Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

119<br />

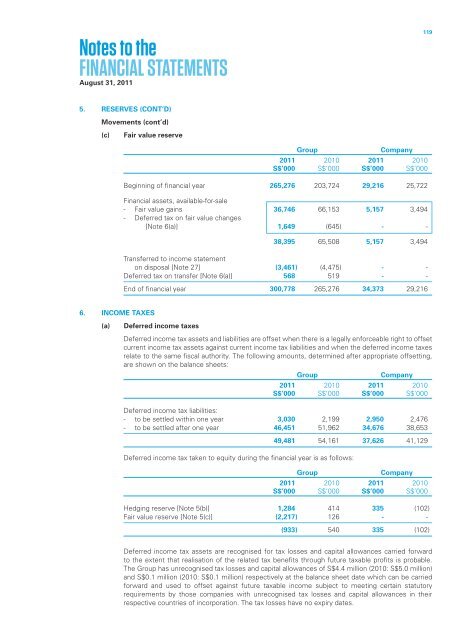

5. RESERVES (cont’d)<br />

Movements (cont’d)<br />

(c)<br />

Fair value reserve<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

Beginning of financial year 265,276 203,724 29,216 25,722<br />

Financial assets, available-for-sale<br />

- Fair value gains 36,746 66,153 5,157 3,494<br />

- Deferred tax on fair value changes<br />

[Note 6(a)] 1,649 (645) - -<br />

38,395 65,508 5,157 3,494<br />

Transferred to income statement<br />

on disposal [Note 27] (3,461) (4,475) - -<br />

Deferred tax on transfer [Note 6(a)] 568 519 - -<br />

End of financial year 300,778 265,276 34,373 29,216<br />

6. INCOME TAXES<br />

(a)<br />

Deferred income taxes<br />

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset<br />

current income tax assets against current income tax liabilities and when the deferred income taxes<br />

relate to the same fiscal authority. The following amounts, determined after appropriate offsetting,<br />

are shown on the balance sheets:<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

Deferred income tax liabilities:<br />

- to be settled within one year 3,030 2,199 2,950 2,476<br />

- to be settled after one year 46,451 51,962 34,676 38,653<br />

49,481 54,161 37,626 41,129<br />

Deferred income tax taken to equity during the financial year is as follows:<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

Hedging reserve [Note 5(b)] 1,284 414 335 (102)<br />

Fair value reserve [Note 5(c)] (2,217) 126 - -<br />

(933) 540 335 (102)<br />

Deferred income tax assets are recognised for tax losses and capital allowances carried forward<br />

to the extent that realisation of the related tax benefits through future taxable profits is probable.<br />

The Group has unrecognised tax losses and capital allowances of S$4.4 million (2010: S$5.0 million)<br />

and S$0.1 million (2010: S$0.1 million) respectively at the balance sheet date which can be carried<br />

forward and used to offset against future taxable income subject to meeting certain statutory<br />

requirements by those companies with unrecognised tax losses and capital allowances in their<br />

respective countries of incorporation. The tax losses have no expiry dates.