TOURISM VICTORIA ANNUAL REPORT

TOURISM VICTORIA ANNUAL REPORT

TOURISM VICTORIA ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

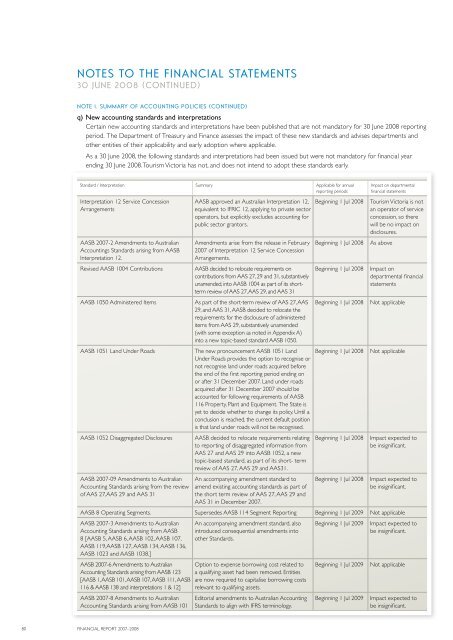

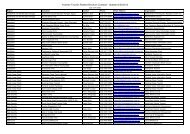

notes to the financial statements<br />

30 june 2008 (continued)<br />

Note 1. Summary of Accounting Policies (CONTINUED)<br />

q) New accounting standards and interpretations<br />

Certain new accounting standards and interpretations have been published that are not mandatory for 30 June 2008 reporting<br />

period. The Department of Treasury and Finance assesses the impact of these new standards and advises departments and<br />

other entities of their applicability and early adoption where applicable.<br />

As a 30 June 2008, the following standards and interpretations had been issued but were not mandatory for financial year<br />

ending 30 June 2008. Tourism Victoria has not, and does not intend to adopt these standards early.<br />

Standard / Interpretation Summary Applicable for annual<br />

reporting periods<br />

Interpretation 12 Service Concession<br />

Arrangements<br />

AASB 2007-2 Amendments to Australian<br />

Accountings Standards arising from AASB<br />

Interpretation 12.<br />

Revised AASB 1004 Contributions<br />

AASB 1050 Administered Items<br />

AASB 1051 Land Under Roads<br />

AASB 1052 Disaggregated Disclosures<br />

AASB 2007-09 Amendments to Australian<br />

Accounting Standards arising from the review<br />

of AAS 27,AAS 29 and AAS 31<br />

AASB approved an Australian Interpretation 12,<br />

equivalent to IFRIC 12, applying to private sector<br />

operators, but explicitly excludes accounting for<br />

public sector grantors.<br />

Amendments arise from the release in February<br />

2007 of Interpretation 12 Service Concession<br />

Arrangements.<br />

AASB decided to relocate requirements on<br />

contributions from AAS 27, 29 and 31, substantively<br />

unamended, into AASB 1004 as part of its shortterm<br />

review of AAS 27, AAS 29, and AAS 31<br />

As part of the short-term review of AAS 27, AAS<br />

29, and AAS 31, AASB decided to relocate the<br />

requirements for the disclousure of administered<br />

items from AAS 29, substantively unamended<br />

(with some exception as noted in Appendix A)<br />

into a new topic-based standard AASB 1050.<br />

The new pronouncement AASB 1051 Land<br />

Under Roads provides the option to recognise or<br />

not recognise land under roads acquired before<br />

the end of the first reporting period ending on<br />

or after 31 December 2007. Land under roads<br />

acquired after 31 December 2007 should be<br />

accounted for following requirements of AASB<br />

116 Property, Plant and Equipment. The State is<br />

yet to decide whether to change its policy. Until a<br />

conclusion is reached, the current default position<br />

is that land under roads will not be recognised.<br />

AASB decided to relocate requirements relating<br />

to reporting of disaggregated information from<br />

AAS 27 and AAS 29 into AASB 1052, a new<br />

topic-based standard, as part of its short- term<br />

review of AAS 27, AAS 29 and AAS31.<br />

An accompanying amendment standard to<br />

amend existing accounting standards as part of<br />

the short term review of AAS 27, AAS 29 and<br />

AAS 31 in December 2007.<br />

Beginning 1 Jul 2008<br />

Beginning 1 Jul 2008<br />

Beginning 1 Jul 2008<br />

Beginning 1 Jul 2008<br />

Beginning 1 Jul 2008<br />

Beginning 1 Jul 2008<br />

Beginning 1 Jul 2008<br />

Impact on departmental<br />

financial statements<br />

Tourism Victoria is not<br />

an operator of service<br />

concession, so there<br />

will be no impact on<br />

disclosures.<br />

As above<br />

Impact on<br />

departmental financial<br />

statements<br />

Not applicable<br />

Not applicable<br />

Impact expected to<br />

be insignificant.<br />

Impact expected to<br />

be insignificant.<br />

AASB 8 Operating Segments. Supersedes AASB 114 Segment Reporting Beginning 1 Jul 2009 Not applicable<br />

AASB 2007-3 Amendments to Australian<br />

Accounting Standards arising from AASB<br />

8 [AASB 5, AASB 6, AASB 102, AASB 107,<br />

AASB 119,AASB 127, AASB 134, AASB 136,<br />

AASB 1023 and AASB 1038.]<br />

An accompanying amendment standard, also<br />

introduced consequential amendments into<br />

other Standards.<br />

Beginning 1 Jul 2009 Impact expected to<br />

be insignificant.<br />

AASB 2007-6 Amendments to Australian<br />

Accounting Standards arising from AASB 123<br />

[AASB 1, AASB 101, AASB 107, AASB 111, AASB<br />

116 & AASB 138 and interpretations 1 & 12]<br />

AASB 2007-8 Amendments to Australian<br />

Accounting Standards arising from AASB 101<br />

Option to expense borrowing cost related to<br />

a qualifying asset had been removed. Entities<br />

are now required to capitalise borrowing costs<br />

relevant to qualifying assets.<br />

Editorial amendments to Australian Accounting<br />

Standards to align with IFRS terminology.<br />

Beginning 1 Jul 2009<br />

Beginning 1 Jul 2009<br />

Not applicable<br />

Impact expected to<br />

be insignificant.<br />

80 FINANCIAL <strong>REPORT</strong> 2007–2008