TOURISM VICTORIA ANNUAL REPORT

TOURISM VICTORIA ANNUAL REPORT

TOURISM VICTORIA ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

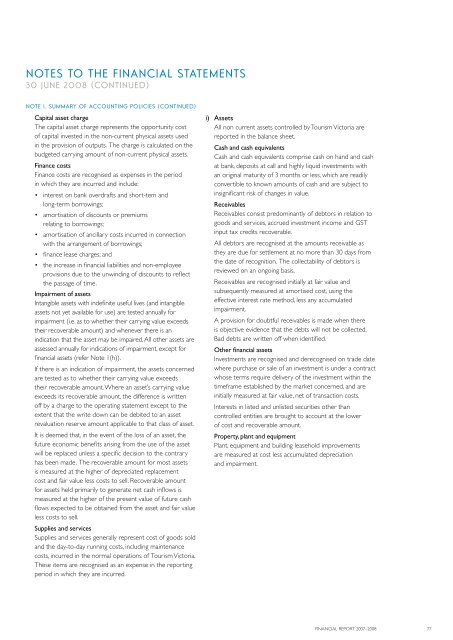

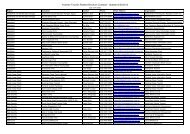

notes to the financial statements<br />

30 june 2008 (continued)<br />

Note 1. Summary of Accounting Policies (CONTINUED)<br />

Capital asset charge<br />

The capital asset charge represents the opportunity cost<br />

of capital invested in the non-current physical assets used<br />

in the provision of outputs. The charge is calculated on the<br />

budgeted carrying amount of non-current physical assets.<br />

Finance costs<br />

Finance costs are recognised as expenses in the period<br />

in which they are incurred and include:<br />

• interest on bank overdrafts and short-tem and<br />

long-term borrowings;<br />

• amortisation of discounts or premiums<br />

relating to borrowings;<br />

• amortisation of ancillary costs incurred in connection<br />

with the arrangement of borrowings;<br />

• finance lease charges; and<br />

• the increase in financial liabilities and non-employee<br />

provisions due to the unwinding of discounts to reflect<br />

the passage of time.<br />

Impairment of assets<br />

Intangible assets with indefinite useful lives (and intangible<br />

assets not yet available for use) are tested annually for<br />

impairment (i.e. as to whether their carrying value exceeds<br />

their recoverable amount) and whenever there is an<br />

indication that the asset may be impaired. All other assets are<br />

assessed annually for indications of impairment, except for<br />

financial assets (refer Note 1(h)).<br />

If there is an indication of impairment, the assets concerned<br />

are tested as to whether their carrying value exceeds<br />

their recoverable amount. Where an asset’s carrying value<br />

exceeds its recoverable amount, the difference is written<br />

off by a charge to the operating statement except to the<br />

extent that the write down can be debited to an asset<br />

revaluation reserve amount applicable to that class of asset.<br />

It is deemed that, in the event of the loss of an asset, the<br />

future economic benefits arising from the use of the asset<br />

will be replaced unless a specific decision to the contrary<br />

has been made. The recoverable amount for most assets<br />

is measured at the higher of depreciated replacement<br />

cost and fair value less costs to sell. Recoverable amount<br />

for assets held primarily to generate net cash inflows is<br />

measured at the higher of the present value of future cash<br />

flows expected to be obtained from the asset and fair value<br />

less costs to sell.<br />

Supplies and services<br />

Supplies and services generally represent cost of goods sold<br />

and the day-to-day running costs, including maintenance<br />

costs, incurred in the normal operations of Tourism Victoria.<br />

These items are recognised as an expense in the reporting<br />

period in which they are incurred.<br />

i) Assets<br />

All non current assets controlled by Tourism Victoria are<br />

reported in the balance sheet.<br />

Cash and cash equivalents<br />

Cash and cash equivalents comprise cash on hand and cash<br />

at bank, deposits at call and highly liquid investments with<br />

an original maturity of 3 months or less, which are readily<br />

convertible to known amounts of cash and are subject to<br />

insignificant risk of changes in value.<br />

Receivables<br />

Receivables consist predominantly of debtors in relation to<br />

goods and services, accrued investment income and GST<br />

input tax credits recoverable.<br />

All debtors are recognised at the amounts receivable as<br />

they are due for settlement at no more than 30 days from<br />

the date of recognition. The collectability of debtors is<br />

reviewed on an ongoing basis.<br />

Receivables are recognised initially at fair value and<br />

subsequently measured at amortised cost, using the<br />

effective interest rate method, less any accumulated<br />

impairment.<br />

A provision for doubtful receivables is made when there<br />

is objective evidence that the debts will not be collected.<br />

Bad debts are written off when identified.<br />

Other financial assets<br />

Investments are recognised and derecognised on trade date<br />

where purchase or sale of an investment is under a contract<br />

whose terms require delivery of the investment within the<br />

timeframe established by the market concerned, and are<br />

initially measured at fair value, net of transaction costs.<br />

Interests in listed and unlisted securities other than<br />

controlled entities are brought to account at the lower<br />

of cost and recoverable amount.<br />

Property, plant and equipment<br />

Plant, equipment and building leasehold improvements<br />

are measured at cost less accumulated depreciation<br />

and impairment.<br />

FINANCIAL <strong>REPORT</strong> 2007–2008<br />

77