Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

120 <strong>Singapore</strong> <strong>Press</strong> <strong>Holdings</strong> <strong>annual</strong> <strong>report</strong> <strong>2011</strong><br />

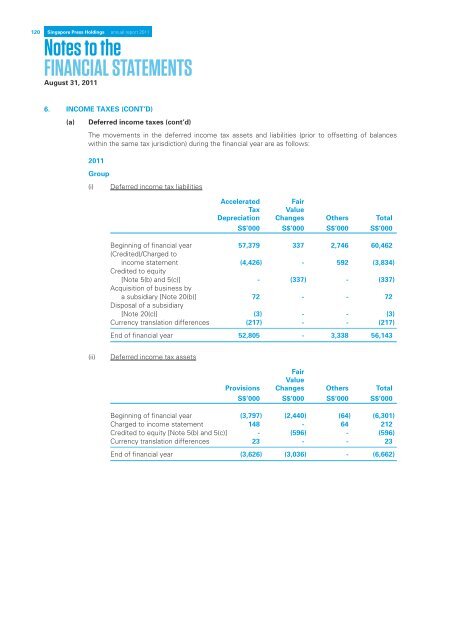

6. INCOME TAXES (CONT’D)<br />

(a)<br />

Deferred income taxes (cont’d)<br />

The movements in the deferred income tax assets and liabilities (prior to offsetting of balances<br />

within the same tax jurisdiction) during the financial year are as follows:<br />

<strong>2011</strong><br />

Group<br />

(i)<br />

Deferred income tax liabilities<br />

Accelerated Fair<br />

Tax Value<br />

Depreciation Changes Others Total<br />

S$’000 S$’000 S$’000 S$’000<br />

Beginning of financial year 57,379 337 2,746 60,462<br />

(Credited)/Charged to<br />

income statement (4,426) - 592 (3,834)<br />

Credited to equity<br />

[Note 5(b) and 5(c)] - (337) - (337)<br />

Acquisition of business by<br />

a subsidiary [Note 20(b)] 72 - - 72<br />

Disposal of a subsidiary<br />

[Note 20(c)] (3) - - (3)<br />

Currency translation differences (217) - - (217)<br />

End of financial year 52,805 - 3,338 56,143<br />

(ii)<br />

Deferred income tax assets<br />

Fair<br />

Value<br />

Provisions Changes Others Total<br />

S$’000 S$’000 S$’000 S$’000<br />

Beginning of financial year (3,797) (2,440) (64) (6,301)<br />

Charged to income statement 148 - 64 212<br />

Credited to equity [Note 5(b) and 5(c)] - (596) - (596)<br />

Currency translation differences 23 - - 23<br />

End of financial year (3,626) (3,036) - (6,662)