Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

___________________________________________________________________________<br />

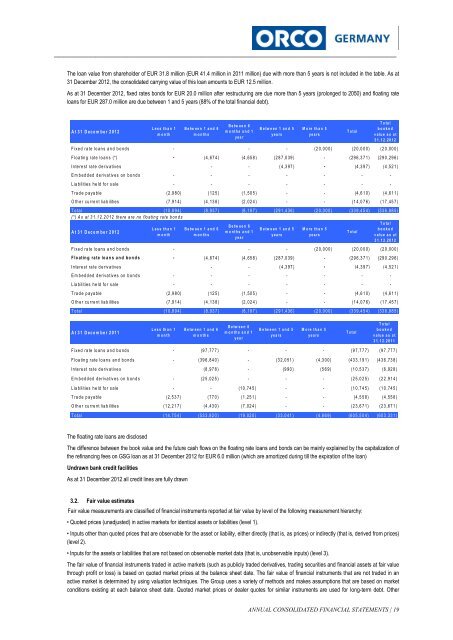

The loan value from shareholder of EUR 31.8 million (EUR 41.4 million in 2011 million) due with more than 5 years is not included in the table. As at<br />

31 December <strong>2012</strong>, the consolidated carrying value of this loan amounts to EUR 12.5 million.<br />

As at 31 December <strong>2012</strong>, fixed rates bonds for EUR 20.0 million after restructuring are due more than 5 years (prolonged to 2050) and floating rate<br />

loans for EUR 287.0 million are due between 1 and 5 years (88% of the total financial debt).<br />

A t 3 1 D e c e m b e r 2 0 1 2<br />

L e s s th a n 1<br />

m o n th<br />

B e tw e e n 1 a n d 6<br />

m o n th s<br />

B e tw e e n 6<br />

m o n t h s a n d 1<br />

y e a r<br />

B e tw e e n 1 a n d 5<br />

y e a rs<br />

M o re th a n 5<br />

y e a rs<br />

T o t a l<br />

T o ta l<br />

b o o k e d<br />

v a l u e a s a t<br />

3 1 .1 2 . 2 0 1 2<br />

F ixe d ra te lo a n s a n d b o n d s - - - (2 0 ,0 0 0 ) (2 0 ,0 0 0 ) (2 0 ,0 0 0 )<br />

F lo a tin g r a te lo a n s (*) - (4 ,6 7 4 ) (4 ,6 5 8 ) (2 8 7 ,0 3 9 ) - (2 9 6 ,3 7 1 ) (2 9 0 ,2 9 6 )<br />

In te re st ra te d e riv a tive s - - ( 4 ,3 9 7 ) - (4 ,3 9 7 ) (4 ,5 2 1 )<br />

E m b e d d e d d e riva tiv e s o n b o n d s - - - - - - -<br />

L ia b ilitie s h e ld fo r s a le - - - - - - -<br />

T ra d e p a ya b le (2 ,9 8 0 ) ( 1 2 5 ) (1 ,5 0 5 ) - - (4 ,6 1 0 ) (4 ,6 1 1 )<br />

O th e r cu rre n t lia b ilitie s (7 ,9 1 4 ) (4 ,1 3 8 ) (2 ,0 2 4 ) - - (1 4 ,0 7 6 ) (1 7 ,4 5 7 )<br />

T o ta l (1 0 ,8 9 4 ) (8 ,9 3 7 ) (8 ,1 8 7 ) (2 9 1 ,4 3 6 ) (2 0 ,0 0 0 ) (3 3 9 ,4 5 4 ) (3 3 6 ,8 8 5 )<br />

(*) A s a t 3 1 .1 2 .2 0 1 2 th e re a re n o flo a tin g ra te b o n d s<br />

T o ta l<br />

B e tw e e n 6<br />

L e s s th a n 1 B e tw e e n 1 a n d 6<br />

B e tw e e n 1 a n d 5 M o re th a n 5<br />

b o o k e d<br />

A t 3 1 D e c e m b e r 2 0 1 2<br />

m o n t h s a n d 1<br />

T o t a l<br />

m o n th<br />

m o n th s<br />

y e a rs<br />

y e a rs<br />

v a l u e a s a t<br />

y e a r<br />

3 1 .1 2 . 2 0 1 2<br />

F ixe d ra te lo a n s a n d b o n d s - - - (2 0 ,0 0 0 ) (2 0 ,0 0 0 ) (2 0 ,0 0 0 )<br />

F lo a t in g ra te lo a n s a n d b o n d s - (4 ,6 7 4 ) (4 ,6 5 8 ) (2 8 7 ,0 3 9 ) - (2 9 6 ,3 7 1 ) (2 9 0 ,2 9 6 )<br />

