Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

___________________________________________________________________________<br />

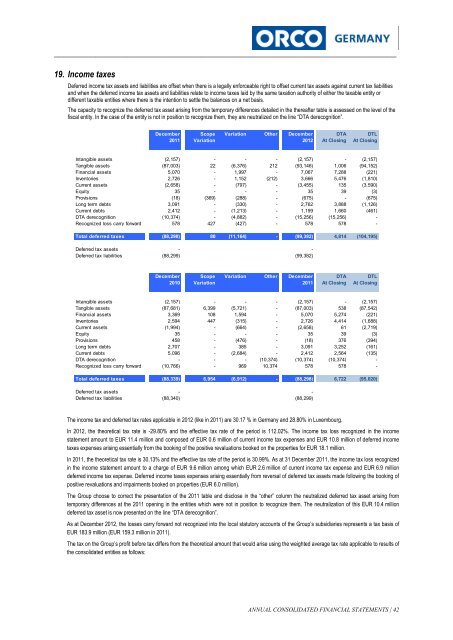

19. Income taxes<br />

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities<br />

and when the deferred income tax assets and liabilities relate to income taxes laid by the same taxation authority of either the taxable entity or<br />

different taxable entities where there is the intention to settle the balances on a net basis.<br />

The capacity to recognize the deferred tax asset arising from the temporary differences detailed in the thereafter table is assessed on the level of the<br />

fiscal entity. In the case of the entity is not in position to recognize them, they are neutralized on the line “DTA derecognition”.<br />

December<br />

2011<br />

Scope<br />

Variation<br />

Variation Other December<br />

<strong>2012</strong><br />

DTA<br />

At Closing<br />

DTL<br />

At Closing<br />

Intangible assets (2,157) - - - (2,157) - (2,157)<br />

Tangible assets (87,003) 22 (6,376) 212 (93,146) 1,006 (94,152)<br />

Financial assets 5,070 - 1,997 - 7,067 7,288 (221)<br />

Inventories 2,726 - 1,152 (212) 3,666 5,476 (1,810)<br />

Current assets (2,658) - (797) - (3,455) 135 (3,590)<br />

Equity 35 - - - 35 39 (3)<br />

Provisions (18) (369) (288) - (675) - (675)<br />

Long term debts 3,091 - (330) - 2,762 3,888 (1,126)<br />

Current debts 2,412 - (1,213) - 1,199 1,660 (461)<br />

DTA derecognition (10,374) - (4,882) - (15,256) (15,256) -<br />

Recognized loss carry forward 578 427 (427) - 578 578 -<br />

Total deferred taxes (88,298) 80 (11,164) - (99,382) 4,814 (104,195)<br />

Deferred tax assets - -<br />

Deferred tax liabilities (88,299) (99,382)<br />

December<br />

2010<br />

Scope<br />

Variation<br />

Variation Other December<br />

2011<br />

DTA<br />

At Closing<br />

DTL<br />

At Closing<br />

Intangible assets (2,157) - - - (2,157) - (2,157)<br />

Tangible assets (87,681) 6,399 (5,721) - (87,003) 538 (87,542)<br />

Financial assets 3,369 108 1,594 - 5,070 5,274 (221)<br />

Inventories 2,594 447 (315) - 2,726 4,414 (1,688)<br />

Current assets (1,994) - (664) - (2,658) 61 (2,719)<br />

Equity 35 - - - 35 39 (3)<br />

Provisions 458 - (476) - (18) 376 (394)<br />

Long term debts 2,707 - 385 - 3,091 3,252 (161)<br />

Current debts 5,096 - (2,684) - 2,412 2,564 (135)<br />

DTA derecognition - - - (10,374) (10,374) (10,374) -<br />

Recognized loss carry forward (10,766) - 969 10,374 578 578 -<br />

Total deferred taxes (88,339) 6,954 (6,912) - (88,298) 6,722 (95,020)<br />

Deferred tax assets - -<br />

Deferred tax liabilities (88,340) (88,299)<br />

The income tax and deferred tax rates applicable in <strong>2012</strong> (like in 2011) are 30.17 % in <strong>Germany</strong> and 28.80% in Luxembourg.<br />

In <strong>2012</strong>, the theoretical tax rate is -29.80% and the effective tax rate of the period is 112.02%. The income tax loss recognized in the income<br />

statement amount to EUR 11.4 million and composed of EUR 0.6 million of current income tax expenses and EUR 10.8 million of deferred income<br />

taxes expenses arising essentially from the booking of the positive revaluations booked on the properties for EUR 18.1 million.<br />

In 2011, the theoretical tax rate is 30.13% and the effective tax rate of the period is 30.99%. As at 31 December 2011, the income tax loss recognized<br />

in the income statement amount to a charge of EUR 9.6 million among which EUR 2.6 million of current income tax expense and EUR 6.9 million<br />

deferred income tax expense. Deferred income taxes expenses arising essentially from reversal of deferred tax assets made following the booking of<br />

positive revaluations and impairments booked on properties (EUR 6.0 million).<br />

The Group choose to correct the presentation of the 2011 table and disclose in the “other” column the neutralized deferred tax asset arising from<br />

temporary differences at the 2011 opening in the entities which were not in position to recognize them. The neutralization of this EUR 10.4 million<br />

deferred tax asset is now presented on the line “DTA derecognition”.<br />

As at December <strong>2012</strong>, the losses carry forward not recognized into the local statutory accounts of the Group’s subsidiaries represents a tax basis of<br />

EUR 183.9 million (EUR 159.3 million in 2011).<br />

The tax on the Group’s profit before tax differs from the theoretical amount that would arise using the weighted average tax rate applicable to results of<br />

the consolidated entities as follows:<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 42