Arcotia Hatsidimitris - International Tax Dialogue

Arcotia Hatsidimitris - International Tax Dialogue

Arcotia Hatsidimitris - International Tax Dialogue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46 – 5. MAINTAINING PROGRESS, TACKLING DELAY<br />

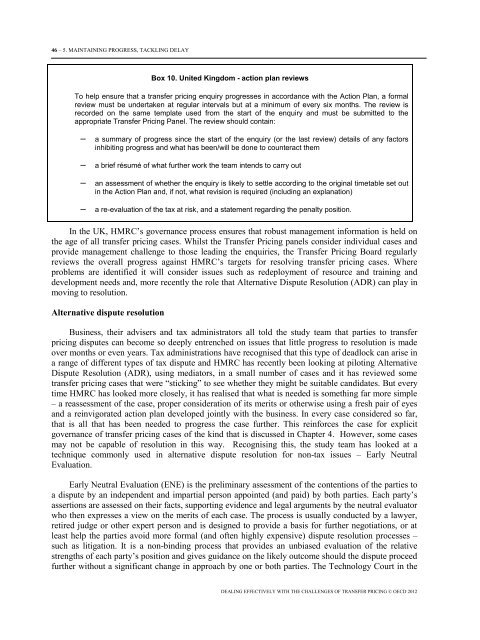

Box 10. United Kingdom - action plan reviews<br />

To help ensure that a transfer pricing enquiry progresses in accordance with the Action Plan, a formal<br />

review must be undertaken at regular intervals but at a minimum of every six months. The review is<br />

recorded on the same template used from the start of the enquiry and must be submitted to the<br />

appropriate Transfer Pricing Panel. The review should contain:<br />

– a summary of progress since the start of the enquiry (or the last review) details of any factors<br />

inhibiting progress and what has been/will be done to counteract them<br />

– a brief résumé of what further work the team intends to carry out<br />

– an assessment of whether the enquiry is likely to settle according to the original timetable set out<br />

in the Action Plan and, if not, what revision is required (including an explanation)<br />

– a re-evaluation of the tax at risk, and a statement regarding the penalty position.<br />

In the UK, HMRC’s governance process ensures that robust management information is held on<br />

the age of all transfer pricing cases. Whilst the Transfer Pricing panels consider individual cases and<br />

provide management challenge to those leading the enquiries, the Transfer Pricing Board regularly<br />

reviews the overall progress against HMRC’s targets for resolving transfer pricing cases. Where<br />

problems are identified it will consider issues such as redeployment of resource and training and<br />

development needs and, more recently the role that Alternative Dispute Resolution (ADR) can play in<br />

moving to resolution.<br />

Alternative dispute resolution<br />

Business, their advisers and tax administrators all told the study team that parties to transfer<br />

pricing disputes can become so deeply entrenched on issues that little progress to resolution is made<br />

over months or even years. <strong>Tax</strong> administrations have recognised that this type of deadlock can arise in<br />

a range of different types of tax dispute and HMRC has recently been looking at piloting Alternative<br />

Dispute Resolution (ADR), using mediators, in a small number of cases and it has reviewed some<br />

transfer pricing cases that were “sticking” to see whether they might be suitable candidates. But every<br />

time HMRC has looked more closely, it has realised that what is needed is something far more simple<br />

– a reassessment of the case, proper consideration of its merits or otherwise using a fresh pair of eyes<br />

and a reinvigorated action plan developed jointly with the business. In every case considered so far,<br />

that is all that has been needed to progress the case further. This reinforces the case for explicit<br />

governance of transfer pricing cases of the kind that is discussed in Chapter 4. However, some cases<br />

may not be capable of resolution in this way. Recognising this, the study team has looked at a<br />

technique commonly used in alternative dispute resolution for non-tax issues – Early Neutral<br />

Evaluation.<br />

Early Neutral Evaluation (ENE) is the preliminary assessment of the contentions of the parties to<br />

a dispute by an independent and impartial person appointed (and paid) by both parties. Each party’s<br />

assertions are assessed on their facts, supporting evidence and legal arguments by the neutral evaluator<br />

who then expresses a view on the merits of each case. The process is usually conducted by a lawyer,<br />

retired judge or other expert person and is designed to provide a basis for further negotiations, or at<br />

least help the parties avoid more formal (and often highly expensive) dispute resolution processes –<br />

such as litigation. It is a non-binding process that provides an unbiased evaluation of the relative<br />

strengths of each party’s position and gives guidance on the likely outcome should the dispute proceed<br />

further without a significant change in approach by one or both parties. The Technology Court in the<br />

DEALING EFFECTIVELY WITH THE CHALLENGES OF TRANSFER PRICING © OECD 2012