Genesee County Agricultural and Farmland Protection Plan

Genesee County Agricultural and Farmland Protection Plan

Genesee County Agricultural and Farmland Protection Plan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

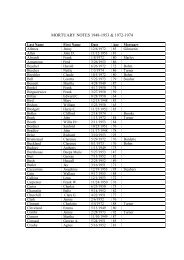

<strong>Genesee</strong> <strong>County</strong>: Town of Byron Cost of Community Services Study<br />

3.0 Findings<br />

The COCS Study completed for the Town of Byron offers a “snapshot in time” for local<br />

<strong>and</strong> <strong>County</strong> decision makers to consider. The findings illustrate the current costs of<br />

servicing each l<strong>and</strong> use type compared with the amount of revenue each l<strong>and</strong> use type<br />

contributes the tax base. This initiative is not meant to be predictive nor to judge the<br />

intrinsic value of one l<strong>and</strong> use over another. The uniqueness of the study is that it<br />

considers agricultural l<strong>and</strong> <strong>and</strong> open space – l<strong>and</strong> uses that are often ignored in other<br />

types of fiscal analyses.<br />

Many proponents of growth often present farml<strong>and</strong> <strong>and</strong> other open l<strong>and</strong>s as awaiting a<br />

“highest <strong>and</strong> best use”; this use is most often residential development. The COCS<br />

findings show the positive tax benefits of maintaining these l<strong>and</strong>s in their current use.<br />

The cost of providing new residents with basic services is quite expensive. Education,<br />

fire services, police protection, road maintenance, public sewer <strong>and</strong> water are all<br />

expenses which must be evaluated along with a new residential development’s<br />

contribution to the tax base.<br />

Similar to agriculture <strong>and</strong> open space, commercial/industrial l<strong>and</strong> uses also provide far<br />

more in revenues than they dem<strong>and</strong> in services. Yet new businesses require new<br />

workers. Often times, if the local market is not enough to satisfy dem<strong>and</strong>s, “urbanizing”<br />

will typically occur. New commercial development is typically followed by an increased<br />

dem<strong>and</strong> for new housing, traffic congestion, <strong>and</strong> pollution.<br />

The COCS Study is intended to encourage local <strong>and</strong> regional policy makers that the<br />

preservation of agriculture <strong>and</strong> open space has many economic consequences. Farml<strong>and</strong><br />

not only pays property tax, but includes many additional economic multipliers in its own<br />

right. Farming is an industry that contributes to the local employment base <strong>and</strong> supports<br />

many other business both locally <strong>and</strong> regionally. Farming is also a cost-effective way to<br />

maintain a community’s rural character.<br />

According to the results of the study completed for Byron, agricultural, open space,<br />

commercial, <strong>and</strong> industrial uses are important contributors to the Town’s fiscal health.<br />

This is demonstrated in the average ratio of dollars generated by residential development<br />

to services required which was $1.00 to $1.30. In other words, for every dollar raised<br />

from residential revenues, the Town spent an extra 30 cents on average in direct services.<br />

These services include education, health <strong>and</strong> human services, fire safety, <strong>and</strong> public<br />

works. The average ratio for agricultural l<strong>and</strong>, forest <strong>and</strong> other open space was $1.00 to<br />

$.49 cents; for every dollar raised in revenue the Town retained $.51 cents. For<br />

commercial <strong>and</strong> industrial uses, the Town retained $.23 cents in excess of expenses.<br />

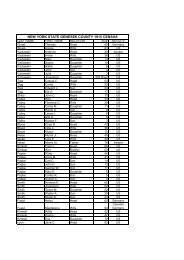

Average L<strong>and</strong> Use Ratios for the Town of Byron, New York<br />

Residential Commercial/Industrial <strong>Agricultural</strong>/Forest/Open Space<br />

$1.00: $1.30 $1:00: $0.77 $1.00: $0.49<br />

<strong>Agricultural</strong> & Community Development Services, Inc. 8<br />

peter j. smith & company, inc.