Tally.ERP 9 Series A Release 3.0 Stat.900 Version 137

Tally.ERP 9 Series A Release 3.0 Stat.900 Version 137

Tally.ERP 9 Series A Release 3.0 Stat.900 Version 137

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

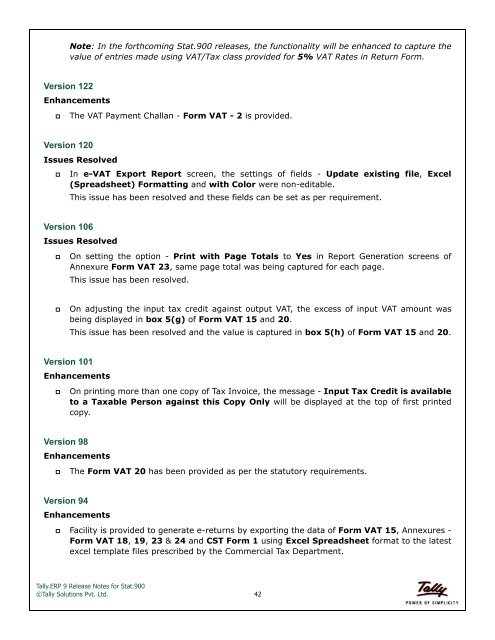

Note: In the forthcoming <strong>Stat.900</strong> releases, the functionality will be enhanced to capture the<br />

value of entries made using VAT/Tax class provided for 5% VAT Rates in Return Form.<br />

<strong>Version</strong> 122<br />

Enhancements<br />

<br />

The VAT Payment Challan - Form VAT - 2 is provided.<br />

<strong>Version</strong> 120<br />

Issues Resolved<br />

<br />

In e-VAT Export Report screen, the settings of fields - Update existing file, Excel<br />

(Spreadsheet) Formatting and with Color were non-editable.<br />

This issue has been resolved and these fields can be set as per requirement.<br />

<strong>Version</strong> 106<br />

Issues Resolved<br />

<br />

On setting the option - Print with Page Totals to Yes in Report Generation screens of<br />

Annexure Form VAT 23, same page total was being captured for each page.<br />

This issue has been resolved.<br />

<br />

On adjusting the input tax credit against output VAT, the excess of input VAT amount was<br />

being displayed in box 5(g) of Form VAT 15 and 20.<br />

This issue has been resolved and the value is captured in box 5(h) of Form VAT 15 and 20.<br />

<strong>Version</strong> 101<br />

Enhancements<br />

<br />

On printing more than one copy of Tax Invoice, the message - Input Tax Credit is available<br />

to a Taxable Person against this Copy Only will be displayed at the top of first printed<br />

copy.<br />

<strong>Version</strong> 98<br />

Enhancements<br />

<br />

The Form VAT 20 has been provided as per the statutory requirements.<br />

<strong>Version</strong> 94<br />

Enhancements<br />

Facility is provided to generate e-returns by exporting the data of Form VAT 15, Annexures -<br />

Form VAT 18, 19, 23 & 24 and CST Form 1 using Excel Spreadsheet format to the latest<br />

excel template files prescribed by the Commercial Tax Department.<br />

<strong>Tally</strong>.<strong>ERP</strong> 9 <strong>Release</strong> Notes for <strong>Stat.900</strong><br />

©<strong>Tally</strong> Solutions Pvt. Ltd. 42