TOURISM VICTORIA ANNUAL REPORT

TOURISM VICTORIA ANNUAL REPORT

TOURISM VICTORIA ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

notes to the financial statements<br />

30 june 2008 (continued)<br />

Note 14. Financial instruments (continued)<br />

d) Credit risk<br />

Credit risk refers to the risk that a counterparty will default<br />

on its contractual obligations resulting in financial loss to<br />

Tourism Victoria.<br />

Tourism Victoria has adopted a policy of only dealing<br />

with creditworthy counterparties and obtaining sufficient<br />

collateral where appropriate, as a means of mitigating<br />

the risk of financial loss from defaults. Toursim Victoria<br />

measures credit risk on a fair value basis.<br />

Tourism Victoria does not have any significant credit risk<br />

exposure to any single counterparty or any group of<br />

counterparties having similar characteristics. The credit risk<br />

on liquid funds and derivative financial instruments is limited<br />

because the counterparties are banks with credit-ratings<br />

assigned by international credit rating agencies.<br />

The carrying amount of financial assets recorded in the<br />

financial statements, net of any allowances for losses, represents<br />

Tourism Victoria’s maximum exposure to credit risk without<br />

taking account for the value of any collateral obtained.<br />

e) Fair value<br />

Management consider that the carrying amount of financial<br />

assets and financial liabilities recorded in the financial<br />

statements approximates their fair values.<br />

The fair values and net fair values of financial assets and<br />

financial liabilities are determined as follows:<br />

• the fair value of financial assets and financial liabilities<br />

with standard terms and conditions and traded on active<br />

liquid markets are determined with reference to quoted<br />

market prices; and<br />

• the fair value of other financial assets and financial<br />

liabilities are determined in accordance with generally<br />

accepted pricing models on discounted cash flow analysis.<br />

The financial statements include holdings in<br />

unlisted shares (note 5).<br />

Transaction costs are included in the determination<br />

of net fair value.<br />

Fair value is estimated using a discounted cash flow<br />

model, which includes some assumptions that are<br />

not supportable by observable market prices or rates.<br />

Changes in these assumptions do not significantly<br />

change the fair value recognised.<br />

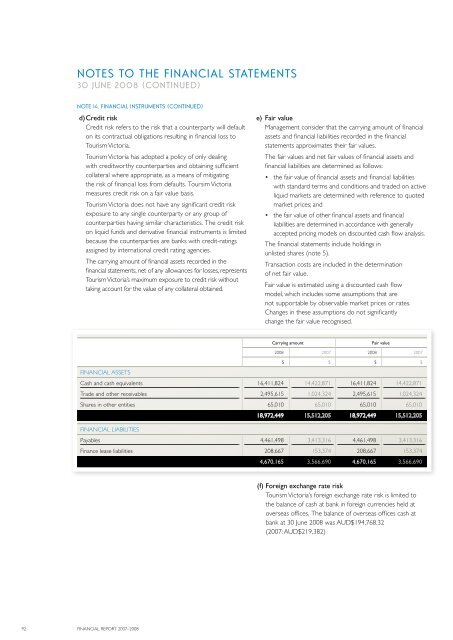

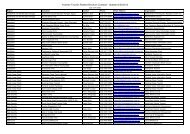

Carrying amount<br />

Fair value<br />

2008 2007 2008 2007<br />

$ $ $ $<br />

Financial Assets<br />

Cash and cash equivalents 16,411,824 14,422,871 16,411,824 14,422,871<br />

Trade and other receivables 2,495,615 1,024,324 2,495,615 1,024,324<br />

Shares in other entities 65,010 65,010 65,010 65,010<br />

18,972,449 15,512,205 18,972,449 15,512,205<br />

Financial Liabilities<br />

Payables 4,461,498 3,413,316 4,461,498 3,413,316<br />

Finance lease liabilities 208,667 153,374 208,667 153,374<br />

4,670,165 3,566,690 4,670,165 3,566,690<br />

(f) Foreign exchange rate risk<br />

Tourism Victoria’s foreign exchange rate risk is limited to<br />

the balance of cash at bank in foreign currencies held at<br />

overseas offices. The balance of overseas offices cash at<br />

bank at 30 June 2008 was AUD$194,768.32<br />

(2007: AUD$219,382)<br />

92 FINANCIAL <strong>REPORT</strong> 2007–2008