Odfjell SE Annual Report 2012

Odfjell SE Annual Report 2012

Odfjell SE Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

odfjell group<br />

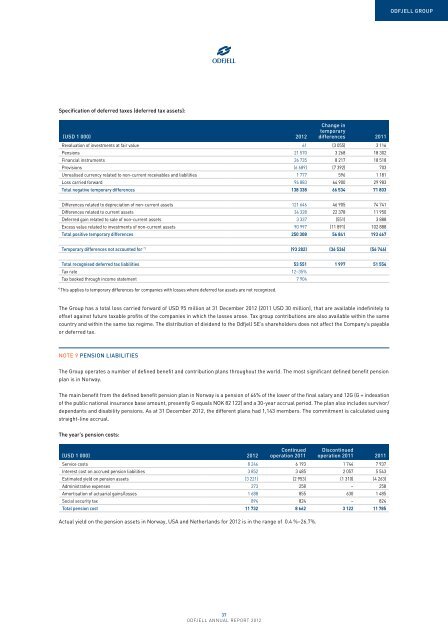

Specification of deferred taxes (deferred tax assets):<br />

(USD 1 000) <strong>2012</strong><br />

Change in<br />

temporary<br />

differences 2011<br />

Revaluation of investments at fair value 61 (3 055) 3 116<br />

Pensions 21 570 3 268 18 302<br />

Financial instruments 26 735 8 217 18 518<br />

Provisions (6 689) (7 392) 703<br />

Unrealised currency related to non-current receivables and liabilities 1 777 596 1 181<br />

Loss carried forward 94 883 64 900 29 983<br />

Total negative temporary differences 138 338 66 534 71 803<br />

Differences related to depreciation of non-current assets 121 646 46 905 74 741<br />

Differences related to current assets 34 328 22 378 11 950<br />

Deferred gain related to sale of non-current assets 3 337 (551) 3 888<br />

Excess value related to investments of non-current assets 90 997 (11 891) 102 888<br />

Total positive temporary differences 250 308 56 841 193 467<br />

Temporary differences not accounted for *) (93 282) (36 536) (56 746)<br />

Total recognised deferred tax liabilities 53 551 1 997 51 554<br />

Tax rate 12–35%<br />

Tax booked through income statement 7 904<br />

*)<br />

This applies to temporary differences for companies with losses where deferred tax assets are not recognized.<br />

v<br />

The Group has a total loss carried forward of USD 95 million at 31 December <strong>2012</strong> (2011 USD 30 million), that are available indefinitely to<br />

offset against future taxable profits of the companies in which the losses arose. Tax group contributions are also available within the same<br />

country and within the same tax regime. The distribution of dividend to the <strong>Odfjell</strong> <strong>SE</strong>’s shareholders does not affect the Company’s payable<br />

or deferred tax.<br />

Note 9 Pension liabilities<br />

The Group operates a number of defined benefit and contribution plans throughout the world. The most significant defined benefit pension<br />

plan is in Norway.<br />

The main benefit from the defined benefit pension plan in Norway is a pension of 66% of the lower of the final salary and 12G (G = indexation<br />

of the public national insurance base amount, presently G equals NOK 82 122) and a 30-year accrual period. The plan also includes survivor/<br />

dependants and disability pensions. As at 31 December <strong>2012</strong>, the different plans had 1,143 members. The commitment is calculated using<br />

straight-line accrual.<br />

The year’s pension costs:<br />

(USD 1 000) <strong>2012</strong><br />

Continued<br />

operation 2011<br />

Discontinued<br />

operation 2011 2011<br />

Service costs 8 246 6 193 1 744 7 937<br />

Interest cost on accrued pension liabilities 3 852 3 485 2 057 5 543<br />

Estimated yield on pension assets (3 221) (2 953) (1 310) (4 263)<br />

Administrative expenses 273 258 – 258<br />

Amortisation of actuarial gains/losses 1 688 855 630 1 485<br />

Social security tax 894 824 – 824<br />

Total pension cost 11 732 8 662 3 122 11 785<br />

Actual yield on the pension assets in Norway, USA and Netherlands for <strong>2012</strong> is in the range of 0.4 %–26.7%.<br />

37<br />

odfjell annual report <strong>2012</strong>