Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

___________________________________________________________________________<br />

3.3. Turnover<br />

The total turnover in the <strong>2012</strong> amounted to EUR 181.0 million compared to EUR 63.8 million recognized in 2011<br />

primarily driven by the sale of Sky Office generating revenues of EUR 117.3 million. Rents generated on the<br />

<strong>ORCO</strong>-GSG portfolio represented the main part of commercial investment revenues (93.9%). Repeatedly <strong>ORCO</strong>-<br />

GSG could overcompensate major move outs by acquiring new tenants and consequently improve rental<br />

revenues.<br />

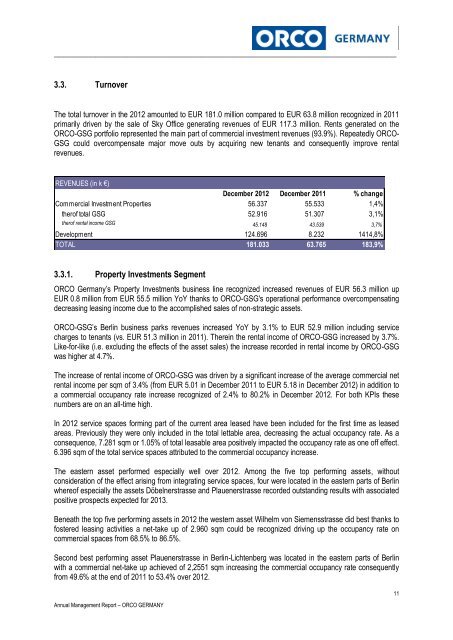

REVENUES (in k €)<br />

December <strong>2012</strong> December 2011 % change<br />

Commercial Investment Properties 56.337 55.533 1,4%<br />

therof total GSG 52.916 51.307 3,1%<br />

therof rental income GSG 45.148 43.539 3,7%<br />

Development 124.696 8.232 1414,8%<br />

TOTAL 181.033 63.765 183,9%<br />

3.3.1. Property Investments Segment<br />

<strong>ORCO</strong> <strong>Germany</strong>’s Property Investments business line recognized increased revenues of EUR 56.3 million up<br />

EUR 0.8 million from EUR 55.5 million YoY thanks to <strong>ORCO</strong>-GSG's operational performance overcompensating<br />

decreasing leasing income due to the accomplished sales of non-strategic assets.<br />

<strong>ORCO</strong>-GSG’s Berlin business parks revenues increased YoY by 3.1% to EUR 52.9 million including service<br />

charges to tenants (vs. EUR 51.3 million in 2011). Therein the rental income of <strong>ORCO</strong>-GSG increased by 3.7%.<br />

Like-for-like (i.e. excluding the effects of the asset sales) the increase recorded in rental income by <strong>ORCO</strong>-GSG<br />

was higher at 4.7%.<br />

The increase of rental income of <strong>ORCO</strong>-GSG was driven by a significant increase of the average commercial net<br />

rental income per sqm of 3.4% (from EUR 5.01 in December 2011 to EUR 5.18 in December <strong>2012</strong>) in addition to<br />

a commercial occupancy rate increase recognized of 2.4% to 80.2% in December <strong>2012</strong>. For both KPIs these<br />

numbers are on an all-time high.<br />

In <strong>2012</strong> service spaces forming part of the current area leased have been included for the first time as leased<br />

areas. Previously they were only included in the total lettable area, decreasing the actual occupancy rate. As a<br />

consequence, 7.281 sqm or 1.05% of total leasable area positively impacted the occupancy rate as one off effect.<br />

6.396 sqm of the total service spaces attributed to the commercial occupancy increase.<br />

The eastern asset performed especially well over <strong>2012</strong>. Among the five top performing assets, without<br />

consideration of the effect arising from integrating service spaces, four were located in the eastern parts of Berlin<br />

whereof especially the assets Döbelnerstrasse and Plauenerstrasse recorded outstanding results with associated<br />

positive prospects expected for 2013.<br />

Beneath the top five performing assets in <strong>2012</strong> the western asset Wilhelm von Siemensstrasse did best thanks to<br />

fostered leasing activities a net-take up of 2.960 sqm could be recognized driving up the occupancy rate on<br />

commercial spaces from 68.5% to 86.5%.<br />

Second best performing asset Plauenerstrasse in Berlin-Lichtenberg was located in the eastern parts of Berlin<br />

with a commercial net-take up achieved of 2,2551 sqm increasing the commercial occupancy rate consequently<br />

from 49.6% at the end of 2011 to 53.4% over <strong>2012</strong>.<br />

<strong>Annual</strong> Management <strong>Report</strong> – <strong>ORCO</strong> GERMANY<br />

11