Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

___________________________________________________________________________<br />

Over the year <strong>2012</strong>, the Group sold 5 assets for EUR 19.5 million and repaid EUR 10.7 million of financing liabilities upon sales:<br />

- Kurfustendamm 102 an investment properties in Berlin valued at EUR 6.3 million and financed by a liability of EUR 6.4 million fully repaid<br />

upon sale;<br />

- Bergfried an investment properties in Berlin valued at EUR 3.7 million;<br />

- Huttendorf an investment property in Dusseldorf valued at EUR 6.5 million and financed by a liability of EUR 4.3 million fully repaid upon<br />

sale;<br />

- Ackerstrasse 83/84 an investment property in berlin valued at EUR 0.6 million;<br />

- Kufurstenstrasse 13/14 an investment property in berlin valued at EUR 2.4 million;<br />

In 2011<br />

As at 31 December 2011 the Group validated the sale of following assets:<br />

4 assets from its Berlin investment properties portfolio: Kurfustendamm 102 with a value of EUR 6.3 million and EUR 6.5 million of liabilities and<br />

Hüttenstrasse with a value of EUR 6.5 million of assets and EUR 4.3 million of liabilities, Berlin Bergfriedstrasse. 2, 4, 6 and Kurfürstenstrasse 13,14<br />

with a value of EUR 6.7 million of assets.<br />

Over the year 2011, EUR 66.0 million of bank loan have been repaid related to the sale of Leipziger Platz, a plot of land with a fair value of<br />

EUR 113.5 million.<br />

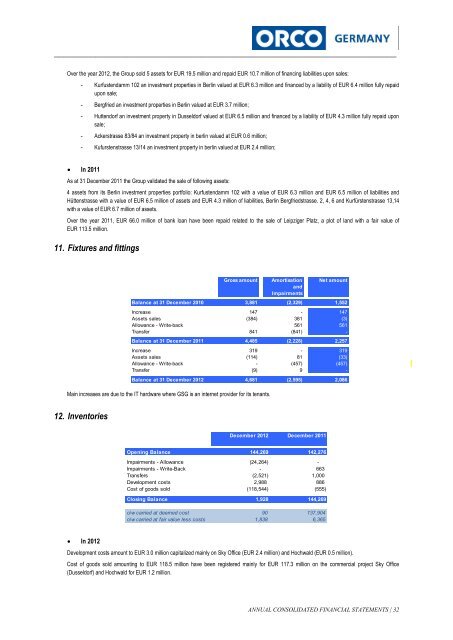

11. Fixtures and fittings<br />

Gross amount<br />

Main increases are due to the IT hardware where GSG is an internet provider for its tenants.<br />

Amortisation<br />

and<br />

Impairments<br />

Net amount<br />

Balance at 31 December 2010 3,881 (2,329) 1,552<br />

Increase 147 - 147<br />

Assets sales (384) 381 (3)<br />

Allowance - Write-back 561 561<br />

Transfer 841 (841) -<br />

Balance at 31 December 2011 4,485 (2,228) 2,257<br />

Increase 319 - 319<br />

Assets sales (114) 81 (33)<br />

Allowance - Write-back - (457) (457)<br />

Transfer (9) 9 -<br />

Balance at 31 December <strong>2012</strong> 4,681 (2,595) 2,086<br />

12. Inventories<br />

December <strong>2012</strong> December 2011<br />

Opening Balance 144,269 142,276<br />

Impairments - Allowance (24,264) -<br />

Impairments - Write-Back - 663<br />

Transfers (2,521) 1,000<br />

Development costs 2,988 886<br />

Cost of goods sold (118,544) (555)<br />

Closing Balance 1,928 144,269<br />

o/w carried at deemed cost 90 137,904<br />

o/w carried at fair value less costs 1,838 6,365<br />

In <strong>2012</strong><br />

Development costs amount to EUR 3.0 million capitalized mainly on Sky Office (EUR 2.4 million) and Hochwald (EUR 0.5 million).<br />

Cost of goods sold amounting to EUR 118.5 million have been registered mainly for EUR 117.3 million on the commercial project Sky Office<br />

(Dusseldorf) and Hochwald for EUR 1.2 million.<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 32