Reply SpA

Reply SpA

Reply SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated income statement<br />

Consolidated statement of comprehensive income<br />

Consolidated statement of financial position<br />

Statement of changes in consolidated equity<br />

Consolidated statement of cash flows<br />

Notes to the consolidated financial statements <br />

Annexed tables<br />

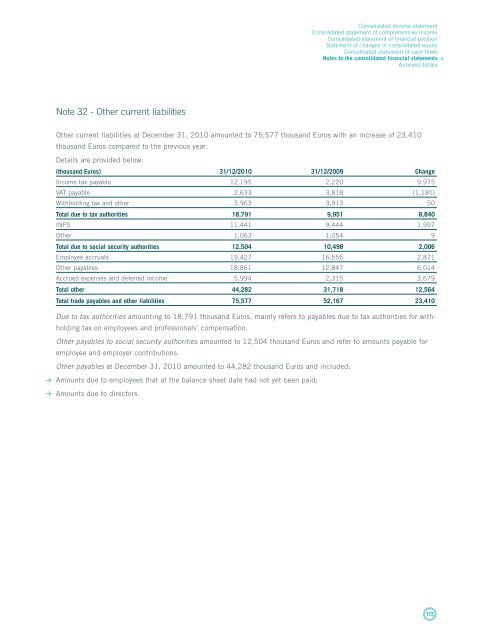

Note 32 - Other current liabilities<br />

Other current liabilities at December 31, 2010 amounted to 75,577 thousand Euros with an increase of 23,410<br />

thousand Euros compared to the previous year.<br />

Details are provided below:<br />

(thousand Euros) 31/12/2010 31/12/2009 Change<br />

Income tax payable 12,195 2,220 9,975<br />

VAT payable 2,633 3,818 (1,185)<br />

Withholding tax and other 3,963 3,913 50<br />

Total due to tax authorities 18,791 9,951 8,840<br />

INPS 11,441 9,444 1,997<br />

Other 1,063 1,054 9<br />

Total due to social security authorities 12,504 10,498 2,006<br />

Employee accruals 19,427 16,556 2,871<br />

Other payables 18,861 12,847 6,014<br />

Accrued expenses and deferred income 5,994 2,315 3,679<br />

Total other 44,282 31,718 12,564<br />

Total trade payables and other liabilities 75,577 52,167 23,410<br />

Due to tax authorities amounting to 18,791 thousand Euros, mainly refers to payables due to tax authorities for withholding<br />

tax on employees and professionals’ compensation.<br />

Other payables to social security authorities amounted to 12,504 thousand Euros and refer to amounts payable for<br />

employee and employer contributions.<br />

Other payables at December 31, 2010 amounted to 44,282 thousand Euros and included:<br />

Amounts due to employees that at the balance sheet date had not yet been paid;<br />

Amounts due to directors.<br />

115