FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

FY 2010 Annual Report - Part II - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Orascom</strong> <strong>Development</strong> Holding (Consolidated Financial Statement)<br />

530,587 was recorded in the statement of comprehensive income<br />

as other gains and losses (see notes 10 and 34).<br />

The members of the Garranah family who were party to the<br />

transaction as sellers in 2008 and buyers in <strong>2010</strong> of the six<br />

percent stake in the former Garranah subsidiaries are related to<br />

the ex minister who is also a member of the Garranah family and<br />

currently being investigated in Egypt in his capacity as a public<br />

officer. The assets of the Garranah family are frozen; however,<br />

this should not impact the recovery of the remaining sales<br />

proceeds as this measure is only precautionary and not<br />

permanent.<br />

On 28 December <strong>2010</strong> the Group signed the legal documents to<br />

register the transfer of title regarding the six percent stake of the<br />

Garranah entities according to the broker’s invoices by the par<br />

value of the shares to the Garranah family except for the legal<br />

title of Tarot Tours Company (Garanah) S.A.E which is still under<br />

execution awaiting the final approval from the regulator. The<br />

company has received a request for clarification from the<br />

authorities regarding the execution of the transfer documents with<br />

par value.<br />

(iv) El Tarek for Nile Cruises & Floating Hotels El Tarek for Nile<br />

Cruises & Floating Hotels<br />

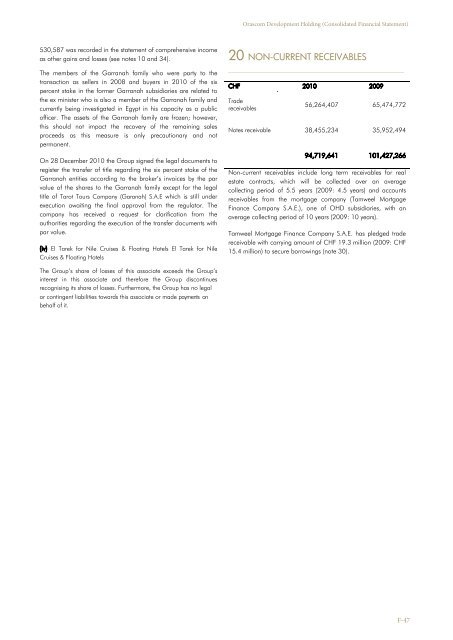

20 NON-CURRENT RECEIVABLES<br />

___________________________________________________________________________________<br />

CHF <strong>2010</strong> 2009<br />

Trade<br />

receivables<br />

56,264,407 65,474,772<br />

Notes receivable 38,455,234 35,952,494<br />

94,719,641 101,427,266<br />

Non-current receivables include long term receivables for real<br />

estate contracts, which will be collected over an average<br />

collecting period of 5.5 years (2009: 4.5 years) and accounts<br />

receivables from the mortgage company (Tamweel Mortgage<br />

Finance Company S.A.E.), one of OHD subsidiaries, with an<br />

average collecting period of 10 years (2009: 10 years).<br />

Tamweel Mortgage Finance Company S.A.E. has pledged trade<br />

receivable with carrying amount of CHF 19.3 million (2009: CHF<br />

15.4 million) to secure borrowings (note 30).<br />

The Group’s share of losses of this associate exceeds the Group’s<br />

interest in this associate and therefore the Group discontinues<br />

recognising its share of losses. Furthermore, the Group has no legal<br />

or contingent liabilities towards this associate or made payments on<br />

behalf of it.<br />

F-47