Kenosha State of Downtown Report.indd - The Lakota Group

Kenosha State of Downtown Report.indd - The Lakota Group

Kenosha State of Downtown Report.indd - The Lakota Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SECTION 2: LAND USE AND PHYSICAL CONDITIONS<br />

NATIONAL REGISTER OF HISTORIC PLACES<br />

In addition to local Historic District designation, three <strong>of</strong> the<br />

four districts – Library Park, Third Avenue and Civic Center–<br />

are listed as districts in the National Register <strong>of</strong> Historic<br />

Places, which is this nation’s <strong>of</strong>ficial list <strong>of</strong> historic buildings,<br />

structures and places worthy <strong>of</strong> preservation. <strong>The</strong> National<br />

Register is maintained by the National Park Service (NPS) and<br />

administered in Wisconsin by the Wisconsin <strong>State</strong> Historical<br />

Society (<strong>State</strong> Historic Preservation Office-SHPO) in Madison.<br />

<strong>The</strong> National Register was established under provisions <strong>of</strong><br />

the National Historic Preservation Act, passed by the U.S.<br />

Congress in 1966. It is unclear why the Pearl Street Historic<br />

District remains the only local district not listed in the National<br />

Register.<br />

To be listed in the National Register <strong>of</strong> Historic Places, a group<br />

<strong>of</strong> properties that may comprise a district must meet one <strong>of</strong> four<br />

criteria for historic and architectural significance established by<br />

the National Park Service. <strong>The</strong> criteria recognizes properties<br />

that have made significant contributions to the broad patterns<br />

<strong>of</strong> our nation’s history; those that are associated with the<br />

lives <strong>of</strong> significant persons; or that embody the distinctive<br />

characteristics <strong>of</strong> a type, period, or method <strong>of</strong> construction, or<br />

that represents the work <strong>of</strong> a master and possess high artistic<br />

values. Other properties or sites may be significant for yielding,<br />

or may likely to yield, information important in prehistory or<br />

history.<br />

Unlike City <strong>of</strong> <strong>Kenosha</strong> Historic District designation, National<br />

Register listing provides no protection or design review for<br />

alterations or demolitions to properties within a District, unless<br />

federally funded, licensed or permitted actions are involved.<br />

For example, if a road improvement project financed partially<br />

through Federal dollars significantly impacts historic resources<br />

within a National Register District, a mediation process is<br />

required between the project sponsor and the Wisconsin SHPO<br />

to mitigate against adverse impacts with alternative solutions.<br />

For commercial and income-producing properties, one<br />

significant benefit <strong>of</strong> National Register listing is eligibility in<br />

the Federal Historic Preservation Tax Credit Program (HPTC).<br />

<strong>The</strong> program provides a 20 percent credit against income<br />

taxes for substantial rehabilitation <strong>of</strong> a historic building in<br />

which rehabilitation costs must be equal to or greater than<br />

the adjusted basis <strong>of</strong> the property (determined by subtracting<br />

the cost <strong>of</strong> the land, improvements already made, and any<br />

depreciation already taken). Property owners and developers<br />

considering a tax credit project must also follow a three-part<br />

application process with the Wisconsin SHPO and NPS to<br />

determine if the building is a “certified historic structure”<br />

(individually eligible to the National Register or located in<br />

a National Register District) and eligible to take the credit.<br />

Projects must also conform to the Secretary <strong>of</strong> the Interior’s<br />

Standard for Rehabilitation – standards that ensure a given<br />

property’s architectural significance is maintained through the<br />

preservation <strong>of</strong> historic materials and features. In addition to<br />

the 20 percent credit, a 10 percent tax credit is available for the<br />

rehabilitation <strong>of</strong> non-historic buildings placed in service before<br />

1936. <strong>The</strong> Wisconsin SHPO administers a 5 percent <strong>State</strong> tax<br />

credit that may be combined with the Federal tax credits for<br />

qualified rehabilitation expenditures<br />

<strong>The</strong> Federal and <strong>State</strong> <strong>of</strong> Wisconsin Tax Credit<br />

programs are significant incentives to encourage the<br />

rehabilitation and adaptive use <strong>of</strong> eligible historic<br />

commercial buildings in downtown <strong>Kenosha</strong>. However,<br />

according to the Wisconsin SHPO, no tax credit project<br />

has been undertaken in <strong>Kenosha</strong> since 1989, and only<br />

four projects have been documented since the Federal<br />

program was started in 1986. Nationally, the Federal<br />

HPTC has leveraged $63 billion in rehabilitated historic<br />

commercial buildings.<br />

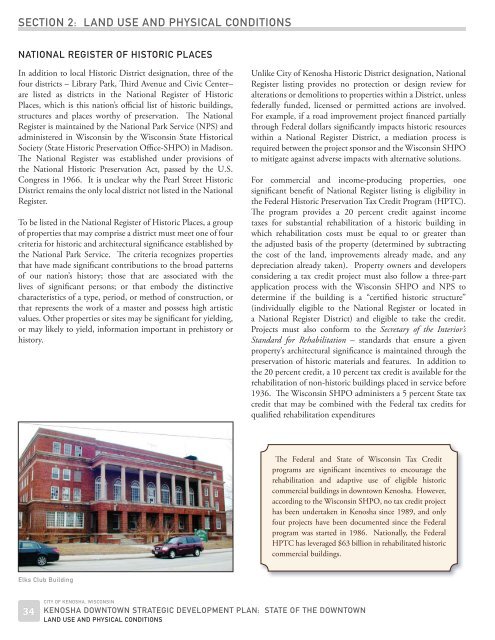

Elks Club Building<br />

34<br />

CITY OF KENOSHA, WISCONSIN<br />

KENOSHA DOWNTOWN STRATEGIC DEVELOPMENT PLAN: STATE OF THE DOWNTOWN<br />

LAND USE AND PHYSICAL CONDITIONS