2007 Annual report - Groupe M6

2007 Annual report - Groupe M6

2007 Annual report - Groupe M6

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MANAGEMENT REPORT<br />

Between the General Meetings of 24 April 2006 and 2 May <strong>2007</strong>, the Company used the<br />

authorisation to buy its own shares as follows:<br />

- shares were purchased through the liquidity contract at an average price of € 25.13 and<br />

sold at an average price of € 25.52;<br />

- a total of 429,261 shares were purchased and 441,761 shares sold within the framework<br />

of this share buyback plan.<br />

Consequently, at 2 May <strong>2007</strong>, which is the date of implementation of the new share buyback<br />

plan, the Company held 297,502 treasury shares, being 0.22% of its share capital.<br />

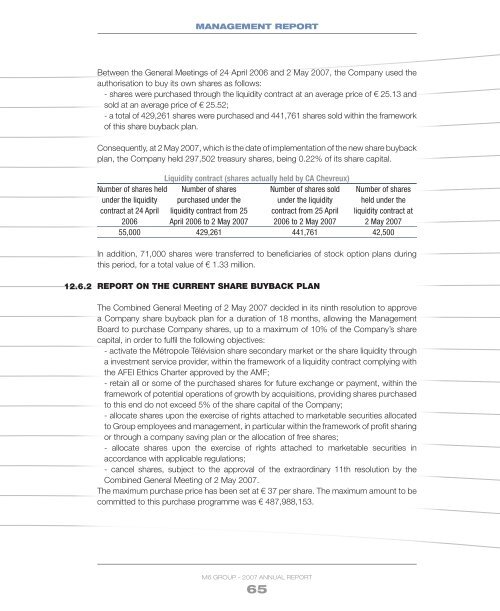

Liquidity contract (shares actually held by CA Chevreux)<br />

Number of shares held Number of shares Number of shares sold Number of shares<br />

under the liquidity purchased under the under the liquidity held under the<br />

contract at 24 April liquidity contract from 25 contract from 25 April liquidity contract at<br />

2006 April 2006 to 2 May <strong>2007</strong> 2006 to 2 May <strong>2007</strong> 2 May <strong>2007</strong><br />

55,000 429,261 441,761 42,500<br />

In addition, 71,000 shares were transferred to beneficiaries of stock option plans during<br />

this period, for a total value of € 1.33 million.<br />

12.6.2 Report on the current share buyback plan<br />

The Combined General Meeting of 2 May <strong>2007</strong> decided in its ninth resolution to approve<br />

a Company share buyback plan for a duration of 18 months, allowing the Management<br />

Board to purchase Company shares, up to a maximum of 10% of the Company’s share<br />

capital, in order to fulfil the following objectives:<br />

- activate the Métropole Télévision share secondary market or the share liquidity through<br />

a investment service provider, within the framework of a liquidity contract complying with<br />

the AFEI Ethics Charter approved by the AMF;<br />

- retain all or some of the purchased shares for future exchange or payment, within the<br />

framework of potential operations of growth by acquisitions, providing shares purchased<br />

to this end do not exceed 5% of the share capital of the Company;<br />

- allocate shares upon the exercise of rights attached to marketable securities allocated<br />

to Group employees and management, in particular within the framework of profit sharing<br />

or through a company saving plan or the allocation of free shares;<br />

- allocate shares upon the exercise of rights attached to marketable securities in<br />

accordance with applicable regulations;<br />

- cancel shares, subject to the approval of the extraordinary 11th resolution by the<br />

Combined General Meeting of 2 May <strong>2007</strong>.<br />

The maximum purchase price has been set at € 37 per share. The maximum amount to be<br />

committed to this purchase programme was € 487,988,153.<br />

<strong>M6</strong> GROUP - <strong>2007</strong> annual <strong>report</strong><br />

65