FY 2012 Annual Report - Orascom Development

FY 2012 Annual Report - Orascom Development

FY 2012 Annual Report - Orascom Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F-51 <strong>Orascom</strong> <strong>Development</strong> <strong>2012</strong> <strong>Annual</strong> <strong>Report</strong> F-52<br />

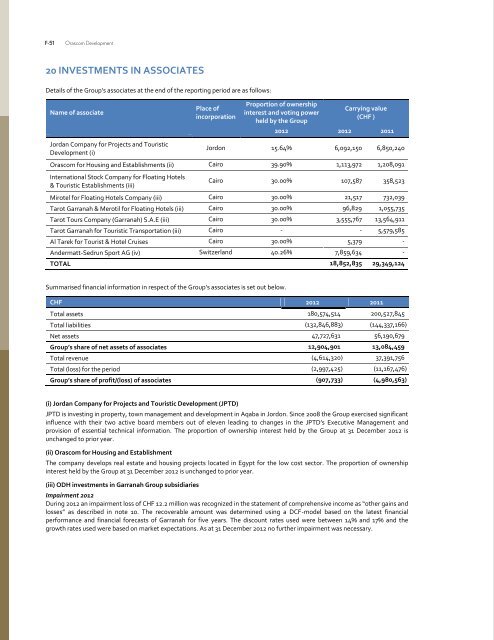

20 INVESTMENTS IN ASSOCIATES<br />

Details of the Group’s associates at the end of the reporting period are as follows:<br />

Name of associate<br />

Jordan Company for Projects and Touristic<br />

<strong>Development</strong> (i)<br />

Place of<br />

incorporation<br />

Proportion of ownership<br />

interest and voting power<br />

held by the Group<br />

Carrying value<br />

(CHF )<br />

<strong>2012</strong> <strong>2012</strong> 2011<br />

Jordon 15.64% 6,092,150 6,850,240<br />

<strong>Orascom</strong> for Housing and Establishments (ii) Cairo 39.90% 1,113,972 1,208,091<br />

International Stock Company for Floating Hotels<br />

& Touristic Establishments (iii)<br />

Cairo 30.00% 107,587 358,523<br />

Mirotel for Floating Hotels Company (iii) Cairo 30.00% 21,517 732,039<br />

Tarot Garranah & Merotil for Floating Hotels (iii) Cairo 30.00% 96,829 1,055,735<br />

Tarot Tours Company (Garranah) S.A.E (iii) Cairo 30.00% 3,555,767 13,564,911<br />

Tarot Garranah for Touristic Transportation (iii) Cairo - - 5,579,585<br />

Al Tarek for Tourist & Hotel Cruises Cairo 30.00% 5,379 -<br />

Andermatt-Sedrun Sport AG (iv) Switzerland 40.26% 7,859,634 -<br />

TOTAL 18,852,835 29,349,124<br />

Summarised financial information in respect of the Group’s associates is set out below.<br />

CHF <strong>2012</strong> 2011<br />

Total assets 180,574,514 200,527,845<br />

Total liabilities (132,846,883) (144,337,166)<br />

Net assets 47,727,631 56,190,679<br />

Group’s share of net assets of associates 12,904,901 13,084,459<br />

Total revenue (4,614,320) 37,391,756<br />

Total (loss) for the period (2,997,425) (11,167,476)<br />

Group’s share of profit/(loss) of associates (907,733) (4,980,563)<br />

(i) Jordan Company for Projects and Touristic <strong>Development</strong> (JPTD)<br />

JPTD is investing in property, town management and development in Aqaba in Jordon. Since 2008 the Group exercised significant<br />

influence with their two active board members out of eleven leading to changes in the JPTD’s Executive Management and<br />

provision of essential technical information. The proportion of ownership interest held by the Group at 31 December <strong>2012</strong> is<br />

unchanged to prior year.<br />

Sale of 15% stake in Garranah investments<br />

On 1 November <strong>2012</strong>, the Group signed a share sale and purchase agreement to sell to the Garranah family an additional 15%<br />

stake in five investment whereof four are operating floating hotels (International Stock Company for Floating Hotels & Touristic<br />

Establishments, Mirotel for Floating Hotels Company, Tarot Garranah & Merotil for Floating Hotels, El Tarek for Nile Cruises &<br />

Floating Hotels) and one is active as a tour operator (Tarot Tours Company (Garranah) SAE). The company that provides tour<br />

transportation services (Tarot Garranah for Touristic Transportation) has been sold completely.<br />

Pursuant to this agreement, the Group’s interest in the four operating floating hotels and the tour operator decreased from 45 to<br />

30 percent however the Group keeps its significant influence over these investments in associates. All interests held in the<br />

company providing tour transportations services have been sold. Legal procedures to transfer title were still in process at year end.<br />

Losses on disposal of the 15% stake in Garranah Group entities of CHF 6.4 million were recognized on sale of the 15% stake.<br />

However, as such losses were already recognized as indirect impairment through provisions based on the estimated sales price in<br />

the third quarter of <strong>2012</strong>, they are shown as impairment and not as loss from disposal of part of the investments in associates.<br />

Together with the gains from the sale of the tour transportation services company these losses were recognised through “other<br />

gains and losses ” (refer to note 10 for further details).<br />

(iv) Andermatt-Sedrun Sport AG<br />

As further explained in note 37, the Group lost control over its investment in Andermatt-Sedrun Sport AG (“ASS”) however with a<br />

40.26% interest still has significant influence. The investment in associates is accounted for at its fair value on transaction date<br />

plus the share of gains/losses of ASS since the transaction date. The fair value of ASS was assessed by using a DCF model for its<br />

investment in the skiing area, which is the main asset of ASS. The DCF valuation is based on a five year business plan and a<br />

relatively low discount rate of 5.5% which is due to favourable long-term government financing. In connection with the acquisition<br />

of the skiing areas a total loss of CHF 1.9m resulted from this transaction. See note 37 for further details.<br />

21 NON-CURRENT RECEIVABLES<br />

CHF <strong>2012</strong> 2011<br />

Trade receivables 47,273,333 53,370,912<br />

Notes receivable 26,846,506 35,796,968<br />

TOTAL 74,119,839 89,167,880<br />

Non-current receivables include long term receivables for real estate contracts, which will be collected over an average collecting<br />

period of 5.5 years (2011: 5.5 years) and accounts receivables from the mortgage company (Tamweel Mortgage Finance Company<br />

S.A.E.), one of OHD subsidiaries, with an average collecting period of 10 years (2011: 10 years). None of these non-current<br />

receivables are impaired and/or overdue.<br />

Tamweel Mortgage Finance Company S.A.E. has pledged trade receivable with carrying amount of CHF 18.7 million (2011: CHF<br />

15.6 million) to secure borrowings (note 31).<br />

(ii) <strong>Orascom</strong> for Housing and Establishment<br />

The company develops real estate and housing projects located in Egypt for the low cost sector. The proportion of ownership<br />

interest held by the Group at 31 December <strong>2012</strong> is unchanged to prior year.<br />

(iii) ODH investments in Garranah Group subsidiaries<br />

Impairment <strong>2012</strong><br />

During <strong>2012</strong> an impairment loss of CHF 12.2 million was recognized in the statement of comprehensive income as “other gains and<br />

losses” as described in note 10. The recoverable amount was determined using a DCF-model based on the latest financial<br />

performance and financial forecasts of Garranah for five years. The discount rates used were between 14% and 17% and the<br />

growth rates used were based on market expectations. As at 31 December <strong>2012</strong> no further impairment was necessary.<br />

F-51<br />

F-52