Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

162 <strong>Singapore</strong> <strong>Press</strong> <strong>Holdings</strong> <strong>annual</strong> <strong>report</strong> <strong>2011</strong><br />

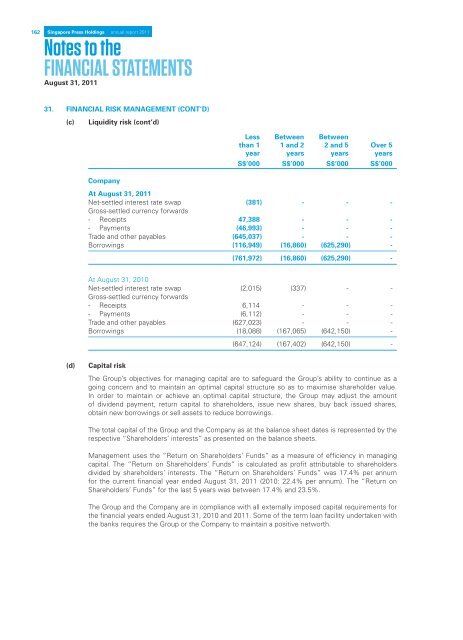

31. FINANCIAL RISK MANAGEMENT (CONT’D)<br />

(c)<br />

Liquidity risk (cont’d)<br />

Less Between Between<br />

than 1 1 and 2 2 and 5 Over 5<br />

year years years years<br />

S$’000 S$’000 S$’000 S$’000<br />

Company<br />

At August 31, <strong>2011</strong><br />

Net-settled interest rate swap (381) - - -<br />

Gross-settled currency forwards<br />

- Receipts 47,388 - - -<br />

- Payments (46,993) - - -<br />

Trade and other payables (645,037) - - -<br />

Borrowings (116,949) (16,860) (625,290) -<br />

(761,972) (16,860) (625,290) -<br />

At August 31, 2010<br />

Net-settled interest rate swap (2,015) (337) - -<br />

Gross-settled currency forwards<br />

- Receipts 6,114 - - -<br />

- Payments (6,112) - - -<br />

Trade and other payables (627,023) - - -<br />

Borrowings (18,088) (167,065) (642,150) -<br />

(647,124) (167,402) (642,150) -<br />

(d)<br />

Capital risk<br />

The Group’s objectives for managing capital are to safeguard the Group’s ability to continue as a<br />

going concern and to maintain an optimal capital structure so as to maximise shareholder value.<br />

In order to maintain or achieve an optimal capital structure, the Group may adjust the amount<br />

of dividend payment, return capital to shareholders, issue new shares, buy back issued shares,<br />

obtain new borrowings or sell assets to reduce borrowings.<br />

The total capital of the Group and the Company as at the balance sheet dates is represented by the<br />

respective “Shareholders’ interests” as presented on the balance sheets.<br />

Management uses the “Return on Shareholders’ Funds” as a measure of efficiency in managing<br />

capital. The “Return on Shareholders’ Funds” is calculated as profit attributable to shareholders<br />

divided by shareholders’ interests. The “Return on Shareholders’ Funds” was 17.4% per annum<br />

for the current financial year ended August 31, <strong>2011</strong> (2010: 22.4% per annum). The “Return on<br />

Shareholders’ Funds” for the last 5 years was between 17.4% and 23.5%.<br />

The Group and the Company are in compliance with all externally imposed capital requirements for<br />

the financial years ended August 31, 2010 and <strong>2011</strong>. Some of the term loan facility undertaken with<br />

the banks requires the Group or the Company to maintain a positive networth.