Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

___________________________________________________________________________<br />

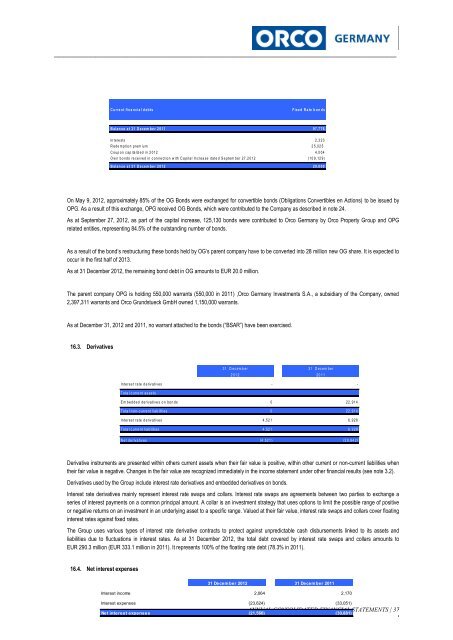

C u r re n t fin a n c ia l d e b ts<br />

F ix e d R a te b o n d s<br />

B a la n c e a t 3 1 D e c e m b e r 2 0 1 1 9 7 ,7 7 6<br />

In te re sts 2 ,3 2 3<br />

R e d e m p tio n p rem iu m 2 5 ,0 2 5<br />

C o u p o n c a p ita liz e d in 2 0 1 2 4 ,0 0 4<br />

O w n b o n d s re ce ive d in c o n n e ctio n w ith C a p ita l In crea se d a te d S e p te m b e r 2 7 ,2 0 1 2 ( 1 0 9 ,1 2 9 )<br />

B a la n c e a t 3 1 D e c e m b e r 2 0 1 2 2 0 ,0 0 0<br />

On May 9, <strong>2012</strong>, approximately 85% of the OG Bonds were exchanged for convertible bonds (Obligations Convertibles en Actions) to be issued by<br />

OPG. As a result of this exchange, OPG received OG Bonds, which were contributed to the Company as described in note 24.<br />

As at September 27, <strong>2012</strong>, as part of the capital increase, 125,130 bonds were contributed to Orco <strong>Germany</strong> by Orco Property Group and OPG<br />

related entities, representing 84.5% of the outstanding number of bonds.<br />

As a result of the bond’s restructuring these bonds held by OG’s parent company have to be converted into 28 million new OG share. It is expected to<br />

occur in the first half of 2013.<br />

As at 31 December <strong>2012</strong>, the remaining bond debt in OG amounts to EUR 20.0 million.<br />

The parent company OPG is holding 550,000 warrants (550,000 in 2011) ,Orco <strong>Germany</strong> Investments S.A., a subsidiary of the Company, owned<br />

2,397,311 warrants and Orco Grundstueck GmbH owned 1,150,000 warrants.<br />

As at December 31, <strong>2012</strong> and 2011, no warrant attached to the bonds (“BSAR”) have been exercised.<br />

16.3. Derivatives<br />

3 1 D e c e m b e r 3 1 D e c e m b e r<br />

2 0 1 2 2 0 1 1<br />

In te res t rate d e riv a tive s - -<br />

T o ta l c u rre n t a s se ts<br />

E m b e d d e d d e riva tive s o n b o n d s 0 2 2 ,9 1 4<br />

T o ta l n o n -c u rre n t lia b ilitie s 0 2 2 ,9 1 4<br />

In te res t rate d e riv a tive s 4 ,5 2 1 6 ,9 2 8<br />

T o ta l c u rre n t lia b ilitie s 4 ,5 2 1 6 ,9 2 8<br />

N e t d e riva tiv e s (4 ,5 2 1 ) (2 9 ,8 4 2 )<br />

Derivative instruments are presented within others current assets when their fair value is positive, within other current or non-current liabilities when<br />

their fair value is negative. Changes in the fair value are recognized immediately in the income statement under other financial results (see note 3.2).<br />

Derivatives used by the Group include interest rate derivatives and embedded derivatives on bonds.<br />

Interest rate derivatives mainly represent interest rate swaps and collars. Interest rate swaps are agreements between two parties to exchange a<br />

series of interest payments on a common principal amount. A collar is an investment strategy that uses options to limit the possible range of positive<br />

or negative returns on an investment in an underlying asset to a specific range. Valued at their fair value, interest rate swaps and collars cover floating<br />

interest rates against fixed rates.<br />

The Group uses various types of interest rate derivative contracts to protect against unpredictable cash disbursements linked to its assets and<br />

liabilities due to fluctuations in interest rates. As at 31 December <strong>2012</strong>, the total debt covered by interest rate swaps and collars amounts to<br />

EUR 290.3 million (EUR 333.1 million in 2011). It represents 100% of the floating rate debt (78.3% in 2011).<br />

16.4. Net interest expenses<br />

31 December <strong>2012</strong> 31 December 2011<br />

Interest income 2,064 2,170<br />

Interest expenses (23,624) (33,051)<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 37<br />

Net interest expenses (21,560) (30,881)