Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ORCO</strong> GERMANY S.A.<br />

Société Anonyme<br />

R.C.S. Luxembourg B 102.254<br />

NOTES TO THE ACCOUNTS<br />

December 31, <strong>2012</strong><br />

- continued -<br />

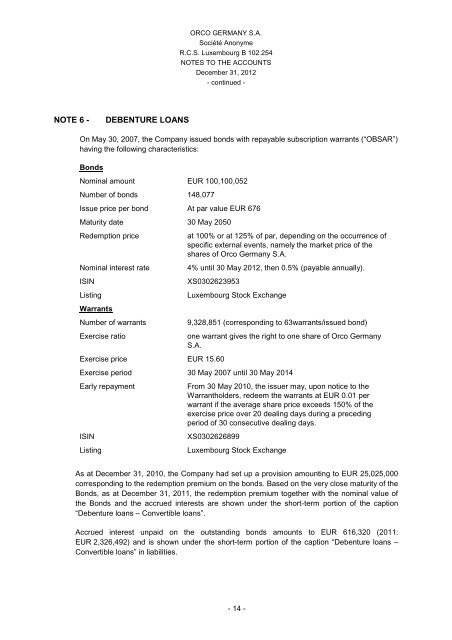

NOTE 6 -<br />

DEBENTURE LOANS<br />

On May 30, 2007, the Company issued bonds with repayable subscription warrants (“OBSAR”)<br />

having the following characteristics:<br />

Bonds<br />

Nominal amount EUR 100,100,052<br />

Number of bonds 148,077<br />

Issue price per bond At par value EUR 676<br />

Maturity date 30 May 2050<br />

Redemption price<br />

Nominal interest rate<br />

ISIN<br />

Listing<br />

Warrants<br />

Number of warrants<br />

Exercise ratio<br />

at 100% or at 125% of par, depending on the occurrence of<br />

specific external events, namely the market price of the<br />

shares of Orco <strong>Germany</strong> S.A.<br />

4% until 30 May <strong>2012</strong>, then 0.5% (payable annually).<br />

XS0302623953<br />

Exercise price EUR 15.60<br />

Luxembourg Stock Exchange<br />

9,328,851 (corresponding to 63warrants/issued bond)<br />

one warrant gives the right to one share of Orco <strong>Germany</strong><br />

S.A.<br />

Exercise period 30 May 2007 until 30 May 2014<br />

Early repayment<br />

ISIN<br />

Listing<br />

From 30 May 2010, the issuer may, upon notice to the<br />

Warrantholders, redeem the warrants at EUR 0.01 per<br />

warrant if the average share price exceeds 150% of the<br />

exercise price over 20 dealing days during a preceding<br />

period of 30 consecutive dealing days.<br />

XS0302626899<br />

Luxembourg Stock Exchange<br />

As at December 31, 2010, the Company had set up a provision amounting to EUR 25,025,000<br />

corresponding to the redemption premium on the bonds. Based on the very close maturity of the<br />

Bonds, as at December 31, 2011, the redemption premium together with the nominal value of<br />

the Bonds and the accrued interests are shown under the short-term portion of the caption<br />

“Debenture loans – Convertible loans”.<br />

Accrued interest unpaid on the outstanding bonds amounts to EUR 616,320 (2011:<br />

EUR 2,326,492) and is shown under the short-term portion of the caption “Debenture loans –<br />

Convertible loans” in liabilities.<br />

- 14 -