TOURISM VICTORIA ANNUAL REPORT

TOURISM VICTORIA ANNUAL REPORT

TOURISM VICTORIA ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

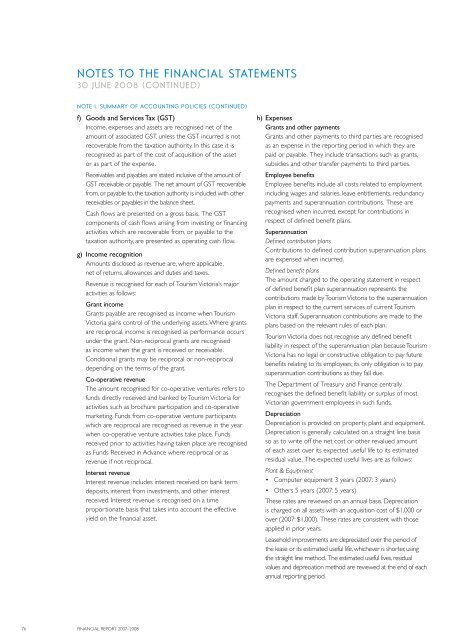

notes to the financial statements<br />

30 june 2008 (continued)<br />

Note 1. Summary of Accounting Policies (CONTINUED)<br />

f) Goods and Services Tax (GST)<br />

Income, expenses and assets are recognised net of the<br />

amount of associated GST, unless the GST incurred is not<br />

recoverable from the taxation authority. In this case it is<br />

recognised as part of the cost of acquisition of the asset<br />

or as part of the expense.<br />

Receivables and payables are stated inclusive of the amount of<br />

GST receivable or payable. The net amount of GST recoverable<br />

from, or payable to, the taxation authority is included with other<br />

receivables or payables in the balance sheet.<br />

Cash flows are presented on a gross basis. The GST<br />

components of cash flows arising from investing or financing<br />

activities which are recoverable from, or payable to the<br />

taxation authority, are presented as operating cash flow.<br />

g) Income recognition<br />

Amounts disclosed as revenue are, where applicable,<br />

net of returns, allowances and duties and taxes.<br />

Revenue is recognised for each of Tourism Victoria’s major<br />

activities as follows:<br />

Grant income<br />

Grants payable are recognised as income when Tourism<br />

Victoria gains control of the underlying assets. Where grants<br />

are reciprocal, income is recognised as performance occurs<br />

under the grant. Non-reciprocal grants are recognised<br />

as income when the grant is received or receivable.<br />

Conditional grants may be reciprocal or non-reciprocal<br />

depending on the terms of the grant.<br />

Co-operative revenue<br />

The amount recognised for co-operative ventures refers to<br />

funds directly received and banked by Tourism Victoria for<br />

activities such as brochure participation and co-operative<br />

marketing. Funds from co-operative venture participants<br />

which are reciprocal are recognised as revenue in the year<br />

when co-operative venture activities take place. Funds<br />

received prior to activities having taken place are recognised<br />

as Funds Received in Advance where reciprocal or as<br />

revenue if not reciprocal.<br />

Interest revenue<br />

Interest revenue includes interest received on bank term<br />

deposits, interest from investments, and other interest<br />

received. Interest revenue is recognised on a time<br />

proportionate basis that takes into account the effective<br />

yield on the financial asset.<br />

h) Expenses<br />

Grants and other payments<br />

Grants and other payments to third parties are recognised<br />

as an expense in the reporting period in which they are<br />

paid or payable. They include transactions such as grants,<br />

subsidies and other transfer payments to third parties.<br />

Employee benefits<br />

Employee benefits include all costs related to employment<br />

including wages and salaries, leave entitlements, redundancy<br />

payments and superannuation contributions. These are<br />

recognised when incurred, except for contributions in<br />

respect of defined benefit plans.<br />

Superannuation<br />

Defined contribution plans<br />

Contributions to defined contribution superannuation plans<br />

are expensed when incurred.<br />

Defined benefit plans<br />

The amount charged to the operating statement in respect<br />

of defined benefit plan superannuation represents the<br />

contributions made by Tourism Victoria to the superannuation<br />

plan in respect to the current services of current Tourism<br />

Victoria staff. Superannuation contributions are made to the<br />

plans based on the relevant rules of each plan.<br />

Tourism Victoria does not recognise any defined benefit<br />

liability in respect of the superannuation plan because Tourism<br />

Victoria has no legal or constructive obligation to pay future<br />

benefits relating to its employees; its only obligation is to pay<br />

superannuation contributions as they fall due.<br />

The Department of Treasury and Finance centrally<br />

recognises the defined benefit liability or surplus of most<br />

Victorian government employees in such funds.<br />

Depreciation<br />

Depreciation is provided on property, plant and equipment.<br />

Depreciation is generally calculated on a straight line basis<br />

so as to write off the net cost or other revalued amount<br />

of each asset over its expected useful life to its estimated<br />

residual value. The expected useful lives are as follows:<br />

Plant & Equipment<br />

• Computer equipment 3 years (2007: 3 years)<br />

• Others 5 years (2007: 5 years)<br />

These rates are reviewed on an annual basis. Depreciation<br />

is charged on all assets with an acquisition cost of $1,000 or<br />

over (2007: $1,000). These rates are consistent with those<br />

applied in prior years.<br />

Leasehold improvements are depreciated over the period of<br />

the lease or its estimated useful life, whichever is shorter, using<br />

the straight line method. The estimated useful lives, residual<br />

values and depreciation method are reviewed at the end of each<br />

annual reporting period.<br />

76 FINANCIAL <strong>REPORT</strong> 2007–2008