Odfjell SE Annual Report 2012

Odfjell SE Annual Report 2012

Odfjell SE Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

odfjell se<br />

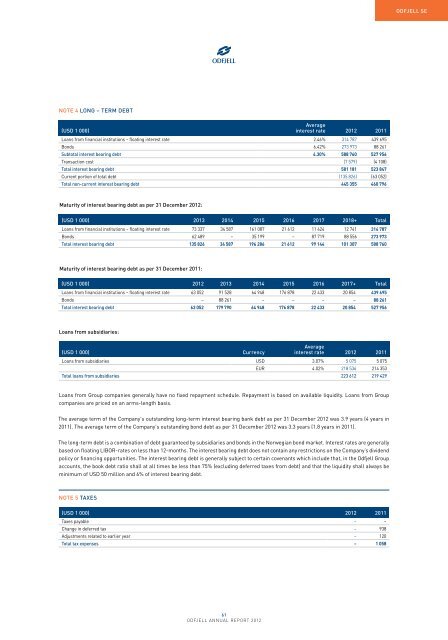

Note 4 Long – term debt<br />

(USD 1 000)<br />

Average<br />

interest rate <strong>2012</strong> 2011<br />

Loans from financial institutions – floating interest rate 2.46% 314 787 439 695<br />

Bonds 6.42% 273 973 88 261<br />

Subtotal interest bearing debt 4.30% 588 760 527 956<br />

Transaction cost (7 579) (4 108)<br />

Total interest bearing debt 581 181 523 847<br />

Current portion of total debt (135 826) (63 052)<br />

Total non-current interest bearing debt 445 355 460 796<br />

Maturity of interest bearing debt as per 31 December <strong>2012</strong>:<br />

(USD 1 000) 2013 2014 2015 2016 2017 2018+ Total<br />

Loans from financial institutions – floating interest rate 73 337 34 587 161 087 21 612 11 424 12 741 314 787<br />

Bonds 62 489 – 35 199 – 87 719 88 556 273 973<br />

Total interest bearing debt 135 826 34 587 196 286 21 612 99 144 101 307 588 760<br />

Maturity of interest bearing debt as per 31 December 2011:<br />

(USD 1 000) <strong>2012</strong> 2013 2014 2015 2016 2017+ Total<br />

Loans from financial institutions – floating interest rate 63 052 91 528 64 948 176 878 22 433 20 854 439 695<br />

Bonds – 88 261 – – – – 88 261<br />

Total interest bearing debt 63 052 179 790 64 948 176 878 22 433 20 854 527 956<br />

Loans from subsidiaries:<br />

(USD 1 000)<br />

Currency<br />

Average<br />

interest rate <strong>2012</strong> 2011<br />

Loans from subsidiaries USD 3.07% 5 075 5 075<br />

EUR 4.02% 218 536 214 353<br />

Total loans from subsidiaries 223 612 219 429<br />

Loans from Group companies generally have no fixed repayment schedule. Repayment is based on available liquidity. Loans from Group<br />

companies are priced on an arms-length basis.<br />

The average term of the Company's outstanding long-term interest bearing bank debt as per 31 December <strong>2012</strong> was 3.9 years (4 years in<br />

2011). The average term of the Company's outstanding bond debt as per 31 December <strong>2012</strong> was 3.3 years (1.8 years in 2011).<br />

The long-term debt is a combination of debt guaranteed by subsidiaries and bonds in the Norwegian bond market. Interest rates are generally<br />

based on floating LIBOR-rates on less than 12-months. The interest bearing debt does not contain any restrictions on the Company’s dividend<br />

policy or financing opportunities. The interest bearing debt is generally subject to certain covenants which include that, in the <strong>Odfjell</strong> Group<br />

accounts, the book debt ratio shall at all times be less than 75% (excluding deferred taxes from debt) and that the liquidity shall always be<br />

minimum of USD 50 million and 6% of interest bearing debt.<br />

Note 5 Taxes<br />

(USD 1 000) <strong>2012</strong> 2011<br />

Taxes payable – –<br />

Change in deferred tax – 938<br />

Adjustments related to earlier year – 120<br />

Total tax expenses – 1 058<br />

61<br />

odfjell annual report <strong>2012</strong>