Reply SpA

Reply SpA

Reply SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated financial statements as at December 31, 2010<br />

As contractually defined, such ratios are as follows:<br />

Net financial indebtedness / Equity ≤ 1.5<br />

Net financial indebtedness / EBITDA ≤ 3.0<br />

At the balance sheet date the Covenants established by the loan have been fully achieved by the company.<br />

The stand-by financial loan is referred to a loan undersigned on March 31, 2009 by <strong>Reply</strong> S.p.A with Intesa San-<br />

Paolo, for a line of credit amounting to 50,000,000 Euros. The loan will be reimbursed on a half-year basis (Euribor<br />

6 months + 2.5%) commencing June 30, 2012 and expires on December 31, 2014.<br />

The credit line amounting has been drawn by 9,411 thousand Euros. This loan is subordinated to the parameters<br />

mentioned herein and at December 31, 2010 have been respected.<br />

The financial loan with Carispe Bank was stipulated in September 2008 by Lem <strong>Reply</strong> S.r.l. for an initial line of<br />

credit amounting to 150 thousand Euros. The loan will be reimbursed on a half-year basis at a floating rate (Euribor<br />

6 months +1.2%) and expires January 31, 2014.<br />

The financial loan stipulated with Credito Bergamasco also refers to a loan undersigned by Lem <strong>Reply</strong> S.r.l. in May<br />

2010 for a line of credit amounting to 20 thousand Euros. The loan will be reimbursed on a monthly basis at a floating<br />

rate (Euribor 3 months +3.5%) and expires June 30, 2011.<br />

The loan with Commerzbank is referred to a loan undersigned by syskotool, a syskoplan Group company, for the<br />

acquisition of the building in which the parent company has its registered office. Installments are paid on a half year<br />

basis (at a rate of 4.28%) and expire on September 30, 2019.<br />

Other financial borrowings are related to financial leases determined according to IAS 17.<br />

Fair value IRS and other is mainly related to the fair value of the cash flow hedge, the amount being hedged amounts<br />

to 17,536 thousand Euros.<br />

The carrying amount of Financial liabilities is deemed to be in line with its fair value.<br />

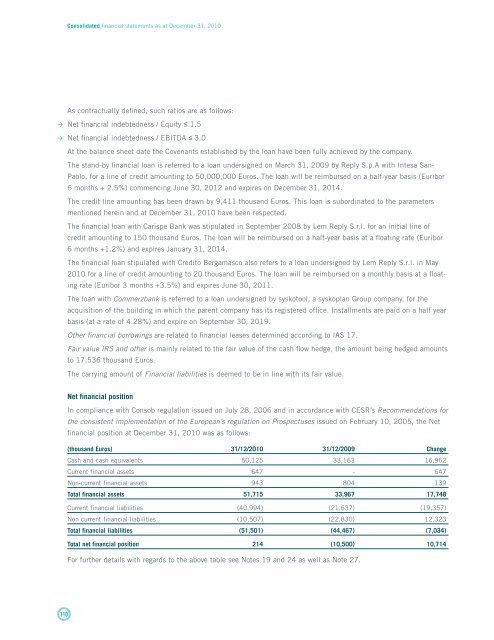

Net financial position<br />

In compliance with Consob regulation issued on July 28, 2006 and in accordance with CESR’s Recommendations for<br />

the consistent implementation of the European’s regulation on Prospectuses issued on February 10, 2005, the Net<br />

financial position at December 31, 2010 was as follows:<br />

(thousand Euros) 31/12/2010 31/12/2009 Change<br />

Cash and cash equivalents 50,125 33,163 16,962<br />

Current financial assets 647 - 647<br />

Non-current financial assets 943 804 139<br />

Total financial assets 51,715 33,967 17,748<br />

Current financial liabilities (40,994) (21,637) (19,357)<br />

Non current financial liabilities (10,507) (22,830) 12,323<br />

Total financial liabilities (51,501) (44,467) (7,034)<br />

Total net financial position 214 (10,500) 10,714<br />

For further details with regards to the above table see Notes 19 and 24 as well as Note 27.<br />

110