Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

Annual Report 2012 - ORCO Germany

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

___________________________________________________________________________<br />

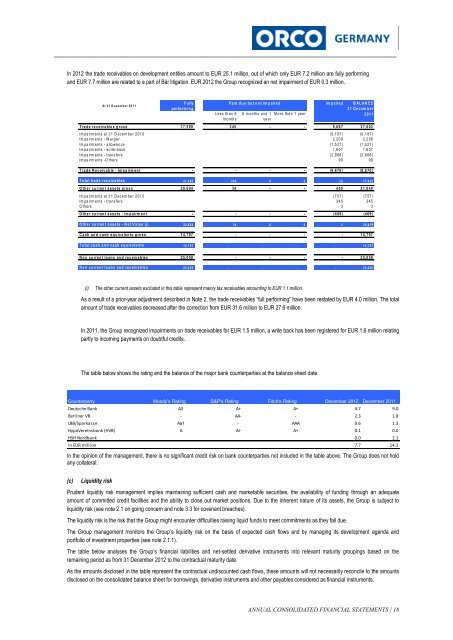

In <strong>2012</strong> the trade receivables on development entities amount to EUR 25.1 million, out of which only EUR 7.2 million are fully performing<br />

and EUR 7.7 million are related to a part of Bär litigation. EUR <strong>2012</strong> the Group recognized an net impairment of EUR 0.3 million.<br />

At 3 1 D e c e m b e r 2 0 1 1<br />

F u lly<br />

p e rfo rm in g<br />

L e s s th a n 6<br />

m o n th s<br />

P a s t d u e b u t n o t im p a ire d Im p a ire d B A L A N C E<br />

3 1 D e c e m b e r<br />

2 0 1 1<br />

6 m o n th s a n d 1 M o re th a n 1 yea r<br />

ye a r<br />

T ra d e re c e iv a b le s g r o s s 1 7 ,5 9 0 3 4 5 - - 9 ,6 6 7 2 7 ,6 0 2<br />

Im p a ir m e n ts a t 3 1 D e c e m b e r 2 0 1 0 (9 ,1 8 7 ) (9 ,1 8 7 )<br />

Im p a ir m e n ts - M e rg e r 2 ,2 0 6 2 ,2 0 6<br />

Im p a ir m e n ts - a llo w a n ce (1 ,5 2 7 ) (1 ,5 2 7 )<br />

Im p a ir m e n ts - w rite -b a ck 1 ,6 0 7 1 ,6 0 7<br />

Im p a ir m e n ts - tra n s fe rs (2 ,8 6 8 ) (2 ,8 6 8 )<br />

Im p a ir m e n ts -O th e rs 99 99<br />

T ra d e R e c e iv a b le - Im p a irm e n t - - - - (9 ,6 7 0 ) (9 ,6 7 0 )<br />

T o ta l tra d e re c e iv a b le s 2 1 ,5 9 0 3 4 5 0 0 (3) 1 7 ,9 3 2<br />

O th e r c u r re n t a s s e ts g ro s s 2 0 ,6 0 4 34 - - 409 2 1 ,0 4 8<br />

Im p a ir m e n ts a t 3 1 D e c e m b e r 2 0 1 0 (7 5 7 ) (7 5 7 )<br />

Im p a ir m e n ts - tra n s fe rs 345 3 4 5<br />

O th e rs 3 3<br />

O th e r c u r re n t a s s e ts - Im p a irm e n t - - - - (4 0 9 ) (4 0 9 )<br />

O th e r c u r re n t a s s e ts - N e t V a lu e (i) 2 0 ,6 0 4 34 0 0 0 2 0 ,6 3 9<br />

C a s h a n d c a s h e q u iv a le n t s g ro s s 1 4 ,7 9 7 - - - - 1 4 ,7 9 7<br />

T o ta l c a s h a n d c a s h e q u iv a le n t s 1 4 ,7 9 7 - - - - 1 4 ,7 9 7<br />

N o n c u rre n t lo a n s a n d re c e iv a b le s 2 5 ,0 5 0 - - - - 2 5 ,0 5 0<br />

N o n c u rre n t lo a n s a n d re c e iv a b le s 2 5 ,0 5 0 - - - - 2 5 ,0 5 0<br />

(i)<br />

The other current assets excluded in this table represent mainly tax receivables amounting to EUR 1.1 million.<br />

As a result of a prior-year adjustment described in Note 2, the trade receivables “full performing” have been restated by EUR 4.0 million. The total<br />

amount of trade receivables decreased after the correction from EUR 31.6 million to EUR 27.6 million.<br />

In 2011, the Group recognized impairments on trade receivables for EUR 1.5 million, a write back has been registered for EUR 1.6 million relating<br />

partly to incoming payments on doubtful credits.<br />

The table below shows the rating and the balance of the major bank counterparties at the balance sheet date.<br />

Counterparty Moody's Rating S&P's Rating Fitch's Rating December <strong>2012</strong> December 2011<br />

Deutsche Bank A2 A+ A+ 4.7 9.0<br />

Berliner VB - AA- - 2.3 1.8<br />

LBB/Sparkasse Aa1 - AAA 0.6 1.3<br />

HypoVereinsbank (HVB) A A+ A+ 0.1 0.0<br />

HSH Nordbank 0.0 2.1<br />

in EUR million 7.7 14.3<br />

In the opinion of the management, there is no significant credit risk on bank counterparties not included in the table above. The Group does not hold<br />

any collateral.<br />

(c)<br />

Liquidity risk<br />

Prudent liquidity risk management implies maintaining sufficient cash and marketable securities, the availability of funding through an adequate<br />

amount of committed credit facilities and the ability to close out market positions. Due to the inherent nature of its assets, the Group is subject to<br />

liquidity risk (see note 2.1 on going concern and note 3.3 for covenant breaches).<br />

The liquidity risk is the risk that the Group might encounter difficulties raising liquid funds to meet commitments as they fall due.<br />

The Group management monitors the Group’s liquidity risk on the basis of expected cash flows and by managing its development agenda and<br />

portfolio of investment properties (see note 2.1.1).<br />

The table below analyses the Group’s financial liabilities and net-settled derivative instruments into relevant maturity groupings based on the<br />

remaining period as from 31 December <strong>2012</strong> to the contractual maturity date.<br />

As the amounts disclosed in the table represent the contractual undiscounted cash flows, these amounts will not necessarily reconcile to the amounts<br />

disclosed on the consolidated balance sheet for borrowings, derivative instruments and other payables considered as financial instruments.<br />

ANNUAL CONSOLIDATED FINANCIAL STATEMENTS | 18