Insurance Handbook - Alaska Department of Community and ...

Insurance Handbook - Alaska Department of Community and ...

Insurance Handbook - Alaska Department of Community and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Updates at www.iii.org/issues_updates <strong>Insurance</strong> Topics<br />

Workers Auto Compensation<br />

<strong>Insurance</strong><br />

the actual benefits received. The involvement <strong>of</strong> an attorney does not necessarily<br />

indicate formal litigation proceedings. Sometimes, injured workers turn to<br />

attorneys to help them negotiate what they believe is a confusing <strong>and</strong> complex<br />

system. Increasingly, states are trying to make the system easier to underst<strong>and</strong><br />

<strong>and</strong> to use.<br />

The workers compensation system plays a major role in improving workplace<br />

safety. An employer’s workers compensation premium reflects the relative<br />

hazards to which workers are exposed <strong>and</strong> the employer’s claim record. About<br />

one-half <strong>of</strong> states allow what is known as “schedule rating,” a discount or rate<br />

credit for superior workplace safety programs.<br />

Workers Compensation Residual Markets: Residual markets, traditionally<br />

the market <strong>of</strong> last resort, are an important segment <strong>of</strong> the workers comp market.<br />

Workers comp residual plans are administered by the NCCI in 29 jurisdictions.<br />

In some states, particularly where rates in the voluntary market are inadequate,<br />

the residual market provides coverage for a large portion <strong>of</strong> policyholders.<br />

Terrorism Coverage: Since the terrorist attacks <strong>of</strong> September 11, 2001, workers<br />

compensation insurers have been taking a closer look at their exposures to<br />

catastrophes, both natural <strong>and</strong> man-made. According to a report by Risk Management<br />

Solutions, if the earthquake that shook San Francisco in 1906 were to<br />

happen today, it could cause as many as 78,000 injuries, 5,000 deaths <strong>and</strong> over<br />

$7 billion in workers compensation losses.<br />

Workers compensation claims for terrorism could cost an insurer anywhere<br />

from $300,000 to $1 million per employee, depending on the state. As a result,<br />

firms with a concentration <strong>of</strong> employees in a single building in major metropolitan<br />

areas, such as New York, or near a “trophy building” are now considered<br />

high risk, a classification that used to apply only to people in dangerous jobs<br />

such as ro<strong>of</strong>ing.<br />

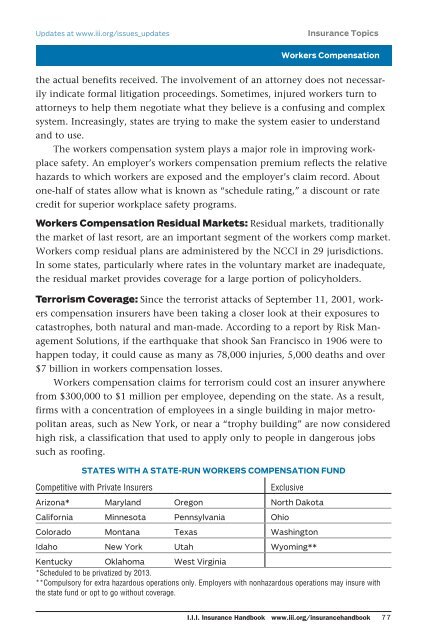

STATES WITH A STATE-RUN WORKERS COMPENSATION FUND<br />

Competitive with Private Insurers Exclusive<br />

Arizona* Maryl<strong>and</strong> Oregon North Dakota<br />

California Minnesota Pennsylvania Ohio<br />

Colorado Montana Texas Washington<br />

Idaho New York Utah Wyoming**<br />

Kentucky Oklahoma West Virginia<br />

*Scheduled to be privatized by 2013.<br />

**Compulsory for extra hazardous operations only. Employers with nonhazardous operations may insure with<br />

the state fund or opt to go without coverage.<br />

I.I.I. <strong>Insurance</strong> <strong>H<strong>and</strong>book</strong> www.iii.org/insuranceh<strong>and</strong>book 77