Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

___________________________________________________________________________<br />

The decrease of interests expenses by EUR 9.5 million is mainly related to the repayment of the loan financing Sky Office and the down payment upon<br />

financing on GSG.<br />

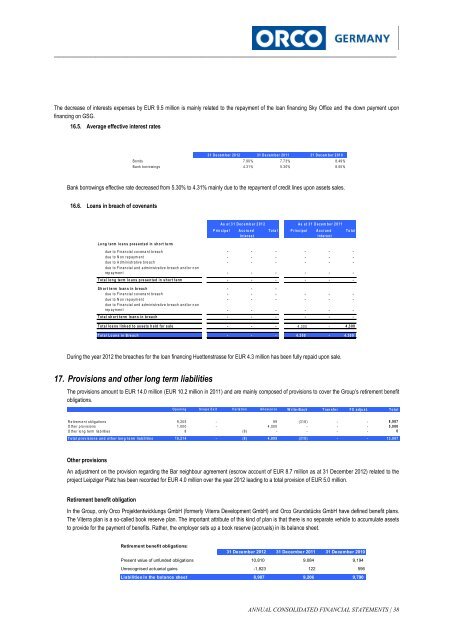

16.5. Average effective interest rates<br />

3 1 D e cem b er 20 12 31 D e cem ber 20 11 31 D ec em b er 2 01 0<br />

B o nds 7.90 % 7.7 3% 8.49 %<br />

B a nk b orro w in gs 4.31 % 5.3 0% 8.55 %<br />

Bank borrowings effective rate decreased from 5.30% to 4.31% mainly due to the repayment of credit lines upon assets sales.<br />

16.6. Loans in breach of covenants<br />

L o n g t e r m lo a n s p r e s e n t e d in s h o rt te rm<br />

As a t 3 1 D e c e m b e r 2 0 1 2 As a t 3 1 D e c e m b e r 2 0 1 1<br />

P rin c ip a l<br />

A c c ru e d<br />

In t e r e s t<br />

T o ta l P rin c ip a l A c c r u e d<br />

In t e r e s t<br />

d u e to F in a n cia l c o v e n a n t b r e a c h - - - - - -<br />

d u e to N o n r e p a ym e n t - - - - - -<br />

d u e to A d m in istr a tive b re a c h - - - - - -<br />

d u e to F in a n cia l a n d a d m in is tra tiv e b r e a ch a n d /o r n o n<br />

re p a y m e n t - - - - - -<br />

T o t a l lo n g te rm lo a n s p re s e n t e d in s h o r t t e r m - - - - - -<br />

S h o r t t e r m lo a n s in b r e a c h - - -<br />

d u e to F in a n cia l c o v e n a n t b r e a c h - - - - - -<br />

d u e to N o n r e p a ym e n t - - - - - -<br />

d u e to F in a n cia l a n d a d m in is tra tiv e b r e a ch a n d /o r n o n<br />

re p a y m e n t - - - - - -<br />

T o t a l s h o r t t e r m lo a n s in b r e a c h - - - - - -<br />

T o t a l lo a n s lin k e d t o a s s e t s h e ld f o r s a le - - - 4 ,3 0 0 - 4 ,3 0 0<br />

T o t a l L o a n s in B re a c h - - - 4 ,3 0 0 - 4 ,3 0 0<br />

T o ta l<br />

During the year <strong>2012</strong> the breaches for the loan financing Huettenstrasse for EUR 4.3 million has been fully repaid upon sale.<br />

17. Provisions and other long term liabilities<br />

The provisions amount to EUR 14.0 million (EUR 10.2 million in 2011) and are mainly composed of provisions to cover the Group’s retirement benefit<br />

obligations.<br />

O p e n i n g S c o p e E x i t V a ria ti o n A ll o w a n c e W rite -B ac k T ran s fe r F X a d ju s t. T o ta l<br />

R e tire m e nt o blig a tio ns 9 ,20 5 - 99 (31 8 ) - - 8 ,9 87<br />

O th e r pro visio ns 1 ,00 0 - 4 ,00 0 - - - 5 ,0 00<br />

O th e r lo ng term lia b ilities 8 (8 ) - - - - 0<br />

T o ta l p r o v is io n s a n d o th e r lo n g te rm lia b ilitie s 10 ,21 4 - (8 ) 4 ,09 9 (31 8 ) - - 13 ,9 87<br />

Other provisions<br />

An adjustment on the provision regarding the Bar neighbour agreement (escrow account of EUR 8.7 million as at 31 December <strong>2012</strong>) related to the<br />

project Leipziger Platz has been recorded for EUR 4.0 million over the year <strong>2012</strong> leading to a total provision of EUR 5.0 million.<br />

Retirement benefit obligation<br />

In the Group, only Orco Projektentwicklungs GmbH (formerly Viterra Development GmbH) and Orco Grundstücks GmbH have defined benefit plans.<br />

The Viterra plan is a so-called book reserve plan. The important attribute of this kind of plan is that there is no separate vehicle to accumulate assets<br />

to provide for the payment of benefits. Rather, the employer sets up a book reserve (accruals) in its balance sheet.<br />

Retirement benefit obligations:<br />

31 December <strong>2012</strong> 31 December 2011 31 December 2010<br />

Present value of unfunded obligations 10,810 9,084 9,194<br />

Unrecognised actuarial gains -1,823 122 596<br />

Liabilities in the balance sheet 8,987 9,206 9,790<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 38