FY 2012 Annual Report - Orascom Development

FY 2012 Annual Report - Orascom Development

FY 2012 Annual Report - Orascom Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F-9 <strong>Orascom</strong> <strong>Development</strong> <strong>2012</strong> <strong>Annual</strong> <strong>Report</strong> F-10<br />

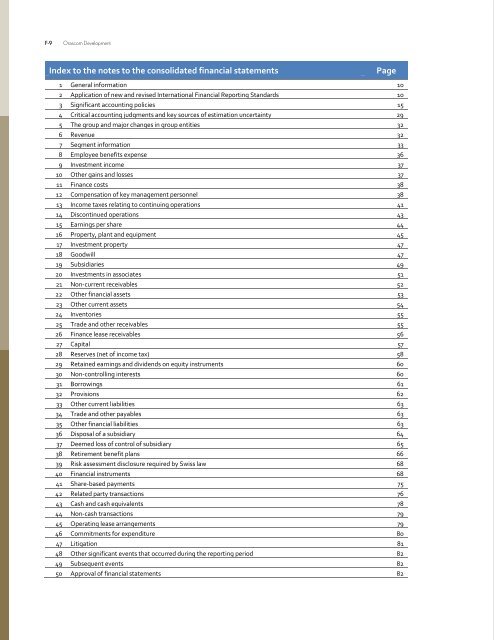

Index to the notes to the consolidated financial statements<br />

Page<br />

1 General information 10<br />

2 Application of new and revised International Financial <strong>Report</strong>ing Standards 10<br />

3 Significant accounting policies 15<br />

4 Critical accounting judgments and key sources of estimation uncertainty 29<br />

5 The group and major changes in group entities 32<br />

6 Revenue 32<br />

7 Segment information 33<br />

8 Employee benefits expense 36<br />

9 Investment income 37<br />

10 Other gains and losses 37<br />

11 Finance costs 38<br />

12 Compensation of key management personnel 38<br />

13 Income taxes relating to continuing operations 41<br />

14 Discontinued operations 43<br />

15 Earnings per share 44<br />

16 Property, plant and equipment 45<br />

17 Investment property 47<br />

18 Goodwill 47<br />

19 Subsidiaries 49<br />

20 Investments in associates 51<br />

21 Non-current receivables 52<br />

22 Other financial assets 53<br />

23 Other current assets 54<br />

24 Inventories 55<br />

25 Trade and other receivables 55<br />

26 Finance lease receivables 56<br />

27 Capital 57<br />

28 Reserves (net of income tax) 58<br />

29 Retained earnings and dividends on equity instruments 60<br />

30 Non-controlling interests 60<br />

31 Borrowings 61<br />

32 Provisions 62<br />

33 Other current liabilities 63<br />

34 Trade and other payables 63<br />

35 Other financial liabilities 63<br />

36 Disposal of a subsidiary 64<br />

37 Deemed loss of control of subsidiary 65<br />

38 Retirement benefit plans 66<br />

39 Risk assessment disclosure required by Swiss law 68<br />

40 Financial instruments 68<br />

41 Share-based payments 75<br />

42 Related party transactions 76<br />

43 Cash and cash equivalents 78<br />

44 Non-cash transactions 79<br />

45 Operating lease arrangements 79<br />

46 Commitments for expenditure 80<br />

47 Litigation 81<br />

48 Other significant events that occurred during the reporting period 82<br />

49 Subsequent events 82<br />

50 Approval of financial statements 82<br />

Notes to the consolidated financial<br />

statements for the year ended 31 December<br />

<strong>2012</strong><br />

1 GENERAL INFORMATION<br />

<strong>Orascom</strong> <strong>Development</strong> Holding AG (“ODH” or “the Parent Company”), a limited company incorporated in Altdorf, Switzerland, is<br />

a public company whose shares are traded on the SIX Swiss Exchange. In addition, Egyptian Depository Receipts (“EDRs”) of the<br />

