Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

138 <strong>Singapore</strong> <strong>Press</strong> <strong>Holdings</strong> <strong>annual</strong> <strong>report</strong> <strong>2011</strong><br />

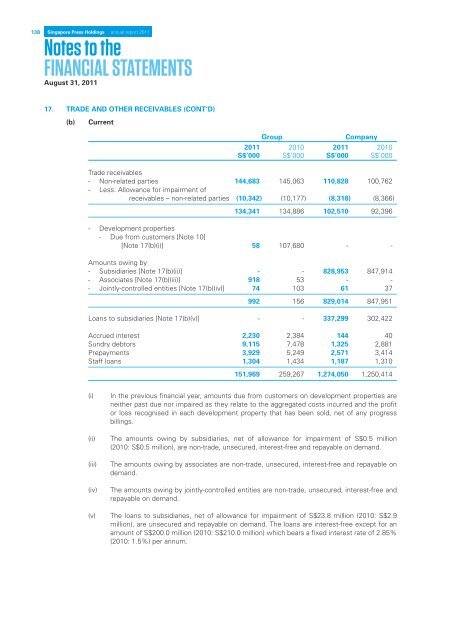

17. TRADE AND OTHER RECEIVABLES (CONT’D)<br />

(b)<br />

Current<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

Trade receivables<br />

- Non-related parties 144,683 145,063 110,828 100,762<br />

- Less: Allowance for impairment of<br />

receivables – non-related parties (10,342) (10,177) (8,318) (8,366)<br />

134,341 134,886 102,510 92,396<br />

- Development properties<br />

- Due from customers [Note 10]<br />

[Note 17(b)(i)] 58 107,680 - -<br />

Amounts owing by<br />

- Subsidiaries [Note 17(b)(ii)] - - 828,953 847,914<br />

- Associates [Note 17(b)(iii)] 918 53 - -<br />

- Jointly-controlled entities [Note 17(b)(iv)] 74 103 61 37<br />

992 156 829,014 847,951<br />

Loans to subsidiaries [Note 17(b)(v)] - - 337,299 302,422<br />

Accrued interest 2,230 2,384 144 40<br />

Sundry debtors 9,115 7,478 1,325 2,881<br />

Prepayments 3,929 5,249 2,571 3,414<br />

Staff loans 1,304 1,434 1,187 1,310<br />

151,969 259,267 1,274,050 1,250,414<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

In the previous financial year, amounts due from customers on development properties are<br />

neither past due nor impaired as they relate to the aggregated costs incurred and the profit<br />

or loss recognised in each development property that has been sold, net of any progress<br />

billings.<br />

The amounts owing by subsidiaries, net of allowance for impairment of S$0.5 million<br />

(2010: S$0.5 million), are non-trade, unsecured, interest-free and repayable on demand.<br />

The amounts owing by associates are non-trade, unsecured, interest-free and repayable on<br />

demand.<br />

The amounts owing by jointly-controlled entities are non-trade, unsecured, interest-free and<br />

repayable on demand.<br />

The loans to subsidiaries, net of allowance for impairment of S$23.8 million (2010: S$2.9<br />

million), are unsecured and repayable on demand. The loans are interest-free except for an<br />

amount of S$200.0 million (2010: S$210.0 million) which bears a fixed interest rate of 2.85%<br />

(2010: 1.5%) per annum.