FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ODH <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

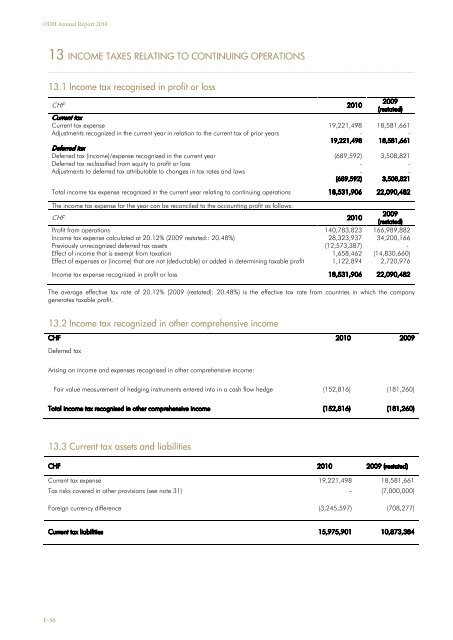

13 INCOME TAXES RELATING TO CONTINUING OPERATIONS<br />

_____________________________________________________________________________________________________________________________________________________________________________<br />

13.1 Income tax recognised in profit or loss<br />

CHF <strong>2010</strong><br />

2009<br />

(restated)<br />

Current tax<br />

Current tax expense 19,221,498 18,581,661<br />

Adjustments recognized in the current year in relation to the current tax of prior years - -<br />

19,221,498 18,581,661<br />

Deferred tax<br />

Deferred tax (income)/expense recognized in the current year (689,592) 3,508,821<br />

Deferred tax reclassified from equity to profit or loss - -<br />

Adjustments to deferred tax attributable to changes in tax rates and laws - -<br />

(689,592) 3,508,821<br />

Total income tax expense recognized in the current year relating to continuing operations 18,531,906 22,090,482<br />

The income tax expense for the year can be reconciled to the accounting profit as follows:<br />

CHF <strong>2010</strong><br />

2009<br />

(restated)<br />

Profit from operations 140,783,823 166,989,882<br />

Income tax expense calculated at 20.12% (2009 restated:: 20.48%) 28,323,937 34,200,166<br />

Previously unrecognized deferred tax assets (12,573,387) -<br />

Effect of income that is exempt from taxation 1,658,462 (14,830,660)<br />

Effect of expenses or (income) that are not (deductable) or added in determining taxable profit 1,122,894 2,720,976<br />

Income tax expense recognized in profit or loss 18,531,906 22,090,482<br />

The average effective tax rate of 20.12% (2009 (restated): 20.48%) is the effective tax rate from countries in which the company<br />

generates taxable profit.<br />

13.2 Income tax recognized in other comprehensive income<br />

CHF <strong>2010</strong> 2009<br />

Deferred tax<br />

Arising on income and expenses recognised in other comprehensive income:<br />

Fair value measurement of hedging instruments entered into in a cash flow hedge (152,816) (181,260)<br />

Total income tax recognised in other comprehensive income (152,816) (181,260)<br />

13.3 Current tax assets and liabilities<br />

CHF <strong>2010</strong> 2009 (restated)<br />

Current tax expense 19,221,498 18,581,661<br />

Tax risks covered in other provisions (see note 31) - (7,000,000)<br />

Foreign currency difference (3,245,597) (708,277)<br />

Current tax liabilities 15,975,901 10,873,384<br />

F-36