FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ODH <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

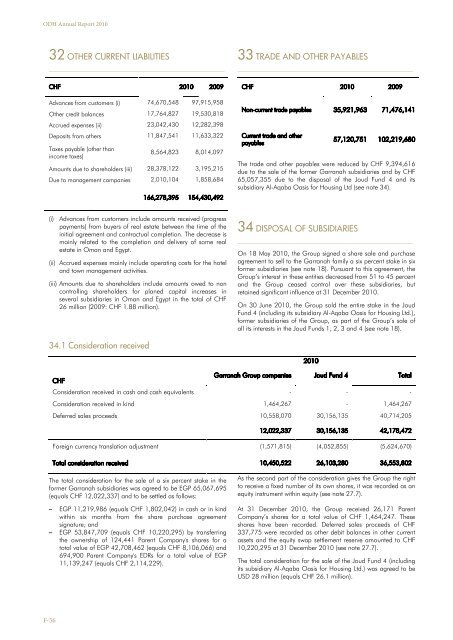

32 OTHER CURRENT LIABILITIES<br />

___________________________________________________________________________________<br />

33 TRADE AND OTHER PAYABLES<br />

___________________________________________________________________________________<br />

CHF <strong>2010</strong> 2009<br />

Advances from customers (i) 74,670,548 97,915,958<br />

Other credit balances 17,764,827 19,530,818<br />

Accrued expenses (ii) 23,042,430 12,282,398<br />

Deposits from others 11,847,541 11,633,322<br />

Taxes payable (other than<br />

income taxes)<br />

8,564,823 8,014,097<br />

Amounts due to shareholders (iii) 28,378,122 3,195,215<br />

Due to management companies 2,010,104 1,858,684<br />

166,278,395 154,430,492<br />

CHF <strong>2010</strong> 2009<br />

Non-current trade payables 35,921,963 71,476,141<br />

Current trade and other<br />

payables<br />

57,120,751 102,219,680<br />

The trade and other payables were reduced by CHF 9,394,616<br />

due to the sale of the former Garranah subsidiaries and by CHF<br />

65,057,355 due to the disposal of the Joud Fund 4 and its<br />

subsidiary Al-Aqaba Oasis for Housing Ltd (see note 34).<br />

(i)<br />

Advances from customers include amounts received (progress<br />

payments) from buyers of real estate between the time of the<br />

initial agreement and contractual completion. The decrease is<br />

mainly related to the completion and delivery of some real<br />

estate in Oman and Egypt.<br />

(ii) Accrued expenses mainly include operating costs for the hotel<br />

and town management activities.<br />

(iii) Amounts due to shareholders include amounts owed to non<br />

controlling shareholders for planed capital increases in<br />

several subsidiaries in Oman and Egypt in the total of CHF<br />

26 million (2009: CHF 1.88 million).<br />

34 DISPOSAL OF SUBSIDIARIES<br />

___________________________________________________________________________________<br />

On 18 May <strong>2010</strong>, the Group signed a share sale and purchase<br />

agreement to sell to the Garranah family a six percent stake in six<br />

former subsidiaries (see note 18). Pursuant to this agreement, the<br />

Group’s interest in these entities decreased from 51 to 45 percent<br />

and the Group ceased control over these subsidiaries, but<br />

retained significant influence at 31 December <strong>2010</strong>.<br />

On 30 June <strong>2010</strong>, the Group sold the entire stake in the Joud<br />

Fund 4 (including its subsidiary Al-Aqaba Oasis for Housing Ltd.),<br />

former subsidiaries of the Group, as part of the Group’s sale of<br />

all its interests in the Joud Funds 1, 2, 3 and 4 (see note 18).<br />

34.1 Consideration received<br />

<strong>2010</strong><br />

CHF<br />

Garranah Group companies Joud Fund 4 Total<br />

Consideration received in cash and cash equivalents - - -<br />

Consideration received in kind 1,464,267 - 1,464,267<br />

Deferred sales proceeds 10,558,070 30,156,135 40,714,205<br />

12,022,337 30,156,135 42,178,472<br />

Foreign currency translation adjustment (1,571,815) (4,052,855) (5,624,670)<br />

Total consideration received 10,450,522 26,103,280 36,553,802<br />

The total consideration for the sale of a six percent stake in the<br />

former Garranah subsidiaries was agreed to be EGP 65,067,695<br />

(equals CHF 12,022,337) and to be settled as follows:<br />

– EGP 11,219,986 (equals CHF 1,802,042) in cash or in kind<br />

within six months from the share purchase agreement<br />

signature; and<br />

– EGP 53,847,709 (equals CHF 10,220,295) by transferring<br />

the ownership of 124,441 Parent Company's shares for a<br />

total value of EGP 42,708,462 (equals CHF 8,106,066) and<br />

694,900 Parent Company's EDRs for a total value of EGP<br />

11,139,247 (equals CHF 2,114,229).<br />

As the second part of the consideration gives the Group the right<br />

to receive a fixed number of its own shares, it was recorded as an<br />

equity instrument within equity (see note 27.7).<br />

At 31 December <strong>2010</strong>, the Group received 26,171 Parent<br />

Company’s shares for a total value of CHF 1,464,247. These<br />

shares have been recorded. Deferred sales proceeds of CHF<br />

337,775 were recorded as other debit balances in other current<br />

assets and the equity swap settlement reserve amounted to CHF<br />

10,220,295 at 31 December <strong>2010</strong> (see note 27.7).<br />

The total consideration for the sale of the Joud Fund 4 (including<br />

its subsidiary Al-Aqaba Oasis for Housing Ltd.) was agreed to be<br />

USD 28 million (equals CHF 26.1 million).<br />

F-56