Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

___________________________________________________________________________<br />

The cancellation of the sales negotiations in September conducted the Group to recognize an impairment of EUR 24.3 million on Sky Office building in<br />

order to adjust the book value to the realizable value under distressed conditions. Indeed the pressure of the financing bank and the need to fill GSG<br />

refinancing gap did not leave the opportunity to secure an arms’ length sale.<br />

The transfers are explained by the change in classification of Naunynstrasse previously classified under Investment Property (see Note 8) for<br />

EUR 1.4 million and by the netting of the net book value of Knorrstrasse with the prepayments following to the finalization of the asset transfer for EUR<br />

-4.3 million.<br />

In 2011<br />

Development costs amount to EUR 0.9 million capitalized mainly on Sky Office (EUR 0.7 Million)<br />

The project in development Sky Office (EUR 139.2 million) is the main contributor in inventories and is pledged for an amount of EUR 96.0 million.<br />

Impairments have been reversed on Sky Office for EUR 0.7 Million.<br />

Transfer corresponds to the reclassification of the land plot Hochwald from Investment Properties to Inventories.<br />

13. Net result on disposal of assets<br />

During <strong>2012</strong> assets and activities were sold for a total consideration of EUR 22.8 million generating a consolidated gain of EUR 12.0 million and net<br />

cash inflow after financial debt repayment amounting to EUR 10.7 million. The main contributors of the asset’s sales are describe in the note 8 and 10.<br />

During 2011, in the framework of the restructuring plan, assets and activities have been sold for a total consideration of EUR 122.7 million generating<br />

a consolidated net gain of EUR 9.9 million and a net cash inflow after financial debt repayment (EUR 6.7 million) amounting to EUR 11.8 million.<br />

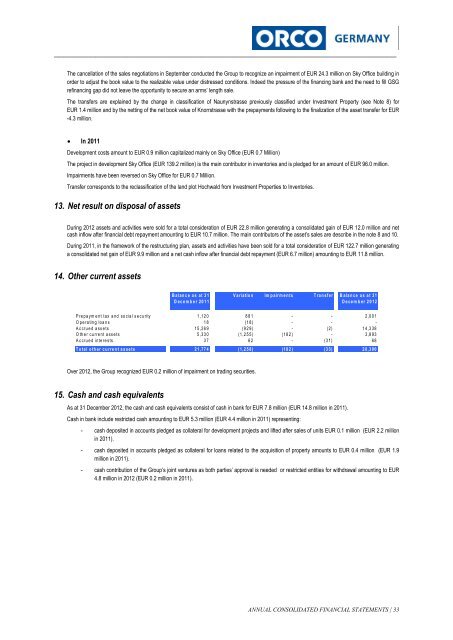

14. Other current assets<br />

B a lan c e a s at 3 1<br />

D ec e m b e r 20 1 1<br />

V a riatio n Im p a ir m e n ts T ra n sf er B ala n ce a s a t 31<br />

D e ce m b er 2 0 12<br />

P re pa ym e nt tax a nd so c ia l s e cu rity 1 ,12 0 881 - - 2,0 01<br />

O pe ra tin g loa n s 18 (1 8) - - -<br />

A c cru e d a ss e ts 15 ,26 9 (9 2 9) - (2) 1 4,3 38<br />

O th e r cu rre nt a ss e ts 5 ,33 0 (1,2 5 5) (18 2 ) - 3,8 93<br />

A c cru e d inte re sts 37 62 - (3 1) 68<br />

T o ta l o th er c u rre n t a s se ts 21 ,77 4 (1,2 5 8) (18 2 ) (3 3) 2 0,3 00<br />

Over <strong>2012</strong>, the Group recognized EUR 0.2 million of impairment on trading securities.<br />

15. Cash and cash equivalents<br />

As at 31 December <strong>2012</strong>, the cash and cash equivalents consist of cash in bank for EUR 7.8 million (EUR 14.8 million in 2011).<br />

Cash in bank include restricted cash amounting to EUR 5.3 million (EUR 4.4 million in 2011) representing:<br />

- cash deposited in accounts pledged as collateral for development projects and lifted after sales of units EUR 0.1 million (EUR 2.2 million<br />

in 2011).<br />

- cash deposited in accounts pledged as collateral for loans related to the acquisition of property amounts to EUR 0.4 million (EUR 1.9<br />

million in 2011).<br />

- cash contribution of the Group’s joint ventures as both parties’ approval is needed or restricted entities for withdrawal amounting to EUR<br />

4.8 million in <strong>2012</strong> (EUR 0.2 million in 2011).<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 33