FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ODH <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

16 INVESTMENT PROPERTY<br />

___________________________________________________________________________________<br />

The Group has historically accounted for all its property as<br />

property, plant and equipment and measured them at cost less<br />

accumulated depreciation and / or accumulated impairment<br />

losses under IAS 16 (“property, plant and equipment”). The<br />

Group has restated its previously reported financial information<br />

including these financial statements to reflect the retrospective<br />

restatement of the Mauritius real-estate from property, plant and<br />

equipment to investment property measured at fair value as of 1<br />

January 2009 (see notes 3.3, 3.19 and 4.2.9).<br />

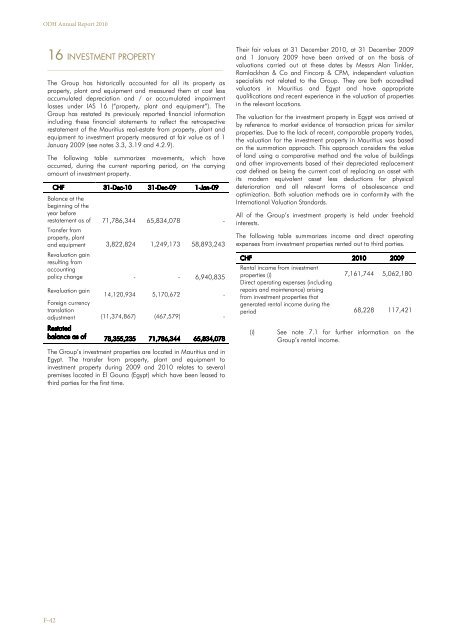

The following table summarizes movements, which have<br />

occurred, during the current reporting period, on the carrying<br />

amount of investment property.<br />

CHF 31-Dec-10 31-Dec-09 1-Jan-09<br />

Balance at the<br />

beginning of the<br />

year before<br />

restatement as of 71,786,344 65,834,078 -<br />

Transfer from<br />

property, plant<br />

and equipment 3,822,824 1,249,173 58,893,243<br />

Revaluation gain<br />

resulting from<br />

accounting<br />

policy change - - 6,940,835<br />

Revaluation gain<br />

14,120,934 5,170,672 -<br />

Foreign currency<br />

translation<br />

adjustment (11,374,867) (467,579) -<br />

Restated<br />

balance as of 78,355,235 71,786,344 65,834,078<br />

The Group’s investment properties are located in Mauritius and in<br />

Egypt. The transfer from property, plant and equipment to<br />

investment property during 2009 and <strong>2010</strong> relates to several<br />

premises located in El Gouna (Egypt) which have been leased to<br />

third parties for the first time.<br />

Their fair values at 31 December <strong>2010</strong>, at 31 December 2009<br />

and 1 January 2009 have been arrived at on the basis of<br />

valuations carried out at these dates by Messrs Alan Tinkler,<br />

Ramlackhan & Co and Fincorp & CPM, independent valuation<br />

specialists not related to the Group. They are both accredited<br />

valuators in Mauritius and Egypt and have appropriate<br />

qualifications and recent experience in the valuation of properties<br />

in the relevant locations.<br />

The valuation for the investment property in Egypt was arrived at<br />

by reference to market evidence of transaction prices for similar<br />

properties. Due to the lack of recent, comparable property trades,<br />

the valuation for the investment property in Mauritius was based<br />

on the summation approach. This approach considers the value<br />

of land using a comparative method and the value of buildings<br />

and other improvements based of their depreciated replacement<br />

cost defined as being the current cost of replacing an asset with<br />

its modern equivalent asset less deductions for physical<br />

deterioration and all relevant forms of obsolescence and<br />

optimization. Both valuation methods are in conformity with the<br />

International Valuation Standards.<br />

All of the Group’s investment property is held under freehold<br />

interests.<br />

The following table summarizes income and direct operating<br />

expenses from investment properties rented out to third parties.<br />

CHF <strong>2010</strong> 2009<br />

Rental income from investment<br />

properties (i) 7,161,744 5,062,180<br />

Direct operating expenses (including<br />

repairs and maintenance) arising<br />

from investment properties that<br />

generated rental income during the<br />

period 68,228 117,421<br />

(i)<br />

See note 7.1 for further information on the<br />

Group’s rental income.<br />

F-42