Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

137<br />

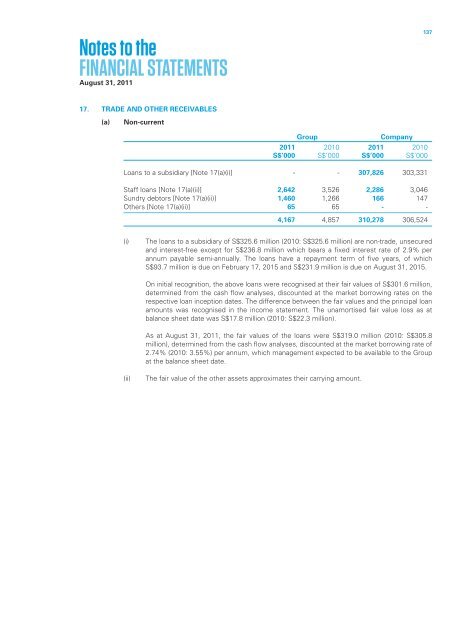

17. TRADE AND OTHER RECEIVABLES<br />

(a)<br />

Non-current<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

S$’000 S$’000 S$’000 S$’000<br />

Loans to a subsidiary [Note 17(a)(i)] - - 307,826 303,331<br />

Staff loans [Note 17(a)(ii)] 2,642 3,526 2,286 3,046<br />

Sundry debtors [Note 17(a)(ii)] 1,460 1,266 166 147<br />

Others [Note 17(a)(ii)] 65 65 - -<br />

4,167 4,857 310,278 306,524<br />

(i)<br />

The loans to a subsidiary of S$325.6 million (2010: S$325.6 million) are non-trade, unsecured<br />

and interest-free except for S$236.8 million which bears a fixed interest rate of 2.9% per<br />

annum payable semi-<strong>annual</strong>ly. The loans have a repayment term of five years, of which<br />

S$93.7 million is due on February 17, 2015 and S$231.9 million is due on August 31, 2015.<br />

On initial recognition, the above loans were recognised at their fair values of S$301.6 million,<br />

determined from the cash flow analyses, discounted at the market borrowing rates on the<br />

respective loan inception dates. The difference between the fair values and the principal loan<br />

amounts was recognised in the income statement. The unamortised fair value loss as at<br />

balance sheet date was S$17.8 million (2010: S$22.3 million).<br />

As at August 31, <strong>2011</strong>, the fair values of the loans were S$319.0 million (2010: S$305.8<br />

million), determined from the cash flow analyses, discounted at the market borrowing rate of<br />

2.74% (2010: 3.55%) per annum, which management expected to be available to the Group<br />

at the balance sheet date.<br />

(ii)<br />

The fair value of the other assets approximates their carrying amount.