Reply SpA

Reply SpA

Reply SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Main risks and uncertainties to which <strong>Reply</strong> S.p.A. and the Group are exposed<br />

Financial review of the Group<br />

Significant operations in 2010<br />

<strong>Reply</strong> on the stock market<br />

The Parent Company <strong>Reply</strong> S.p.A.<br />

Corporate Governance<br />

Other information<br />

Events subsequent to December 31, 2010<br />

Outlook on operations<br />

Motion for approval of the Financial statements and allocation of the net result<br />

<br />

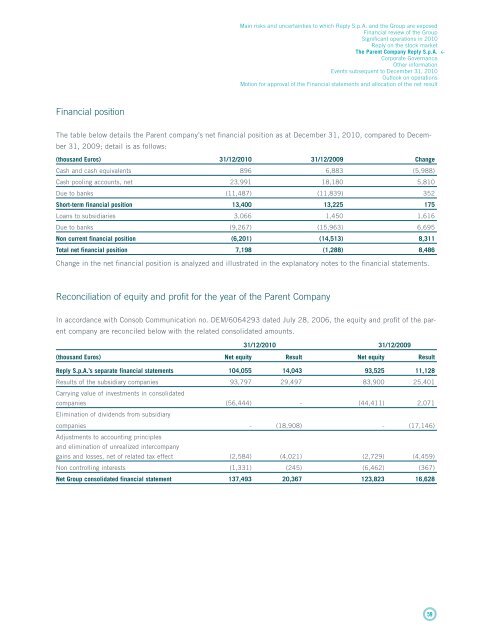

Financial position<br />

The table below details the Parent company’s net financial position as at December 31, 2010, compared to December<br />

31, 2009; detail is as follows:<br />

(thousand Euros) 31/12/2010 31/12/2009 Change<br />

Cash and cash equivalents 896 6,883 (5,988)<br />

Cash pooling accounts, net 23,991 18,180 5,810<br />

Due to banks (11,487) (11,839) 352<br />

Short-term financial position 13,400 13,225 175<br />

Loans to subsidiaries 3,066 1,450 1,616<br />

Due to banks (9,267) (15,963) 6,695<br />

Non current financial position (6,201) (14,513) 8,311<br />

Total net financial position 7,198 (1,288) 8,486<br />

Change in the net financial position is analyzed and illustrated in the explanatory notes to the financial statements.<br />

Reconciliation of equity and profit for the year of the Parent Company<br />

In accordance with Consob Communication no. DEM/6064293 dated July 28, 2006, the equity and profit of the parent<br />

company are reconciled below with the related consolidated amounts.<br />

31/12/2010 31/12/2009<br />

(thousand Euros) Net equity Result Net equity Result<br />

<strong>Reply</strong> S.p.A.’s separate financial statements 104,055 14,043 93,525 11,128<br />

Results of the subsidiary companies 93,797 29,497 83,900 25,401<br />

Carrying value of investments in consolidated<br />

companies (56,444) - (44,411) 2,071<br />

Elimination of dividends from subsidiary<br />

companies - (18,908) - (17,146)<br />

Adjustments to accounting principles<br />

and elimination of unrealized intercompany<br />

gains and losses, net of related tax effect (2,584) (4,021) (2,729) (4,459)<br />

Non controlling interests (1,331) (245) (6,462) (367)<br />

Net Group consolidated financial statement 137,493 20,367 123,823 16,628<br />

59