Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

124 <strong>Singapore</strong> <strong>Press</strong> <strong>Holdings</strong> <strong>annual</strong> <strong>report</strong> <strong>2011</strong><br />

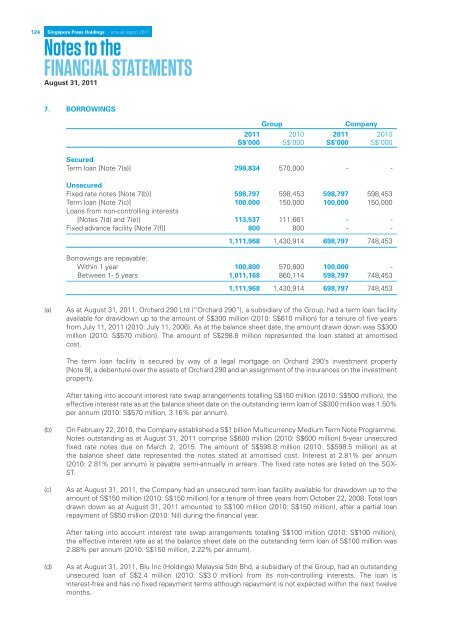

7. BORROWINGS<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

Secured<br />

Term loan [Note 7(a)] 298,834 570,000 - -<br />

Unsecured<br />

Fixed rate notes [Note 7(b)] 598,797 598,453 598,797 598,453<br />

Term loan [Note 7(c)] 100,000 150,000 100,000 150,000<br />

Loans from non-controlling interests<br />

[Notes 7(d) and 7(e)] 113,537 111,661 - -<br />

Fixed advance facility [Note 7(f)] 800 800 - -<br />

1,111,968 1,430,914 698,797 748,453<br />

Borrowings are repayable:<br />

Within 1 year 100,800 570,800 100,000 -<br />

Between 1- 5 years 1,011,168 860,114 598,797 748,453<br />

1,111,968 1,430,914 698,797 748,453<br />

(a)<br />

As at August 31, <strong>2011</strong>, Orchard 290 Ltd (“Orchard 290”), a subsidiary of the Group, had a term loan facility<br />

available for drawdown up to the amount of S$300 million (2010: S$610 million) for a tenure of five years<br />

from July 11, <strong>2011</strong> (2010: July 11, 2006). As at the balance sheet date, the amount drawn down was S$300<br />

million (2010: S$570 million). The amount of S$298.8 million represented the loan stated at amortised<br />

cost.<br />

The term loan facility is secured by way of a legal mortgage on Orchard 290’s investment property<br />

[Note 9], a debenture over the assets of Orchard 290 and an assignment of the insurances on the investment<br />

property.<br />

After taking into account interest rate swap arrangements totalling S$150 million (2010: S$500 million), the<br />

effective interest rate as at the balance sheet date on the outstanding term loan of S$300 million was 1.50%<br />

per annum (2010: S$570 million, 3.16% per annum).<br />

(b)<br />

(c)<br />

On February 22, 2010, the Company established a S$1 billion Multicurrency Medium Term Note Programme.<br />

Notes outstanding as at August 31, <strong>2011</strong> comprise S$600 million (2010: S$600 million) 5-year unsecured<br />

fixed rate notes due on March 2, 2015. The amount of S$598.8 million (2010: S$598.5 million) as at<br />

the balance sheet date represented the notes stated at amortised cost. Interest at 2.81% per annum<br />

(2010: 2.81% per annum) is payable semi-<strong>annual</strong>ly in arrears. The fixed rate notes are listed on the SGX-<br />

ST.<br />

As at August 31, <strong>2011</strong>, the Company had an unsecured term loan facility available for drawdown up to the<br />

amount of S$150 million (2010: S$150 million) for a tenure of three years from October 22, 2008. Total loan<br />

drawn down as at August 31, <strong>2011</strong> amounted to S$100 million (2010: S$150 million), after a partial loan<br />

repayment of S$50 million (2010: Nil) during the financial year.<br />

After taking into account interest rate swap arrangements totalling S$100 million (2010: S$100 million),<br />

the effective interest rate as at the balance sheet date on the outstanding term loan of S$100 million was<br />

2.88% per annum (2010: S$150 million, 2.22% per annum).<br />

(d)<br />

As at August 31, <strong>2011</strong>, Blu Inc (<strong>Holdings</strong>) Malaysia Sdn Bhd, a subsidiary of the Group, had an outstanding<br />

unsecured loan of S$2.4 million (2010: S$3.0 million) from its non-controlling interests. The loan is<br />

interest-free and has no fixed repayment terms although repayment is not expected within the next twelve<br />

months.