Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Singapore Press Holdings annual report 2011 Singapore Press ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the<br />

Financial StatementS<br />

August 31, <strong>2011</strong><br />

123<br />

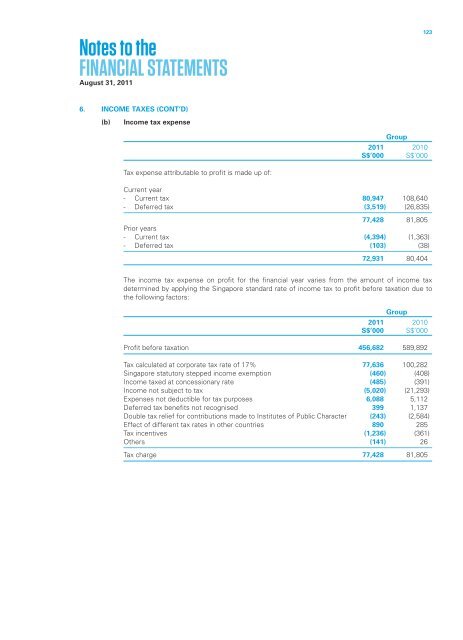

6. INCOME TAXES (CONT’D)<br />

(b)<br />

Income tax expense<br />

Group<br />

<strong>2011</strong> 2010<br />

S$’000 S$’000<br />

Tax expense attributable to profit is made up of:<br />

Current year<br />

- Current tax 80,947 108,640<br />

- Deferred tax (3,519) (26,835)<br />

77,428 81,805<br />

Prior years<br />

- Current tax (4,394) (1,363)<br />

- Deferred tax (103) (38)<br />

72,931 80,404<br />

The income tax expense on profit for the financial year varies from the amount of income tax<br />

determined by applying the <strong>Singapore</strong> standard rate of income tax to profit before taxation due to<br />

the following factors:<br />

Group<br />

<strong>2011</strong> 2010<br />

S$’000 S$’000<br />

Profit before taxation 456,682 589,892<br />

Tax calculated at corporate tax rate of 17% 77,636 100,282<br />

<strong>Singapore</strong> statutory stepped income exemption (460) (408)<br />

Income taxed at concessionary rate (485) (391)<br />

Income not subject to tax (5,020) (21,293)<br />

Expenses not deductible for tax purposes 6,088 5,112<br />

Deferred tax benefits not recognised 399 1,137<br />

Double tax relief for contributions made to Institutes of Public Character (243) (2,584)<br />

Effect of different tax rates in other countries 890 285<br />

Tax incentives (1,236) (361)<br />

Others (141) 26<br />

Tax charge 77,428 81,805