Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

159<br />

31. FINANCIAL RISK MANAGEMENT (CONT’D)<br />

(b)<br />

Credit risk<br />

Credit risk refers to the risk that a counterparty will default on its contractual obligations, thereby<br />

resulting in financial loss to the Group. For trade receivables, the Group manages its credit risk through<br />

the application of credit approvals, credit limits and monitoring procedures. Where appropriate,<br />

the Group obtains collateral in the form of deposits, bankers’/insurance guarantees from its<br />

customers, and imposes cash terms and/or advance payments from customers of lower credit<br />

standing. For other financial assets, the Group adopts the policy of dealing only with high credit<br />

quality counterparties.<br />

As at the balance sheet date, the Group has no significant concentration of credit risks.<br />

The maximum exposure to credit risk for each class of financial instruments is the carrying amount<br />

of that class of financial instruments presented on the balance sheet which comprise mainly trade<br />

receivables, investments in bonds and notes, and cash balances placed with banks. In addition, the<br />

Company is the primary obligor for an unsecured composite advance facility which could be utilised<br />

by the Company and its designated subsidiaries. The amount utilised by the subsidiaries as at August<br />

31, <strong>2011</strong> was S$0.8 million (2010: S$0.8 million) [Note 7(f)].<br />

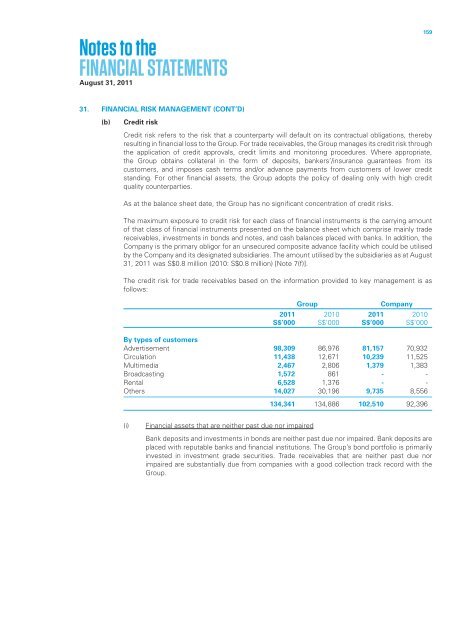

The credit risk for trade receivables based on the information provided to key management is as<br />

follows:<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

By types of customers<br />

Advertisement 98,309 86,976 81,157 70,932<br />

Circulation 11,438 12,671 10,239 11,525<br />

Multimedia 2,467 2,806 1,379 1,383<br />

Broadcasting 1,572 861 - -<br />

Rental 6,528 1,376 - -<br />

Others 14,027 30,196 9,735 8,556<br />

134,341 134,886 102,510 92,396<br />

(i)<br />

Financial assets that are neither past due nor impaired<br />

Bank deposits and investments in bonds are neither past due nor impaired. Bank deposits are<br />

placed with reputable banks and financial institutions. The Group’s bond portfolio is primarily<br />

invested in investment grade securities. Trade receivables that are neither past due nor<br />

impaired are substantially due from companies with a good collection track record with the<br />

Group.