Arcotia Hatsidimitris - International Tax Dialogue

Arcotia Hatsidimitris - International Tax Dialogue

Arcotia Hatsidimitris - International Tax Dialogue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

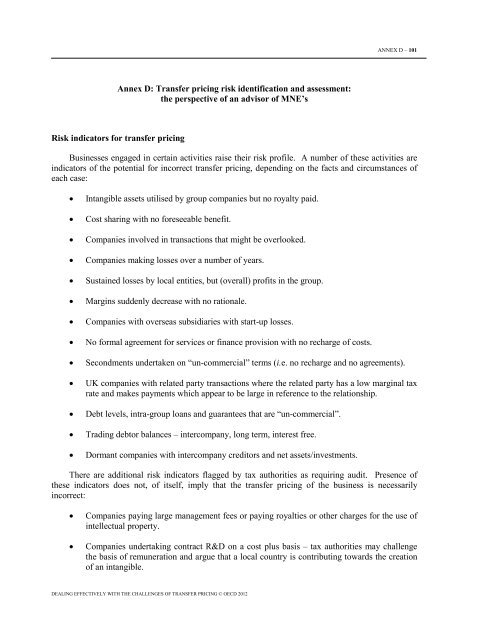

ANNEX D – 101<br />

Annex D: Transfer pricing risk identification and assessment:<br />

the perspective of an advisor of MNE’s<br />

Risk indicators for transfer pricing<br />

Businesses engaged in certain activities raise their risk profile. A number of these activities are<br />

indicators of the potential for incorrect transfer pricing, depending on the facts and circumstances of<br />

each case:<br />

• Intangible assets utilised by group companies but no royalty paid.<br />

• Cost sharing with no foreseeable benefit.<br />

• Companies involved in transactions that might be overlooked.<br />

• Companies making losses over a number of years.<br />

• Sustained losses by local entities, but (overall) profits in the group.<br />

• Margins suddenly decrease with no rationale.<br />

• Companies with overseas subsidiaries with start-up losses.<br />

• No formal agreement for services or finance provision with no recharge of costs.<br />

• Secondments undertaken on “un-commercial” terms (i.e. no recharge and no agreements).<br />

• UK companies with related party transactions where the related party has a low marginal tax<br />

rate and makes payments which appear to be large in reference to the relationship.<br />

• Debt levels, intra-group loans and guarantees that are “un-commercial”.<br />

• Trading debtor balances – intercompany, long term, interest free.<br />

• Dormant companies with intercompany creditors and net assets/investments.<br />

There are additional risk indicators flagged by tax authorities as requiring audit. Presence of<br />

these indicators does not, of itself, imply that the transfer pricing of the business is necessarily<br />

incorrect:<br />

• Companies paying large management fees or paying royalties or other charges for the use of<br />

intellectual property.<br />

• Companies undertaking contract R&D on a cost plus basis – tax authorities may challenge<br />

the basis of remuneration and argue that a local country is contributing towards the creation<br />

of an intangible.<br />

DEALING EFFECTIVELY WITH THE CHALLENGES OF TRANSFER PRICING © OECD 2012