Chemical & Engineering News Digital Edition ... - IMM@BUCT

Chemical & Engineering News Digital Edition ... - IMM@BUCT

Chemical & Engineering News Digital Edition ... - IMM@BUCT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUSINESS<br />

CHEMEXPLORER<br />

LILLY DROPS AN<br />

ANCHOR IN SHANGHAI<br />

Senior scientists staff new office COORDINATING R&D in China<br />

JEAN-FRANÇOIS TREMBLAY, C&EN HONG KONG<br />

LAST MONTH, a group of senior scientists<br />

from Eli Lilly & Co. started working out of<br />

an office in Shanghai’s Zhangjiang Hi-Tech<br />

Park. Rather than do research themselves,<br />

they are there to provide scientific leadership<br />

to the Chinese firms that Lilly has<br />

tasked with a steadily expanding range of<br />

R&D activities.<br />

“Large multinational drug companies<br />

conduct research in China either by building<br />

their own brick-and-mortar R&D<br />

centers or by building relationships with<br />

contract research organizations,” says<br />

Robert W. Armstrong, a Lilly vice president<br />

in charge of global external R&D. “We are<br />

in the second camp.”<br />

Non-U.S. pharmaceutical companies,<br />

including Novartis, AstraZeneca, Roche,<br />

and GlaxoSmithKline, have built or are in<br />

the process of building their own R&D centers<br />

in China. U.S. drug firms such as Lilly,<br />

Pfizer, and Merck & Co. have generally opted<br />

to take advantage of China’s scientists<br />

by collaborating with third parties there.<br />

Armstrong does not see the new coordination<br />

facility in Shanghai as contradicting<br />

Lilly’s aversion to brick-and-mortar investments<br />

in Chinese research. As the range<br />

and complexity of the R&D services Lilly<br />

purchased in China expanded, the need for<br />

a permanent scientific presence became<br />

clear. For one thing, Lilly can now better<br />

respond when a research partner in China<br />

comes up with lab results that are at odds<br />

with what scientists at the firm’s Indianapolis<br />

headquarters had expected.<br />

More important, the presence of experienced<br />

Lilly scientists in China improves the<br />

firm’s ability to identify promising research<br />

partners. “If we stay in Indiana, we’re going<br />

to be closing ourselves to the ideas that are<br />

elsewhere,” says William W. Chin, the Indianapolis-based<br />

vice president in charge of<br />

discovery research and clinical investigation.<br />

Lilly was motivated to come to China,<br />

Armstrong points out, because both patients<br />

and shareholders are demanding<br />

improvements in Lilly’s ability to bring innovative<br />

drugs to the market in a cost-efficient<br />

way. “We see partnerships as a mechanism<br />

to learn how to do things differently,<br />

not as a substitute for the things that we do<br />

right now” in the U.S., Armstrong says.<br />

Important for Lilly is that the availability<br />

of drug development services in China<br />

is steadily expanding. The same week that<br />

Lilly inaugurated its R&D center, three<br />

others opened biology service facilities in<br />

Shanghai: the U.S. firm Charles River; the<br />

Chinese company PharmaLegacy Laboratories;<br />

and Medicilon-MPI, a joint venture<br />

between China’s Shanghai Medicilon and<br />

Michigan-based MPI Research. Darren Ji,<br />

chief executive of PharmaLegacy, says his<br />

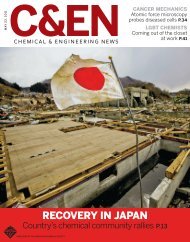

REACHING OUT<br />

In China, Lilly<br />

collaborates with<br />

local research<br />

companies such<br />

as Shanghai<br />

ChemExplorer,<br />

an employee of<br />

which is pictured<br />

here.<br />

company provides preclinical<br />

specialty pharmacology<br />

services.<br />

For the five years<br />

beginning in 2007 and<br />

running until 2011,<br />

Lilly will spend a minimum<br />

of $100 million<br />

on third-party research<br />

in China, says Tony Y.<br />

Zhang, the managing<br />

director of the new Shanghai center who<br />

relocated to China from the U.S. earlier<br />

this year.<br />

THROUGH ITS LOCAL PARTNERS, Lilly<br />

already employs 300 scientists in China, the<br />

majority of them chemists, Zhang points<br />

out. Shanghai ChemExplorer, a member<br />

of the Shangpharma contract research and<br />

manufacturing group, works exclusively on<br />

Lilly projects. About a year ago, Lilly set up<br />

a profit-sharing research collaboration with<br />

Shanghai-based Hutchison MediPharma<br />

(C&EN, Oct. 22, 2007, page 39).<br />

Lilly’s investment in the coordination<br />

center is modest, Zhang acknowledges. It<br />

consists of 5,500 sq ft of office space essentially<br />

devoid of scientific instruments.<br />

Zhang says Lilly’s scientists will make use<br />

of data and instrumentation supplied by<br />

the company’s Chinese partners. There are<br />

10 Lilly senior scientists from Indianapolis<br />

in China now, and Zhang expects that number<br />

could increase to 30.<br />

The group that Lilly has established<br />

in China may be small in number, but it<br />

is staffed with “drug hunters,” Chin says.<br />

These are scientists who over the years<br />

have demonstrated the ability to tease<br />

promising drug candidates out of the<br />

reams of data that discovery labs generate<br />

every day. For example, before Peter A.<br />

Lander relocated to Shanghai to become<br />

Lilly’s head of discovery chemistry in Asia,<br />

he was in charge of drug lead generation at<br />

the firm’s headquarters.<br />

Armstrong insists that Lilly employees<br />

in the U.S. don’t feel threatened by the company’s<br />

expansion in China. In response to<br />

cost pressure, “we have been challenged to<br />

do things differently,” he says. “China is part<br />

of a transformation agenda for our R&D.”<br />

According to Armstrong’s colleague<br />

Chin, merely cutting expenses and employees<br />

is not a smart way to contain the cost of<br />

bringing new drugs to market. “We have to<br />

have an innovation engine,” he says. “We<br />

cannot save our way into the new drugs for<br />

our patients of the future.” ■<br />

WWW.CEN-ONLINE.ORG 15 NOVEMBER 3, 2008