Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

___________________________________________________________________________<br />

F in a n c ia l in s tru m e n ts<br />

3 1 D e c e m b e r 2 0 1 1<br />

L o a n s a n d R e c e iv a b le s<br />

A s s e t a t fa ir v a lu e<br />

th ro u g h p ro fit o r<br />

lo s s<br />

3 1 D e c e m b e r<br />

2 0 1 1<br />

F in a n c ia l a s se ts a t fa ir va lu e th ro u g h p r o fit o r lo s s - 1 ,2 1 6 1 ,2 1 6<br />

C u rre n t fin a n c ia l a s s e ts 27 - 27<br />

T ra d e a n d o th e r re c e iva b le s 3 9 ,7 0 7 - 3 9 ,7 0 7<br />

N o n c u rr e n t lo a n s a n d re c e iva b le s - 2 5 ,0 5 1 2 5 ,0 5 1<br />

C a sh a n d ca sh e q u iva le n t 1 4 ,7 9 7 - 1 4 ,7 9 7<br />

F in a n c ia l A s s e ts 5 4 ,5 3 1 2 6 ,2 6 7 8 0 ,7 9 8<br />

O th e r fin a n c ia l<br />

lia b ilitie s a t a m o rtis e d<br />

c o s t<br />

L ia b ilitie s a t fa ir v a lu e<br />

th ro u g h p ro fit o r lo s s<br />

T O T A L<br />

F in a n c ia l d e b ts a n d b o n d s 5 4 5 ,2 6 0 - 5 4 5 ,2 6 0<br />

D e riv a tive s - 2 9 ,8 4 2 2 9 ,8 4 2<br />

T ra d e a n d o th e r p a yab le s 4 ,4 6 5 - 4 ,4 6 5<br />

F in a n c ia l L ia b ilitie s 5 4 9 ,7 2 5 2 9 ,8 4 2 5 7 9 ,5 6 7<br />

Financial instruments<br />

31 December 2011<br />

Loans and Receivables<br />

Asset at fair value<br />

through profit or<br />

loss<br />

31 December<br />

2011<br />

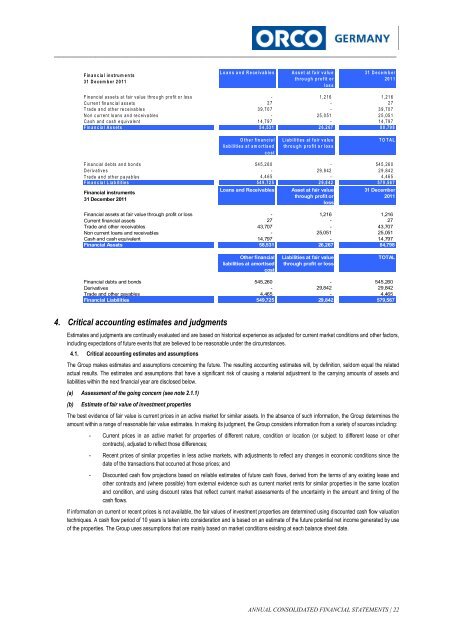

Financial assets at fair value through profit or loss - 1,216 1,216<br />

Current financial assets 27 - 27<br />

Trade and other receivables 43,707 - 43,707<br />

Non current loans and receivables - 25,051 25,051<br />

Cash and cash equivalent 14,797 - 14,797<br />

Financial Assets 58,531 26,267 84,798<br />

Other financial<br />

liabilities at amortised<br />

cost<br />

Liabilities at fair value<br />

through profit or loss<br />

TOTAL<br />

Financial debts and bonds 545,260 - 545,260<br />

Derivatives - 29,842 29,842<br />

Trade and other payables 4,465 - 4,465<br />

Financial Liabilities 549,725 29,842 579,567<br />

4. Critical accounting estimates and judgments<br />

Estimates and judgments are continually evaluated and are based on historical experience as adjusted for current market conditions and other factors,<br />

including expectations of future events that are believed to be reasonable under the circumstances.<br />

4.1. Critical accounting estimates and assumptions<br />

The Group makes estimates and assumptions concerning the future. The resulting accounting estimates will, by definition, seldom equal the related<br />

actual results. The estimates and assumptions that have a significant risk of causing a material adjustment to the carrying amounts of assets and<br />

liabilities within the next financial year are disclosed below.<br />

(a) Assessment of the going concern (see note 2.1.1)<br />

(b)<br />

Estimate of fair value of investment properties<br />

The best evidence of fair value is current prices in an active market for similar assets. In the absence of such information, the Group determines the<br />

amount within a range of reasonable fair value estimates. In making its judgment, the Group considers information from a variety of sources including:<br />

- Current prices in an active market for properties of different nature, condition or location (or subject to different lease or other<br />

contracts), adjusted to reflect those differences;<br />

- Recent prices of similar properties in less active markets, with adjustments to reflect any changes in economic conditions since the<br />

date of the transactions that occurred at those prices; and<br />

- Discounted cash flow projections based on reliable estimates of future cash flows, derived from the terms of any existing lease and<br />

other contracts and (where possible) from external evidence such as current market rents for similar properties in the same location<br />

and condition, and using discount rates that reflect current market assessments of the uncertainty in the amount and timing of the<br />

cash flows.<br />

If information on current or recent prices is not available, the fair values of investment properties are determined using discounted cash flow valuation<br />

techniques. A cash flow period of 10 years is taken into consideration and is based on an estimate of the future potential net income generated by use<br />

of the properties. The Group uses assumptions that are mainly based on market conditions existing at each balance sheet date.<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 22