Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

___________________________________________________________________________<br />

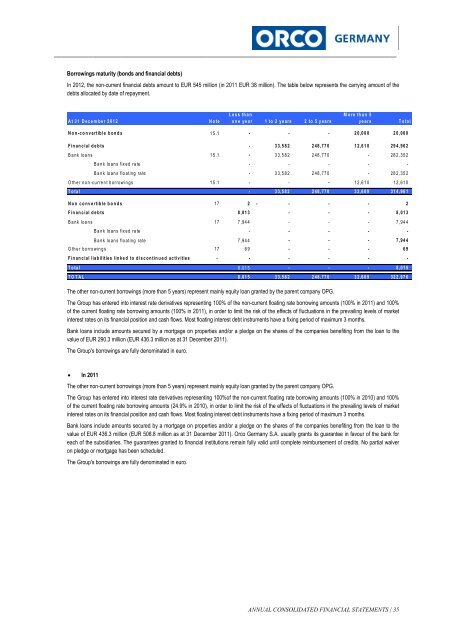

Borrowings maturity (bonds and financial debts)<br />

In <strong>2012</strong>, the non-current financial debts amount to EUR 545 million (in 2011 EUR 38 million). The table below represents the carrying amount of the<br />

debts allocated by date of repayment.<br />

A t 3 1 D e c e m b e r 2 0 1 2<br />

N o te<br />

L e s s th a n<br />

o n e y e a r 1 to 2 y e a rs 2 to 5 y e a rs<br />

M o re th a n 5<br />

y e a r s<br />

T o ta l<br />

N o n -c o n v e rt ib le b o n d s 1 5 .1 - - - 2 0 ,0 0 0 2 0 ,0 0 0<br />

F in a n c ia l d e b ts - 3 3 ,5 8 2 2 4 8 ,7 7 0 1 2 ,6 1 0 2 9 4 ,9 6 2<br />

B a n k lo a n s 1 5 .1 - 3 3 ,5 8 2 2 4 8 ,7 7 0 - 2 8 2 ,3 5 2<br />

B a n k lo a n s fix e d ra te - - - - -<br />

B a n k lo a n s flo a tin g ra te - 3 3 ,5 8 2 2 4 8 ,7 7 0 - 2 8 2 ,3 5 2<br />

O th e r n o n -cu rre n t b o r ro w in g s 1 5 .1 - - - 1 2 ,6 1 0 1 2 ,6 1 0<br />

T o ta l - 3 3 ,5 8 2 2 4 8 ,7 7 0 3 2 ,6 0 9 3 1 4 ,9 6 1<br />

N o n c o n v e rtib le b o n d s 17 2 - - - - 2<br />

F in a n c ia l d e b ts 8 ,0 1 3 - - - 8 ,0 1 3<br />

B a n k lo a n s 17 7 ,9 4 4 - - - 7 ,9 4 4<br />

B a n k lo a n s fix e d ra te - - - - -<br />

B a n k lo a n s flo a tin g ra te 7 ,9 4 4 - - - 7 ,9 4 4 -<br />

O th e r b o rro w in g s 17 69 - - - 69<br />

F in a n c ia l lia b ilitie s lin k e d to d is c o n t in u e d a c tiv itie s - - - - - -<br />

T o ta l 8 ,0 1 5 - - - 8 ,0 1 5<br />

T O T A L 8 ,0 1 5 3 3 ,5 8 2 2 4 8 ,7 7 0 3 2 ,6 0 9 3 2 2 ,9 7 6<br />

The other non-current borrowings (more than 5 years) represent mainly equity loan granted by the parent company OPG.<br />

The Group has entered into interest rate derivatives representing 100% of the non-current floating rate borrowing amounts (100% in 2011) and 100%<br />

of the current floating rate borrowing amounts (100% in 2011), in order to limit the risk of the effects of fluctuations in the prevailing levels of market<br />

interest rates on its financial position and cash flows. Most floating interest debt instruments have a fixing period of maximum 3 months.<br />

Bank loans include amounts secured by a mortgage on properties and/or a pledge on the shares of the companies benefiting from the loan to the<br />

value of EUR 290.3 million (EUR 436.3 million as at 31 December 2011).<br />

The Group's borrowings are fully denominated in euro.<br />

In 2011<br />

The other non-current borrowings (more than 5 years) represent mainly equity loan granted by the parent company OPG.<br />

The Group has entered into interest rate derivatives representing 100%of the non-current floating rate borrowing amounts (100% in 2010) and 100%<br />

of the current floating rate borrowing amounts (24.9% in 2010), in order to limit the risk of the effects of fluctuations in the prevailing levels of market<br />

interest rates on its financial position and cash flows. Most floating interest debt instruments have a fixing period of maximum 3 months.<br />

Bank loans include amounts secured by a mortgage on properties and/or a pledge on the shares of the companies benefiting from the loan to the<br />

value of EUR 436.3 million (EUR 508.8 million as at 31 December 2011). Orco <strong>Germany</strong> S.A. usually grants its guarantee in favour of the bank for<br />

each of the subsidiaries. The guarantees granted to financial institutions remain fully valid until complete reimbursement of credits. No partial waiver<br />

on pledge or mortgage has been scheduled.<br />

The Group's borrowings are fully denominated in euro.<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 35