Parent Company are traded at the EGX Egyptian Exchange. One EDR represents 1/20 of an ODH share.<br />

The Company and its subsidiaries (the “Group”) is a leading developer of fully integrated towns that include hotels, private villas<br />

and apartments, leisure facilities such as golf courses, marinas and supporting infrastructure. The Group’s diversified portfolio of<br />

projects is spread over nine jurisdictions, with primary focus on touristic towns and recently affordable housing. The Group<br />

currently operates in Egypt, Jordan, UAE, Oman, Switzerland, Morocco, United Kingdom, Montenegro and Romania and is<br />

continuously seeking development opportunities in untapped yet attractive locations all over the world. The Group has four<br />

existing projects: El Gouna, the flagship project, a fully-fledged town on the Red Sea coast (Egypt); Taba Heights, on the Sinai<br />

Peninsula (Egypt), the Group’s second tourism destination following El Gouna’s business model; the Cove (Ras Al Khaimah, UAE),<br />

the Group’s first development experience outside Egypt; and Haram City, an integrated town dedicated to affordable housing in<br />

Egypt, catering for the mass population.<br />

The addresses of its registered office and principal place of business are disclosed in the introduction to the annual report.<br />

2 Application of new and revised International Financial <strong>Report</strong>ing Standards<br />

(“IFRSs”)<br />

2.1 New and revised IFRSs affecting amounts reported in the current year and prior years<br />

The following new and revised Standards and Interpretations have been applied in the current period and have affected these<br />

financial statements. Details of other new and revised IFRSs applied in these financial statements that have had no material effect<br />

on the financial statements are set out in note 2.2:<br />

IFRS 9 Financial Instruments – Amendment of recognition and measurement requirements as the first part of the project to<br />

replace IAS 39<br />

In the current year, the Group has early applied IFRS 9 Financial Instruments (as issued in November 2009 and revised in October<br />

2010) and the related consequential amendments. As the Standard is required to be applied retrospectively, the date of initial<br />

application is 1 January 2011. Comparative amounts have been restated where appropriate. The main reason why the Group<br />

decided to early apply IFRS 9 is the elimination of the available-for-sale (“AFS”) category of financial assets. AFS financial assets<br />

needed to be assessed for impairment with any impairment losses recognised through profit or loss. Going forward any gains and<br />

losses in financial assets previously classified as AFS will be shown either in profit or loss or, where the Group irrevocably<br />

designates, other comprehensive income relating to equity instruments which are not held for trading and at initial recognition<br />

have been classified as at fair value through other comprehensive income (FVTOCI) with no subsequent recycling to profit or loss<br />

even in case of disposal or if they are impaired as indicated by significant or prolonged declines in fair values.<br />

In its 2011 financial statements the group held equity instruments classified as AFS in the amount of CHF 56.4 million for which a<br />

decline in fair value of CHF 35.8 million has been recognised in other comprehensive income. Although the decline in fair value was<br />

significant and prolonged the group has assessed that the decline did not represent an impairment based on the reasons given in<br />

Note 21.1 of the 2011 financial statements. During <strong>2012</strong> in the course of an investigation by SIX Exchange Regulation the company<br />

agreed that the group should have deemed these investments impaired based on the requirements of IAS 39 and that this error<br />

could be remediated through the early application of IFRS 9 in <strong>2012</strong>. Had the requirements of IAS 39 been applied accordingly,<br />

other gains and losses as well as loss for the period would have increased by the same amount and basic and diluted losses per<br />

share would have been CHF 3.72. However, due to the early adoption of IFRS 9 the comparative period does not need to be<br />

restated.<br />

IFRS 9 introduces new classification and measurement requirements as set out below for financial assets and liabilities that before<br />

were in the scope of IAS 39 Financial Instruments: Recognition and Measurement.<br />

F-9<br />

F-10