Arcotia Hatsidimitris - International Tax Dialogue

Arcotia Hatsidimitris - International Tax Dialogue

Arcotia Hatsidimitris - International Tax Dialogue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6. REACHING A DECISION POINT – 53<br />

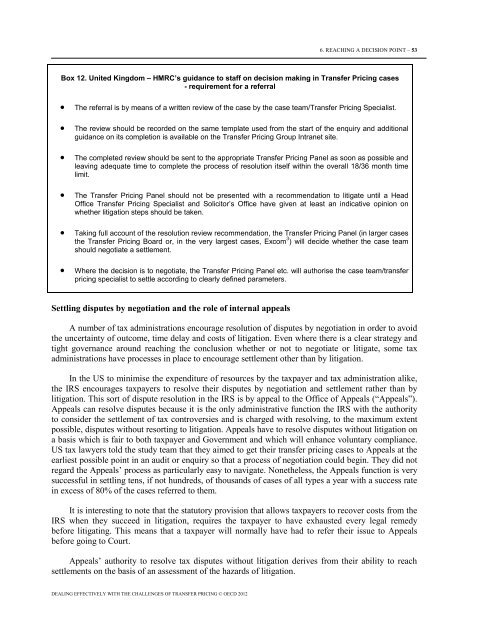

Box 12. United Kingdom – HMRC’s guidance to staff on decision making in Transfer Pricing cases<br />

- requirement for a referral<br />

• The referral is by means of a written review of the case by the case team/Transfer Pricing Specialist.<br />

• The review should be recorded on the same template used from the start of the enquiry and additional<br />

guidance on its completion is available on the Transfer Pricing Group Intranet site.<br />

• The completed review should be sent to the appropriate Transfer Pricing Panel as soon as possible and<br />

leaving adequate time to complete the process of resolution itself within the overall 18/36 month time<br />

limit.<br />

• The Transfer Pricing Panel should not be presented with a recommendation to litigate until a Head<br />

Office Transfer Pricing Specialist and Solicitor’s Office have given at least an indicative opinion on<br />

whether litigation steps should be taken.<br />

• Taking full account of the resolution review recommendation, the Transfer Pricing Panel (in larger cases<br />

the Transfer Pricing Board or, in the very largest cases, Excom 3 ) will decide whether the case team<br />

should negotiate a settlement.<br />

• Where the decision is to negotiate, the Transfer Pricing Panel etc. will authorise the case team/transfer<br />

pricing specialist to settle according to clearly defined parameters.<br />

Settling disputes by negotiation and the role of internal appeals<br />

A number of tax administrations encourage resolution of disputes by negotiation in order to avoid<br />

the uncertainty of outcome, time delay and costs of litigation. Even where there is a clear strategy and<br />

tight governance around reaching the conclusion whether or not to negotiate or litigate, some tax<br />

administrations have processes in place to encourage settlement other than by litigation.<br />

In the US to minimise the expenditure of resources by the taxpayer and tax administration alike,<br />

the IRS encourages taxpayers to resolve their disputes by negotiation and settlement rather than by<br />

litigation. This sort of dispute resolution in the IRS is by appeal to the Office of Appeals (“Appeals”).<br />

Appeals can resolve disputes because it is the only administrative function the IRS with the authority<br />

to consider the settlement of tax controversies and is charged with resolving, to the maximum extent<br />

possible, disputes without resorting to litigation. Appeals have to resolve disputes without litigation on<br />

a basis which is fair to both taxpayer and Government and which will enhance voluntary compliance.<br />

US tax lawyers told the study team that they aimed to get their transfer pricing cases to Appeals at the<br />

earliest possible point in an audit or enquiry so that a process of negotiation could begin. They did not<br />

regard the Appeals’ process as particularly easy to navigate. Nonetheless, the Appeals function is very<br />

successful in settling tens, if not hundreds, of thousands of cases of all types a year with a success rate<br />

in excess of 80% of the cases referred to them.<br />

It is interesting to note that the statutory provision that allows taxpayers to recover costs from the<br />

IRS when they succeed in litigation, requires the taxpayer to have exhausted every legal remedy<br />

before litigating. This means that a taxpayer will normally have had to refer their issue to Appeals<br />

before going to Court.<br />

Appeals’ authority to resolve tax disputes without litigation derives from their ability to reach<br />

settlements on the basis of an assessment of the hazards of litigation.<br />

DEALING EFFECTIVELY WITH THE CHALLENGES OF TRANSFER PRICING © OECD 2012