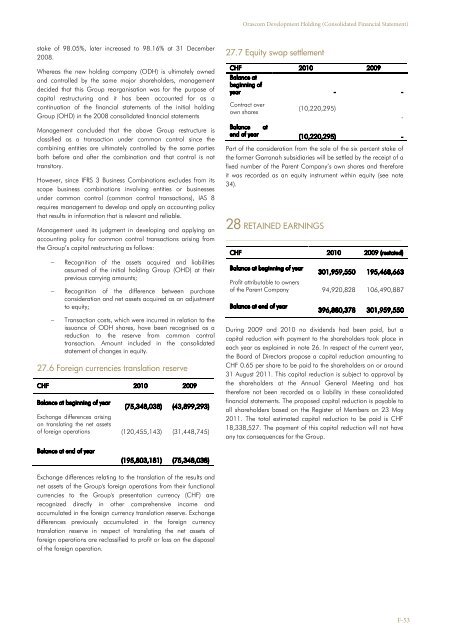

27.6 Foreign currencies translation reserve<br />

CHF <strong>2010</strong> 2009<br />

Balance at beginning of year<br />

(75,348,038) (43,899,293)<br />

Exchange differences arising<br />

on translating the net assets<br />

of foreign operations (120,455,143) (31,448,745)<br />

27.7 Equity swap settlement<br />

CHF <strong>2010</strong> 2009<br />

Balance at<br />

beginning of<br />

year - -<br />

Contract over<br />

(10,220,295)<br />

own shares<br />

-<br />

Balance at<br />

end of year (10,220,295) -<br />

<strong>Part</strong> of the consideration from the sale of the six percent stake of<br />

the former Garranah subsidiaries will be settled by the receipt of a<br />

fixed number of the Parent Company’s own shares and therefore<br />

it was recorded as an equity instrument within equity (see note<br />

34).<br />

28 RETAINED EARNINGS<br />

___________________________________________________________________________________<br />

CHF <strong>2010</strong> 2009 (restated)<br />

Balance at beginning of year<br />

301,959,550 195,468,663<br />

Profit attributable to owners<br />

of the Parent Company 94,920,828 106,490,887<br />

Balance at end of year<br />

396,880,378 301,959,550<br />

During 2009 and <strong>2010</strong> no dividends had been paid, but a<br />

capital reduction with payment to the shareholders took place in<br />

each year as explained in note 26. In respect of the current year,<br />

the Board of Directors propose a capital reduction amounting to<br />

CHF 0.65 per share to be paid to the shareholders on or around<br />

31 August 2011. This capital reduction is subject to approval by<br />

the shareholders at the <strong>Annual</strong> General Meeting and has<br />

therefore not been recorded as a liability in these consolidated<br />

financial statements. The proposed capital reduction is payable to<br />

all shareholders based on the Register of Members on 23 May<br />

2011. The total estimated capital reduction to be paid is CHF<br />

18,338,527. The payment of this capital reduction will not have<br />

any tax consequences for the Group.<br />

Balance at end of year<br />

(195,803,181) (75,348,038)<br />

Exchange differences relating to the translation of the results and<br />

net assets of the Group's foreign operations from their functional<br />

currencies to the Group's presentation currency (CHF) are<br />

recognized directly in other comprehensive income and<br />

accumulated in the foreign currency translation reserve. Exchange<br />

differences previously accumulated in the foreign currency<br />

translation reserve in respect of translating the net assets of<br />

foreign operations are reclassified to profit or loss on the disposal<br />

of the foreign operation.<br />

F-53