Arcotia Hatsidimitris - International Tax Dialogue

Arcotia Hatsidimitris - International Tax Dialogue

Arcotia Hatsidimitris - International Tax Dialogue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22 – 2. SELECTING THE RIGHT CASES<br />

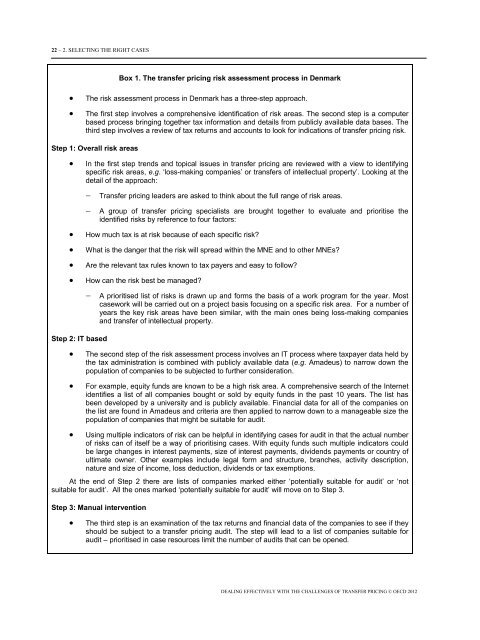

Box 1. The transfer pricing risk assessment process in Denmark<br />

• The risk assessment process in Denmark has a three-step approach.<br />

• The first step involves a comprehensive identification of risk areas. The second step is a computer<br />

based process bringing together tax information and details from publicly available data bases. The<br />

third step involves a review of tax returns and accounts to look for indications of transfer pricing risk.<br />

Step 1: Overall risk areas<br />

• In the first step trends and topical issues in transfer pricing are reviewed with a view to identifying<br />

specific risk areas, e.g. ‘loss-making companies’ or transfers of intellectual property’. Looking at the<br />

detail of the approach:<br />

<br />

<br />

Transfer pricing leaders are asked to think about the full range of risk areas.<br />

A group of transfer pricing specialists are brought together to evaluate and prioritise the<br />

identified risks by reference to four factors:<br />

• How much tax is at risk because of each specific risk?<br />

• What is the danger that the risk will spread within the MNE and to other MNEs?<br />

• Are the relevant tax rules known to tax payers and easy to follow?<br />

• How can the risk best be managed?<br />

<br />

Step 2: IT based<br />

A prioritised list of risks is drawn up and forms the basis of a work program for the year. Most<br />

casework will be carried out on a project basis focusing on a specific risk area. For a number of<br />

years the key risk areas have been similar, with the main ones being loss-making companies<br />

and transfer of intellectual property.<br />

• The second step of the risk assessment process involves an IT process where taxpayer data held by<br />

the tax administration is combined with publicly available data (e.g. Amadeus) to narrow down the<br />

population of companies to be subjected to further consideration.<br />

• For example, equity funds are known to be a high risk area. A comprehensive search of the Internet<br />

identifies a list of all companies bought or sold by equity funds in the past 10 years. The list has<br />

been developed by a university and is publicly available. Financial data for all of the companies on<br />

the list are found in Amadeus and criteria are then applied to narrow down to a manageable size the<br />

population of companies that might be suitable for audit.<br />

• Using multiple indicators of risk can be helpful in identifying cases for audit in that the actual number<br />

of risks can of itself be a way of prioritising cases. With equity funds such multiple indicators could<br />

be large changes in interest payments, size of interest payments, dividends payments or country of<br />

ultimate owner. Other examples include legal form and structure, branches, activity description,<br />

nature and size of income, loss deduction, dividends or tax exemptions.<br />

At the end of Step 2 there are lists of companies marked either ‘potentially suitable for audit’ or ‘not<br />

suitable for audit’. All the ones marked ‘potentially suitable for audit’ will move on to Step 3.<br />

Step 3: Manual intervention<br />

• The third step is an examination of the tax returns and financial data of the companies to see if they<br />

should be subject to a transfer pricing audit. The step will lead to a list of companies suitable for<br />

audit – prioritised in case resources limit the number of audits that can be opened.<br />

DEALING EFFECTIVELY WITH THE CHALLENGES OF TRANSFER PRICING © OECD 2012