Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

160 <strong>Singapore</strong> <strong>Press</strong> <strong>Holdings</strong> <strong>annual</strong> <strong>report</strong> <strong>2011</strong><br />

31. FINANCIAL RISK MANAGEMENT (CONT’D)<br />

(b)<br />

Credit risk (cont’d)<br />

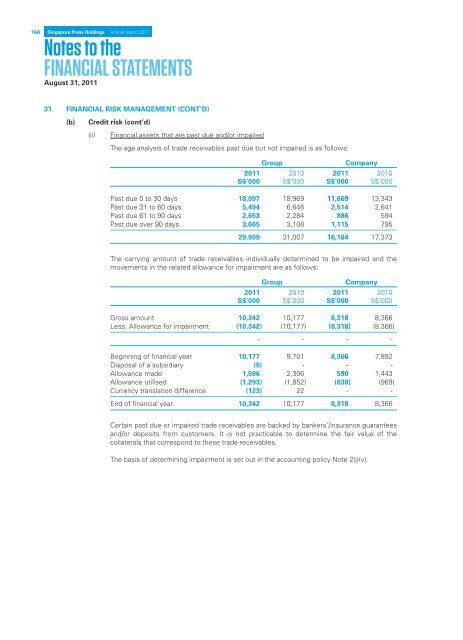

(ii) Financial assets that are past due and/or impaired<br />

The age analysis of trade receivables past due but not impaired is as follows:<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

Past due 0 to 30 days 18,097 18,969 11,669 13,343<br />

Past due 31 to 60 days 5,494 6,646 2,514 2,641<br />

Past due 61 to 90 days 2,653 2,284 886 594<br />

Past due over 90 days 3,665 3,108 1,115 795<br />

29,909 31,007 16,184 17,373<br />

The carrying amount of trade receivables individually determined to be impaired and the<br />

movements in the related allowance for impairment are as follows:<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

Gross amount 10,342 10,177 8,318 8,366<br />

Less: Allowance for impairment (10,342) (10,177) (8,318) (8,366)<br />

- - - -<br />

Beginning of financial year 10,177 9,701 8,366 7,892<br />

Disposal of a subsidiary (5) - - -<br />

Allowance made 1,586 2,306 590 1,443<br />

Allowance utilised (1,293) (1,852) (638) (969)<br />

Currency translation difference (123) 22 - -<br />

End of financial year 10,342 10,177 8,318 8,366<br />

Certain past due or impaired trade receivables are backed by bankers’/insurance guarantees<br />

and/or deposits from customers. It is not practicable to determine the fair value of the<br />

collaterals that correspond to these trade receivables.<br />

The basis of determining impairment is set out in the accounting policy Note 2(j)(v).