In te re st ra te d e riv a tive s - - ( 4 ,3 9 7 ) - (4 ,3 9 7 ) (4 ,5 2 1 )<br />

E m b e d d e d d e riva tiv e s o n b o n d s - - - - - - -<br />

L ia b ilitie s h e ld fo r s a le - - - - - - -<br />

T ra d e p a ya b le (2 ,9 8 0 ) ( 1 2 5 ) (1 ,5 0 5 ) - - (4 ,6 1 0 ) (4 ,6 1 1 )<br />

O th e r cu rre n t lia b ilitie s (7 ,9 1 4 ) (4 ,1 3 8 ) (2 ,0 2 4 ) - - (1 4 ,0 7 6 ) (1 7 ,4 5 7 )<br />

T o ta l (1 0 ,8 9 4 ) (8 ,9 3 7 ) (8 ,1 8 7 ) (2 9 1 ,4 3 6 ) (2 0 ,0 0 0 ) (3 3 9 ,4 5 4 ) (3 3 6 ,8 8 5 )<br />

A t 3 1 D e c e m b e r 2 0 1 1<br />

L e s s th a n 1<br />

m o n th<br />

B e tw e e n 1 a n d 6<br />

m o n th s<br />

B e tw e e n 6<br />

m o n t h s a n d 1<br />

y e a r<br />

B e tw e e n 1 a n d 5<br />

y e a rs<br />

M o re th a n 5<br />

y e a rs<br />

T o t a l<br />

T o ta l<br />

b o o k e d<br />

v a l u e a s a t<br />

3 1 .1 2 . 2 0 1 1<br />

F ixe d ra te lo a n s a n d b o n d s - (9 7 ,7 7 7 ) - - - (9 7 ,7 7 7 ) (9 7 ,7 7 7 )<br />

F lo a tin g r a te lo a n s a n d b o n d s - (3 9 6 ,8 4 0 ) - (3 2 ,0 5 1 ) (4 ,3 0 0 ) (4 3 3 ,1 9 1 ) (4 3 6 ,7 3 8 )<br />

In te re st ra te d e riv a tive s (8 ,9 7 8 ) - (9 9 0 ) (5 6 9 ) (1 0 ,5 3 7 ) (6 ,9 2 8 )<br />

E m b e d d e d d e riva tiv e s o n b o n d s - (2 5 ,0 2 5 ) - - - (2 5 ,0 2 5 ) (2 2 ,9 1 4 )<br />

L ia b ilitie s h e ld fo r s a le - - (1 0 ,7 4 5 ) - - (1 0 ,7 4 5 ) (1 0 ,7 4 5 )<br />

T ra d e p a ya b le (2 ,5 3 7 ) ( 7 7 0 ) (1 ,2 5 1 ) - - (4 ,5 5 8 ) (4 ,5 5 8 )<br />

O th e r cu rre n t lia b ilitie s (1 2 ,2 1 7 ) (4 ,4 3 0 ) (7 ,0 2 4 ) - - (2 3 ,6 7 1 ) (2 3 ,6 7 1 )<br />

T o ta l (1 4 ,7 5 4 ) (5 3 3 ,8 2 0 ) (1 9 ,0 2 0 ) (3 3 ,0 4 1 ) (4 ,8 6 9 ) (6 0 5 ,5 0 4 ) (6 0 3 ,3 3 1 )<br />

The floating rate loans are disclosed<br />

The difference between the book value and the future cash flows on the floating rate loans and bonds can be mainly explained by the capitalization of<br />

the refinancing fees on GSG loan as at 31 December <strong>2012</strong> for EUR 6.0 million (which are amortized during till the expiration of the loan)<br />

Undrawn bank credit facilities<br />

As at 31 December <strong>2012</strong> all credit lines are fully drawn<br />

3.2. Fair value estimates<br />

Fair value measurements are classified of financial instruments reported at fair value by level of the following measurement hierarchy:<br />

• Quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1).<br />

• Inputs other than quoted prices that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is, derived from prices)<br />

(level 2).<br />

• Inputs for the assets or liabilities that are not based on observable market data (that is, unobservable inputs) (level 3).<br />

The fair value of financial instruments traded in active markets (such as publicly traded derivatives, trading securities and financial assets at fair value<br />

through profit or loss) is based on quoted market prices at the balance sheet date. The fair value of financial instruments that are not traded in an<br />

active market is determined by using valuation techniques. The Group uses a variety of methods and makes assumptions that are based on market<br />

conditions existing at each balance sheet date. Quoted market prices or dealer quotes for similar instruments are used for long-term debt. Other<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 19